Ready to take control of your finances and break free from spending habits that hold you back? A ‘No-Spend Challenge’ is your secret weapon. This isn’t just about saving money; it’s a journey of self-discovery, where you’ll uncover the “why” behind your spending and build lasting habits. Imagine transforming your relationship with money, one mindful purchase at a time.

This guide will walk you through every step of a successful no-spend challenge. We’ll explore the core concepts, from defining essential vs. non-essential spending, to setting clear boundaries and strategies to minimize spending. You’ll learn how to plan, prepare, and navigate the inevitable temptations, all while tracking your progress and making adjustments along the way. Get ready to understand your spending triggers, discover free entertainment options, and utilize your existing resources to their fullest potential.

Understanding the No-Spend Challenge

A no-spend challenge is a powerful tool for re-evaluating your relationship with money and building healthier financial habits. It’s essentially a temporary commitment to abstain from spending money on non-essential items or activities. This focused approach allows you to identify spending patterns, curb impulsive purchases, and ultimately gain better control over your finances.

Core Concept and Purpose

The primary goal of a no-spend challenge is to reset your spending habits and gain a clearer understanding of where your money is going. By consciously restricting spending for a set period, you’re forced to confront your spending triggers and make deliberate choices about what you truly need versus what you simply want. The intended purpose is multifaceted, including:

- Identifying Spending Patterns: The challenge encourages you to track every dollar spent, revealing where your money typically flows. This can highlight areas where you’re overspending or making impulse purchases.

- Breaking Bad Habits: By consciously avoiding non-essential spending, you can disrupt ingrained spending habits and create space for new, more mindful behaviors.

- Boosting Savings: The money you

-don’t* spend during the challenge can be directed towards savings goals, debt repayment, or other financial priorities. - Increasing Financial Awareness: The challenge heightens your awareness of the value of money and the impact of your spending decisions.

Defining “Spending”

Defining what constitutes “spending” is crucial for a successful no-spend challenge. The boundaries can be tailored to your individual goals, but generally, spending is categorized as either essential or non-essential.

- Essential Expenses: These are the necessary costs of living that you cannot avoid. They typically include:

- Housing (rent or mortgage payments)

- Utilities (electricity, water, gas)

- Groceries (food for your household)

- Transportation (public transport, gas, car payments, insurance)

- Essential healthcare (doctor visits, medications)

- Debt payments (minimum payments on credit cards, loans)

- Non-Essential Expenses: These are discretionary purchases that you can choose to eliminate or significantly reduce during the challenge. Examples include:

- Dining out and takeout

- Entertainment (movies, concerts, streaming services)

- Shopping for clothing, accessories, and other non-essential items

- Subscriptions (magazines, online services)

- Coffee and snacks purchased outside the home

- Hobbies and recreational activities

It’s important to clarify the specificsbefore* starting the challenge. For instance, you might decide that replacing a broken appliance is essential, while buying a new gadget is not.

Potential Benefits

Undertaking a no-spend challenge offers a range of potential benefits, extending beyond simple financial savings.

- Improved Financial Literacy: The challenge necessitates tracking expenses and budgeting, fostering a deeper understanding of your financial situation.

- Reduced Debt: By redirecting funds typically spent on non-essentials, you can accelerate debt repayment or build emergency savings.

- Increased Savings: The discipline of the challenge encourages you to prioritize saving goals, such as a down payment on a house or investments.

- Enhanced Self-Control: Successfully completing a no-spend challenge strengthens your ability to resist impulsive purchases and make more thoughtful financial decisions.

- Greater Awareness of Value: You begin to appreciate the value of the things you already own and become less susceptible to marketing and advertising pressures.

- Reduced Stress: Financial stress is a common source of anxiety. The challenge can help reduce this by giving you a better handle on your finances.

For example, imagine a person who typically spends $200 per month on eating out. During a no-spend challenge, that money could be saved, invested, or used to pay down debt, significantly improving their financial position.

Psychological Impact on Consumer Behavior

A no-spend challenge has a significant psychological impact on consumer behavior. It helps individuals to become more aware of the emotional triggers that lead to spending.

- Breaking the Cycle of Impulse Buying: The challenge forces you to pause before making a purchase, allowing you to consider whether it’s truly necessary. This can disrupt the cycle of impulsive buying.

- Reframing Needs vs. Wants: By focusing on essentials, you learn to differentiate between what you genuinely need and what you simply desire.

- Altering the Relationship with Materialism: The challenge can lead to a shift in perspective, making you less reliant on material possessions for happiness.

- Developing a Sense of Empowerment: Successfully completing a no-spend challenge can boost your self-esteem and confidence in your ability to control your finances.

- Creating New Habits: The challenge provides an opportunity to form new, healthier habits, such as meal prepping, finding free entertainment options, and delayed gratification.

For instance, consider a person who frequently buys new clothes to cope with stress. A no-spend challenge can help them find alternative coping mechanisms, such as exercise or spending time in nature, rather than resorting to retail therapy. The psychological shift can be substantial, leading to long-term changes in consumer behavior and a healthier relationship with money.

