Embark on a journey to financial freedom with the ‘Cash Envelope’ System! This timeless budgeting method empowers you to take control of your spending habits and make smarter shopping decisions. Forget the swipe-and-hope approach; this guide will walk you through a practical and effective way to manage your money, fostering a healthier relationship with your finances.

We’ll delve into the core concepts of this system, explore its historical roots, and highlight its primary benefit: curbing overspending. From setting up your envelopes and allocating funds to navigating shopping scenarios and handling leftover cash, we’ll provide you with actionable steps to implement this proven strategy. Get ready to transform your financial habits and build a brighter future!

Introduction to the Cash Envelope System

The cash envelope system is a budgeting method that involves allocating cash for specific spending categories. It’s a hands-on approach to managing your money, helping you gain control over your spending habits. By using physical cash, you can visually track your spending and avoid overspending in each category. This method is especially useful for those who struggle with impulse purchases or find it difficult to stick to a budget using digital tools alone.

Core Concept of the Cash Envelope System

The fundamental principle of the cash envelope system is simple: you withdraw a specific amount of cash at the beginning of the month (or pay period) for each spending category in your budget. These categories might include groceries, dining out, entertainment, transportation, or personal care. You then place the allocated cash into separate envelopes, each labeled with the corresponding category.

When you make a purchase in a particular category, you pay with the cash from that envelope. Once the cash in an envelope is gone, you’re done spending in that category for the rest of the budgeting period. This forces you to live within your means and make conscious spending decisions.

History and Origins of the Cash Envelope System

While the exact origins of the cash envelope system are difficult to pinpoint, the concept has roots in traditional budgeting practices. Historically, people have used physical cash to manage their finances, long before the advent of credit cards and online banking. The cash envelope system is a modern adaptation of these older methods, making budgeting more tangible and accessible. It gained popularity as a way to combat overspending and gain a clearer picture of where money was going.

It’s a simple, effective method that has been used for generations.

Primary Benefits of the Cash Envelope System: Overspending Control

The primary benefit of the cash envelope system is its ability to help you control overspending. By limiting your spending to the cash available in each envelope, you’re forced to make choices and prioritize your purchases. This tangible approach prevents you from racking up debt or exceeding your budget in any given category.

- Visual Representation: Seeing the physical cash in each envelope provides a clear visual representation of your budget. As the money in an envelope dwindles, you become more aware of your spending habits and are less likely to make impulsive purchases.

- Reduced Impulse Spending: The system actively discourages impulse purchases. When you’re paying with cash, you’re less likely to make spontaneous buys because you can physically see the money leaving your possession.

- Increased Awareness: Using the cash envelope system increases your awareness of where your money is going. You are more mindful of your spending when you have to physically hand over cash for each purchase.

- Debt Prevention: By sticking to the cash in your envelopes, you’re less likely to use credit cards, thereby preventing the accumulation of debt. This is a critical benefit for those who struggle with overspending and credit card debt.

- Simplified Budgeting: The system simplifies the budgeting process. It removes the complexity of tracking transactions and managing accounts online, making it easier to understand and stick to your budget.

For example, imagine a scenario where someone allocates $400 for groceries for the month. If they use the cash envelope system and find themselves halfway through the month with only $50 remaining, they will be forced to adjust their spending habits and make more conscious choices. This might involve eating at home more often, choosing less expensive items, or postponing certain purchases until the next budgeting period.

This real-world example demonstrates the system’s effectiveness in preventing overspending and promoting financial discipline.

Setting Up Your Cash Envelope System

Getting started with the cash envelope system might seem daunting, but it’s a straightforward process. This section will guide you through the essential steps, from gathering your supplies to setting up your budget, ensuring you’re well-equipped to manage your spending effectively.

Essential Materials for the Cash Envelope System

To begin your cash envelope journey, you’ll need a few essential items. These tools are simple but crucial for the system’s functionality.