Planning and Preparation

Embarking on a no-spend challenge requires careful planning to ensure its success. Without adequate preparation, you might find yourself tempted to give up or, worse, experience financial setbacks. This section focuses on the essential steps to take before you even begin your challenge, setting you up for a positive and effective experience.

Setting Financial Goals

Establishing clear financial goals is fundamental before undertaking a no-spend challenge. These goals provide the motivation and direction needed to stay committed. Knowing

why* you’re doing the challenge is crucial for overcoming inevitable temptations.

Here’s how to define your financial goals:

- Identify Your “Why”: Determine the underlying reason for wanting to change your spending habits. Are you saving for a down payment on a house, paying off debt, building an emergency fund, or something else? Your “why” is the emotional driver.

- Set SMART Goals: Financial goals should be SMART: Specific, Measurable, Achievable, Relevant, and Time-bound.

- Specific: Instead of “save money,” aim for “save $1,000.”

- Measurable: Track your progress. For example, “reduce eating out expenses by 50%.”

- Achievable: Set realistic goals. Don’t aim to eliminate all spending overnight.

- Relevant: Ensure the goal aligns with your overall financial objectives.

- Time-bound: Set a deadline. For instance, “save $1,000 in six months.”

- Prioritize Goals: If you have multiple financial goals, prioritize them. This helps you allocate your resources effectively. Consider the urgency and importance of each goal.

- Document Your Goals: Write down your goals. Regularly review them to stay motivated and track progress. This creates accountability.

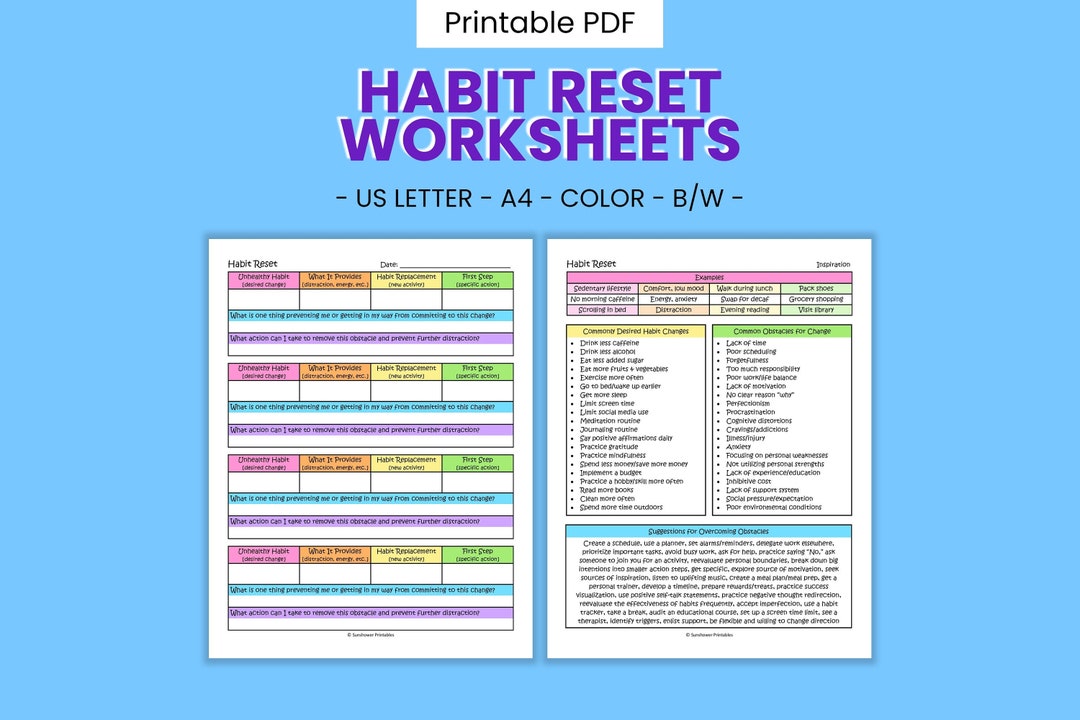

Tracking Spending Habits

Understanding where your money currently goes is vital before restricting spending. This allows you to identify areas for improvement and track the impact of your no-spend challenge.Here’s how to track your spending:

- Choose a Tracking Method: Select a method that suits your lifestyle.

- Spreadsheet: Use a spreadsheet (Google Sheets, Excel) to manually record every transaction.

- Budgeting App: Utilize apps like Mint, YNAB (You Need a Budget), or Personal Capital to automatically track spending. These apps often categorize transactions.

- Notebook and Pen: For a more analog approach, use a notebook to write down every expense.

- Track All Expenses: Record every purchase, no matter how small. This includes cash transactions, online purchases, and recurring bills.

- Categorize Your Spending: Group your expenses into categories like housing, transportation, food, entertainment, and personal care. This helps identify spending patterns.

- Review Your Data: Regularly review your spending data (weekly or monthly). Identify areas where you can cut back and areas where you’re overspending.