- Cash Envelopes: These are the core of the system. You can use pre-made envelopes designed for budgeting, or create your own using plain envelopes or even small zippered pouches. The key is to have a separate envelope for each spending category.

- A Budgeting Worksheet or App: This is where you’ll track your income, expenses, and envelope allocations. You can use a notebook, a spreadsheet (like Google Sheets or Microsoft Excel), or a budgeting app (like Mint, YNAB, or EveryDollar).

- A Pen or Pencil: For writing down transactions and making notes on your budget.

- A Calculator (Optional): Useful for quickly calculating amounts, especially when you’re first setting up your budget.

Determining Spending Categories and Allocating Amounts

Choosing the right spending categories and assigning appropriate amounts is key to the success of your cash envelope system. Consider your past spending habits and your financial goals when making these decisions.

- Review Your Past Spending: If you have access to past bank statements or credit card bills, review your spending history for the last few months. This will give you a clear picture of where your money is going. Identify the main areas where you spend money, such as groceries, dining out, entertainment, gas, and personal care.

- Create Your Categories: Based on your spending history, create a list of spending categories. Be specific, but avoid creating too many categories, which can make the system difficult to manage. Aim for a manageable number, typically between 5 and 10 categories.

- Estimate Your Monthly Expenses: For each category, estimate how much you typically spend in a month. Be realistic. It’s better to overestimate slightly than to underestimate.

- Prioritize Your Needs: Make sure to allocate funds to essential categories first, such as groceries, housing, and transportation. These are non-negotiable expenses.

- Set Realistic Limits: Once you know how much you’re spending in each category, determine how much you want to spend. Set spending limits for each category based on your income and your financial goals.

- Track Your Spending: As you spend money from each envelope, track your transactions. Note the date, amount, and the category. This will help you monitor your spending and stay within your budget.

Calculating Monthly Income and Expenses to Create a Budget

Creating a budget involves understanding your income and expenses to allocate funds effectively. This is the foundation of the cash envelope system.

- Calculate Your Net Monthly Income: This is the amount of money you actually receive each month after taxes and other deductions. If your income varies each month, calculate an average.

- List Your Fixed Expenses: These are expenses that stay relatively the same each month, such as rent or mortgage, utilities, and loan payments.

- Estimate Your Variable Expenses: These expenses fluctuate each month, such as groceries, gas, and entertainment. Use your spending history and set realistic limits for each category.

- Determine Your Savings and Debt Payments: Include amounts for savings goals and debt payments.

- Subtract Expenses from Income: Subtract your total expenses (fixed + variable + savings/debt payments) from your net monthly income. The result should ideally be zero or positive. If you have a negative result, you’ll need to adjust your spending or find ways to increase your income.

- Allocate Funds to Envelopes: Based on your budget, determine how much cash to put into each envelope at the beginning of the month or pay period.

Example Spending Categories and Budget Amounts

This table provides an example of how you might allocate your budget using the cash envelope system. Note that these are just examples, and your actual budget will vary depending on your income, expenses, and financial goals.

| Category | Budget Amount | Notes | Remaining Balance |

|---|---|---|---|

| Groceries | $400 | Includes food and household supplies. | $400 |

| Dining Out | $100 | Eating at restaurants or ordering takeout. | $100 |

| Gas | $150 | Fuel for your vehicle. | $150 |

| Entertainment | $100 | Movies, concerts, and other fun activities. | $100 |

| Personal Care | $50 | Haircuts, toiletries, and other personal items. | $50 |

Preparing Your Envelopes

Now that you’ve decided on your spending categories and set up your system, it’s time to get the cash you need to fill those envelopes. This step is crucial for the cash envelope system to work effectively, as it physically limits your spending to the allocated amounts. Let’s break down the process of withdrawing cash, dividing it, and labeling your envelopes for success.

Withdrawing Cash for Your Envelopes

Getting cash from your bank account is a straightforward process.

- Determine Your Total Cash Needs: Before you head to the bank or ATM, calculate the total amount of cash you’ll need for the entire budgeting period (usually a month). Add up the budgeted amounts for each of your spending categories. For example, if you’ve budgeted $400 for groceries, $200 for dining out, $100 for entertainment, and $50 for transportation, your total cash withdrawal would be $750.

- Choose Your Withdrawal Method: You have a few options for getting your cash:

- ATM Withdrawal: This is the most convenient option, but be mindful of ATM fees. Ensure your bank’s ATM network is fee-free or find an ATM within your network.

- Bank Teller: Going to your bank branch allows you to avoid ATM fees and potentially request specific denominations of bills.

- Cash Back at a Store: Some stores offer cash back with a debit card purchase, but ensure you are not tempted to overspend.

- Request Specific Denominations (Optional but Recommended): When withdrawing from a bank teller, consider requesting specific denominations of bills. This makes it easier to divide the cash into your envelopes. For example, ask for a mix of $20s, $10s, and $5s, rather than all $100s. This aids in tracking spending and preventing overspending.

- Record Your Withdrawal: Always record your cash withdrawal in your budget tracking system (spreadsheet, app, or notebook). This helps reconcile your accounts and ensures you stay on track.

Dividing Cash into Individual Envelopes

Once you have the cash, the next step is to divide it among your spending categories. This is where the magic of the cash envelope system happens!

- Gather Your Envelopes: Have all your envelopes ready and clearly labeled (we’ll cover labeling in the next section).

- Distribute the Cash: Starting with the largest denominations, divide the cash into your envelopes according to your budget. For example:

- Groceries: $400

- Dining Out: $200

- Entertainment: $100

- Transportation: $50

- Use Smaller Bills for Frequent Spending: Consider using smaller bills in categories where you spend frequently, such as groceries and dining out. This helps you stay aware of how much you are spending and makes it easier to manage your budget.

- Keep Track of Remaining Cash: If you have any leftover cash after dividing, you can either keep it as a buffer in your “miscellaneous” envelope or put it towards the next month’s budget.

Labeling Your Envelopes Clearly

Clear labeling is critical for avoiding confusion and ensuring you spend from the correct envelope.

- Choose Clear Labels: Use clear, legible labels. You can use pre-printed labels, write directly on the envelopes with a marker, or use a label maker.

- Include Category Names: The most important element of your label is the spending category name (e.g., “Groceries,” “Dining Out,” “Entertainment”).

- Include Budgeted Amount (Optional but Helpful): Adding the budgeted amount on the envelope is a good reminder of your spending limit. For example, “Groceries: $400”.

- Consider Adding the Budgeting Period: To avoid confusion across months, you can add the budgeting period to your label (e.g., “Groceries – October: $400”).

Visual Representation of a Typical Cash Envelope Setup

Here’s a descriptive example of how your cash envelope setup might look:

Imagine a small, rectangular box. Inside, you have several manila envelopes, each labeled clearly. The envelopes are organized and each represents a different spending category.

Envelope 1: Groceries. The label is prominently displayed on the front, with the word “Groceries” written in bold, clear letters. Underneath, smaller text states “$400.” Inside, the envelope contains a mix of bills: some $20s, some $10s, and a few $5s, representing the allocated grocery budget.

Envelope 2: Dining Out. This envelope is labeled “Dining Out: $200.” It contains a mix of $20 bills, ready for meals out and quick bites.

Envelope 3: Entertainment. The label reads “Entertainment: $100.” Inside, you find a combination of bills, prepared for movies, events, or other fun activities.

Envelope 4: Transportation. The label says “Transportation: $50.” Inside are a few bills, specifically allocated for gas or public transport.

Envelope 5: Miscellaneous. The label reads “Miscellaneous: $50.” Inside are a few bills, for unexpected expenses or for carrying over to the next month.

This setup allows you to easily see your budget allocation, physically limits your spending, and makes it easier to track where your money is going. This setup is a practical way to manage your finances, providing clarity and control over your spending.

Shopping with Cash Envelopes

Now that you’ve set up your cash envelope system, the real fun begins: actuallyusing* it! This is where you’ll see the power of cash envelopes in action, helping you make mindful spending choices and stay within your budget. Let’s dive into how to navigate different shopping scenarios and make the most of your cash envelope system.

Shopping at Different Types of Stores

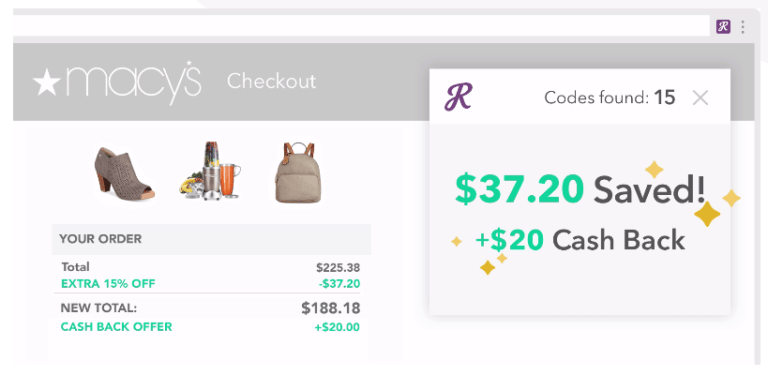

Using cash envelopes effectively means adapting to various shopping environments. This section details how to shop at different types of stores.For grocery shopping, take your “Groceries” envelope. As you fill your cart, keep a running mental tally of your spending. This will help you stay within your allocated budget. At the checkout, hand over the cash from your envelope.For online shopping, you might be thinking, “How does this work with cash?” Here’s a workaround: Before you shop, decide which envelope the purchase falls under (e.g., “Clothing,” “Entertainment”).

Withdraw the cash from that envelopebefore* you start browsing. This forces you to be mindful of your spending limit. You can then use the cash to purchase a gift card for the online retailer. Alternatively, if you have a credit card that you only use for rewards, you can use the credit card for the purchase and then immediately withdraw the same amount of cash from the corresponding envelope to pay off the credit card balance.

This keeps your cash envelope system in sync.When shopping at a department store, use the envelope that corresponds to the type of purchase (e.g., “Clothing,” “Household Goods,” or “Gifts”). As with groceries, be mindful of your spending and avoid impulse buys.

Tracking Spending Within Each Envelope

Tracking your spending is crucial for the success of the cash envelope system. There are several methods to effectively monitor your spending within each envelope.Here are several ways to track your spending:

- Use a small notebook or a piece of paper: Keep a small notebook or a piece of paper inside each envelope. As you spend money, write down the date, the store, and the amount spent. Subtract the amount from the starting balance. This is the simplest method.

- Use a dedicated expense tracking app: Many budgeting apps allow you to track your cash envelope spending. You can enter each transaction and categorize it by envelope.

- Create a spreadsheet: If you prefer a more detailed approach, create a spreadsheet to track your spending. You can include columns for the date, store, amount, category (envelope), and remaining balance.

Regularly reviewing your spending allows you to identify areas where you might be overspending and make adjustments to your budget.

Handling Transactions with Inexact Change

Dealing with inexact change is a common occurrence when using cash. Here’s how to handle these situations:When you receive change, immediately put it back into the envelope. This helps you maintain an accurate record of your spending.If you are short a few cents, it is acceptable to round up or use a few cents from another envelope, but always note the adjustment in your tracking method.If you consistently find yourself needing exact change, consider keeping a small amount of change in a separate compartment or small change purse to use for these situations.

Cash vs. Debit Card Shopping Experience

The experience of shopping with cash differs significantly from using a debit card. This section compares and contrasts the two methods.Here are some key differences:

- Visibility of funds: With cash, you physically see the money leaving your possession. This can be a powerful psychological deterrent to overspending. With a debit card, it’s easy to lose track of your spending, as you don’t physically see the money.

- Impulse control: Cash envelopes can help you curb impulse purchases because you are limited to the amount of cash in your envelope. A debit card allows you to spend beyond your means if you are not careful.

- Tracking: Tracking cash spending requires more manual effort (writing down transactions). Debit card transactions are automatically recorded, but you still need to actively monitor your spending.

- Security: If you lose your cash, it’s gone. If you lose your debit card, you can cancel it and potentially recover any unauthorized charges.

The primary benefit of cash envelopes is the increased awareness of your spending, which can lead to better budgeting habits and financial discipline.

Dealing with Leftover Cash

The cash envelope system provides a clear picture of your spending and helps you stay within your budget. A crucial aspect of the system is managing the money that remains at the end of your spending period. Knowing what to do with leftover cash maximizes its benefit and contributes to your financial goals. This section will guide you through strategies for handling leftover funds, ensuring you make the most of every dollar.

Saving Leftover Cash

At the end of your spending period, you might have cash remaining in some of your envelopes. Deciding what to do with this money is an important part of the process. There are several effective strategies to put this leftover cash to good use, fostering financial discipline and progress.

- Rolling Over to the Next Month: This is a straightforward approach, especially for categories where spending fluctuates. Place the remaining cash back into the same envelope for the next month. This can create a buffer for months with higher expenses. For example, if you have $20 left in your “Groceries” envelope, add it to the amount you allocate for groceries the following month. This strategy is particularly helpful for irregular expenses or for building a small surplus over time.

- Transferring to a Savings Goal: Leftover cash can be a powerful tool for accelerating savings. Identify a specific savings goal, such as a down payment on a car, a vacation, or an emergency fund. Transfer the leftover cash from your envelopes into a dedicated savings account. Regularly contributing small amounts from your envelopes can result in significant progress toward your goals over time.

- Creating a “Sinking Fund”: Sinking funds are dedicated savings accounts for specific, often infrequent, expenses. Examples include holiday gifts, car maintenance, or annual subscriptions. You can allocate leftover cash to these sinking funds. For example, if you have $15 left in your “Entertainment” envelope, and you are saving for a concert, put it in that envelope for the concert fund. This allows you to spread out the cost of larger expenses over time, making them more manageable.

- Paying Down Debt: If you have outstanding debt, such as credit card balances or student loans, using leftover cash to make extra payments can be a wise choice. Paying down debt reduces interest charges and helps you become debt-free faster. Even small extra payments can make a significant difference over time, especially with high-interest debt.

Handling Envelopes Running Out of Cash

Sometimes, an envelope might run out of cash before the end of the spending period. This situation is a common occurrence, and understanding how to address it is crucial for maintaining control of your finances.

- Assessing the Situation: Before taking any action, determine why the envelope ran out of cash. Was it due to an unexpected expense, a miscalculation of needs, or overspending in that category? Understanding the root cause will help you make informed decisions.

- Evaluating Alternatives:

- Adjusting Other Envelopes: If possible, can you transfer funds from another envelope that has a surplus? For example, if your “Entertainment” envelope has money left, and your “Groceries” envelope is short, you could consider transferring some funds. This requires careful consideration to ensure you don’t jeopardize your other spending plans.

- Delaying the Purchase: Can you postpone the purchase until the next spending period, or do you absolutely need the item or service immediately?

- Using a Savings Account (Emergency): If the expense is truly essential and you have no other options, you might consider using your emergency fund, but only as a last resort.

- Documenting the Event: Note the overspending, the reason, and the solution in your budget tracker or notebook. This will help you learn from the experience and adjust your budgeting in the future.

- Reviewing and Adjusting the Budget: After the spending period, review the categories that ran out of cash and identify areas where you might need to adjust your allocations. Consider increasing the budget for that category or modifying your spending habits in the future.

Adapting the System to Different Lifestyles

Adapting the cash envelope system allows it to be a flexible tool suitable for various financial situations. This adaptability ensures that the system can be effectively implemented regardless of individual circumstances, whether managing finances as a couple, dealing with fluctuating income, or incorporating online shopping.

Adjusting the System for Couples and Families

Managing finances together requires open communication and agreed-upon strategies. The cash envelope system can be adapted to accommodate shared expenses and individual allowances within a household.

Here’s how to adjust the system for couples and families:

- Joint Accounts and Shared Envelopes: Establish joint accounts for shared expenses such as groceries, utilities, and mortgage payments. Create shared cash envelopes for these categories, where both partners contribute and withdraw funds. This promotes transparency and shared responsibility.

- Individual Allowances: Allocate individual cash envelopes for personal spending, such as entertainment, hobbies, or clothing. Each partner manages their own envelope and spending, providing financial independence within the framework of a shared budget.

- Budget Meetings: Regularly schedule budget meetings to review spending, adjust envelope amounts, and discuss financial goals. These meetings help maintain alignment and address any issues that arise. This allows you to work as a team.

- Tracking and Communication: Utilize shared budgeting apps or spreadsheets to track spending from both joint and individual accounts. Maintain open communication about financial decisions and any unexpected expenses.

- Children’s Allowances (for families): Introduce children to financial responsibility by providing them with their own cash envelopes for specific expenses, such as school lunches or entertainment. This teaches them about budgeting and making spending choices.

Applicability for Fluctuating Incomes

Individuals with fluctuating incomes can still effectively use the cash envelope system by making some adjustments. This requires a proactive approach to budgeting and spending based on the income cycle.

Here’s how the system can be applied to fluctuating incomes:

- Income Tracking: Accurately track income over several months to identify income patterns. This helps in estimating future income levels.

- Variable Budgeting: Instead of fixed envelope amounts, create a variable budget based on expected income. For months with higher income, allocate more to each envelope. For months with lower income, adjust envelope amounts accordingly or prioritize essential expenses.

- Buffer Funds: Maintain a buffer fund in a separate savings account to cover unexpected expenses or income shortfalls. This provides a safety net during lean months.

- Prioritize Essential Categories: During months of lower income, prioritize essential expense categories such as groceries, housing, and utilities. Consider reducing spending in discretionary categories.

- Review and Adjust Regularly: Review the budget and envelope amounts regularly, ideally after each pay period or income cycle. Adjust as needed based on actual income and spending patterns.

Incorporating the System with Online Shopping

Online shopping is a common practice, and the cash envelope system can still be integrated. Careful planning and execution are necessary to stay within budget.

Here’s how to incorporate the system with online shopping:

- Pre-Budgeting: Before making online purchases, allocate funds to the relevant cash envelope categories.

- Virtual Envelopes: Use a budgeting app or spreadsheet to create virtual envelopes for online spending. Track spending within each category.

- Debit Card for Online Purchases: Use a debit card linked to the cash envelope category for online purchases. Ensure sufficient funds are available in the corresponding envelope.

- Track Online Spending: Monitor online spending closely and compare it to the allocated budget for each category.

- Receipt Management: Save all online purchase receipts and file them with the corresponding cash envelope category for accurate tracking and reconciliation.

Example: Adapting the System for a Student

A student could use the cash envelope system to manage their limited budget. They might create envelopes for categories like “Groceries,” “Transportation,” “Entertainment,” and “Books & Supplies.” They would receive a set amount of cash from their parents or through a part-time job and divide it among the envelopes at the start of each month. When shopping online for textbooks, they would allocate money from their “Books & Supplies” envelope to their debit card, ensuring they don’t overspend.

For eating out with friends, they would use the “Entertainment” envelope, setting a limit to prevent overspending. This system helps the student stay within their budget and teaches them about financial responsibility.

Potential Challenges and Solutions

The cash envelope system, while effective, isn’t without its hurdles. Many users encounter difficulties when first implementing the system. Understanding these potential challenges and having solutions ready can significantly increase your chances of success and help you stay on track with your financial goals.

Overcoming Temptations to Overspend

The allure of overspending is a common pitfall. Staying within your budget requires discipline and proactive strategies to resist impulsive purchases.* Recognize Your Triggers: Identify the situations or emotions that lead to overspending. Are you more likely to splurge when stressed, bored, or shopping with friends?

Create a “Buffer” Envelope

Designate a small envelope specifically for unexpected, non-essential purchases. This allows for occasional treats without breaking the bank.

Delay Purchases

When tempted, tell yourself you’ll wait 24 hours before buying something. Often, the urge will pass.

Shop with a Buddy

Having a friend or family member who supports your financial goals can help you stay accountable.

Track Your Progress

Regularly review your spending and see how well you are adhering to your budget. Celebrate small victories to stay motivated.

Dealing with Unexpected Expenses

Life throws curveballs. Unexpected expenses are inevitable, and it’s crucial to have a plan to manage them without derailing your budget.* Establish an Emergency Fund: Ideally, have a separate savings account specifically for emergencies. Aim to save at least 3-6 months’ worth of living expenses.

Prioritize Expenses

When an unexpected cost arises, assess its importance. Is it essential, or can it be postponed?

Adjust Your Budget

If an unexpected expense is unavoidable, adjust your other envelope categories accordingly. This might involve reducing spending in other areas for the current month.

Consider a “Sinking Fund”

For predictable, infrequent expenses (like car maintenance or holiday gifts), create sinking funds by saving small amounts each month in a separate envelope or account.

Explore Financing Options

For large, unavoidable expenses, consider low-interest financing options as a last resort, but always factor in the cost of interest and the impact on your overall budget.

Common Problems and Solutions

Here’s a table summarizing common challenges and corresponding solutions:

| Potential Problem | Description | Suggested Solution |

|---|---|---|

| Overspending | The tendency to exceed the budgeted amount within an envelope category. | Track spending closely, use the “buffer” envelope for small treats, and delay purchases to curb impulses. |

| Running Out of Cash Mid-Month | Depleting an envelope’s funds before the end of the budgeting period. | Re-evaluate the initial budget allocation, consider borrowing from other envelopes (with a plan to replenish), or adjust spending habits. |

| Difficulty with Online Purchases | The cash envelope system is designed for physical cash, and online purchases are more challenging. | Use a debit card linked to your checking account and categorize the purchase within your budget. Or, withdraw cash from the relevant envelope to cover online spending. |

| Unexpected Expenses | Unforeseen costs that were not included in the initial budget. | Utilize an emergency fund, prioritize expenses, adjust other envelope categories, or use sinking funds for predictable costs. |

| Inconsistent Tracking | Failure to accurately record spending, making it difficult to assess budget performance. | Use a budget tracking app, a notebook, or a spreadsheet to meticulously record every transaction. |

Tracking Your Progress and Making Adjustments

The cash envelope system isn’t just about spending; it’s about gaining control over your finances and achieving your goals. Monitoring your progress and making adjustments are crucial steps in ensuring the system works effectively for you. This section focuses on how to track your spending, review your budget, and refine your approach for optimal results.

Monitoring Spending Habits

Tracking your spending is vital for understanding where your money is going and identifying areas for improvement. There are several methods you can use to monitor your cash envelope spending.

- Using a Ledger or Spreadsheet: Maintain a simple ledger or spreadsheet to record every transaction. Include the date, the envelope category, the vendor, the amount spent, and the remaining balance in the envelope. This provides a clear picture of your spending patterns.

- Employing a Dedicated Budgeting App: Many budgeting apps allow you to track cash envelope spending. You can manually enter transactions or, if the app supports it, link it to your bank account to track your spending. Some apps even allow you to categorize your spending based on your cash envelopes.

- Reviewing Receipts Regularly: At the end of each day or week, review your receipts and reconcile them with your ledger or budgeting app. This helps you catch any discrepancies and ensures accuracy.

- Visualizing Spending with Charts: Use charts and graphs (available in most budgeting apps or spreadsheet programs) to visualize your spending. Pie charts can show the percentage of your budget spent in each category, while line graphs can track spending trends over time.

Reviewing the Budget and Making Adjustments

Regularly reviewing your budget and making adjustments is key to keeping the cash envelope system effective. This involves assessing your spending habits, identifying areas where you are overspending or underspending, and modifying your budget accordingly.

- Conducting Monthly Budget Reviews: At the end of each month, review your spending in each envelope category. Compare your actual spending to your budgeted amounts. Identify any categories where you consistently overspent or underspent.

- Analyzing Spending Patterns: Look for patterns in your spending. Are there certain times of the month when you tend to overspend? Are there specific categories that consistently require more money than you initially budgeted?

- Adjusting Envelope Amounts: Based on your analysis, adjust the amounts allocated to each envelope category. If you consistently overspend in a category, consider increasing the budget for that envelope. If you consistently underspend, consider decreasing the budget or reallocating the extra funds to another category or towards a financial goal.

- Revisiting Your Financial Goals: Ensure your budget aligns with your financial goals. If you are saving for a down payment on a house, for example, make sure your savings envelope reflects your target savings rate. If your goals change, adjust your budget accordingly.

- Considering Seasonal Variations: Some spending categories, such as groceries or entertainment, may fluctuate throughout the year. Take seasonal variations into account when creating and adjusting your budget. For example, increase your grocery budget during the holiday season.

Using the System to Achieve Financial Goals

The cash envelope system is a powerful tool for achieving financial goals, whether it’s saving for a down payment, paying off debt, or building an emergency fund.

- Allocating Funds to Savings Envelopes: Create separate envelopes for specific savings goals. For example, have an envelope for “Vacation,” “New Car,” or “Emergency Fund.” Regularly contribute to these envelopes.

- Accelerating Debt Repayment: Use the cash envelope system to aggressively pay off debt. Allocate extra money to your “Debt Payment” envelope each month. This can help you reduce interest payments and become debt-free faster.

- Tracking Progress Towards Goals: Monitor your progress towards your financial goals. Use a spreadsheet or budgeting app to track your savings and debt repayment. Celebrate your milestones and stay motivated.

- Using Surplus Funds Strategically: If you have leftover cash in your envelopes at the end of the month, use it to accelerate your financial goals. You can contribute the surplus to your savings envelopes or use it to pay down debt.

- Setting Realistic Goals and Timelines: Set realistic financial goals and timelines. Break down large goals into smaller, more manageable steps. This makes the process less daunting and increases your chances of success. For example, if your goal is to save $6,000 for a vacation in one year, aim to save $500 per month.

Tracking Spending Progress Over Time

Tracking progress over time provides valuable insights into your spending habits and the effectiveness of your budget. Here are some ways to track progress:

- Creating a Spending Journal: Keep a journal where you record your spending and any insights you gain. This can include notes on why you overspent in a particular category or what strategies worked well.

- Using a Spreadsheet or App for Data Visualization: Use a spreadsheet or budgeting app to create charts and graphs that visualize your spending trends over time. This allows you to see your progress at a glance.

- Calculating Monthly Savings Rates: Calculate your monthly savings rate by dividing your total savings by your total income. Track this rate over time to see if you are increasing your savings.

- Measuring Debt Reduction: Track your debt reduction progress by monitoring the balance of your outstanding debts. Observe the change in your debt over time.

- Conducting Quarterly or Annual Reviews: Schedule quarterly or annual reviews to assess your progress and make necessary adjustments to your budget and financial goals. This allows you to step back and evaluate your overall financial health.

Concluding Remarks

In summary, the ‘Cash Envelope’ System is more than just a budgeting tool; it’s a lifestyle change. By embracing this method, you’ll gain a deeper understanding of your spending patterns, curb impulsive purchases, and work towards your financial goals. Remember to adapt the system to your unique needs and regularly track your progress. With dedication and consistency, you can unlock the power of the cash envelope system and pave the way for a more secure and fulfilling financial future.