Identifying and Categorizing Spending Triggers

Recognizing your spending triggers is crucial for proactively managing them during your no-spend challenge. These triggers are the situations, emotions, or environments that prompt you to spend money.Here’s how to identify and categorize your spending triggers:

- Reflect on Past Spending: Review your spending data and identify patterns. What were you doing when you made impulsive purchases? What emotions were you experiencing?

- Brainstorm Common Triggers: Common spending triggers include:

- Emotions: Stress, boredom, sadness, or happiness.

- Environments: Being in a mall, browsing online stores, or hanging out with friends who spend a lot.

- Situations: Seeing advertisements, receiving paychecks, or experiencing social pressure.

- Categorize Your Triggers: Group your triggers into categories to better understand them. For example:

- Emotional Triggers: Spending due to stress.

- Environmental Triggers: Spending while shopping.

- Social Triggers: Spending to keep up with friends.

- Create a Trigger Log: As you track your spending, also track your triggers. Note the date, time, trigger, and the amount spent. This helps you build awareness and anticipate future temptations.

Managing Unexpected Expenses

Life is unpredictable, and unexpected expenses are inevitable. Having a plan for handling these during your no-spend challenge prevents setbacks and minimizes stress.Here’s how to plan for unexpected expenses:

- Set a Contingency Fund: Allocate a small amount of money to cover unexpected expenses. This could be a percentage of your usual spending or a fixed amount.

- Identify Essential vs. Non-Essential Expenses: Determine which expenses are truly unavoidable.

- Essential: Medical emergencies, necessary car repairs, essential home repairs.

- Non-Essential: New clothes, dining out, entertainment.

- Establish Rules for Unexpected Expenses: Decide how you will handle unexpected expenses during your challenge.

- Emergency Fund: If the expense is essential, use your emergency fund (if you have one).

- Postpone Non-Essentials: Delay non-essential purchases until after the challenge.

- Seek Alternatives: Look for cheaper alternatives or solutions. For example, borrow from a friend instead of buying a new item.

- Document All Unexpected Expenses: Keep a record of all unexpected expenses, even if you use your contingency fund. This helps you analyze your spending patterns after the challenge.

Gathering Items Before Starting

Before starting your no-spend challenge, gather essential items to avoid unnecessary spending during the challenge. This proactive step minimizes the need to buy things, helping you stay on track.Here is a checklist of items to gather:

- Food and Groceries: Stock up on essential food items and ingredients to avoid eating out or ordering takeout. Plan your meals in advance.

- Toiletries and Personal Care Items: Gather enough shampoo, soap, toothpaste, and other personal care products to last the duration of the challenge.

- Household Supplies: Ensure you have enough cleaning supplies, laundry detergent, and other household essentials.

- Entertainment Options: Gather books, movies, games, and other forms of entertainment to avoid spending on leisure activities.

- Work and School Supplies: If applicable, gather necessary supplies for work or school to avoid last-minute purchases.

- Subscriptions and Memberships: Review your subscriptions and memberships. Cancel any that are not essential or that you rarely use.

- Cash: Consider withdrawing some cash to use for necessary expenses, especially if you’re accustomed to using cash for certain purchases.

Setting the Rules and Boundaries

Establishing clear rules and boundaries is the cornerstone of a successful no-spend challenge. Without a well-defined framework, you risk ambiguity, frustration, and ultimately, failure. This section will guide you through the process of creating a robust set of rules that will help you stay on track and achieve your financial goals.

Defining the Challenge Duration

The duration of your no-spend challenge is a critical decision. It should be long enough to create noticeable behavioral changes but not so long that it becomes unsustainable. The ideal length depends on your individual circumstances and goals.

- One Week: This is a good starting point for beginners. It’s a relatively short commitment that allows you to test the waters and identify spending triggers. It is ideal for small lifestyle adjustments.

- Two Weeks: A slightly longer duration, allowing for a deeper exploration of your spending habits and providing more time to develop alternative strategies.

- One Month: This is a popular choice, offering a significant opportunity to reset your habits and experience tangible financial results. A month-long challenge is suitable for establishing more robust and long-lasting changes.

- Custom Durations: You can tailor the challenge to fit your needs. For example, you might choose a challenge that aligns with a specific pay period, like a two-week or a month-long challenge that begins on the first of the month.

Establishing Clear Boundaries

Setting explicit boundaries is paramount for a successful no-spend challenge. Boundaries define what you are and are not allowed to spend money on during the challenge. This prevents loopholes and keeps you accountable.

- Consider your goals: Are you trying to save money, pay down debt, or simply curb impulse spending? Your goals will influence the boundaries you set.

- Be specific: Vague rules are easily circumvented. Define each category with precision. For example, instead of “entertainment,” specify “movies, concerts, and sporting events.”

- Document your rules: Write down all your rules and boundaries. This provides a clear reference point and helps you stay consistent.

- Share your rules: If you’re comfortable, share your rules with a friend or family member who can provide support and accountability.

Allowed and Disallowed Spending Categories

Creating clear distinctions between allowed and disallowed spending is crucial for adhering to the challenge. Here are some examples, but remember to customize them to fit your specific circumstances.

| Category | Allowed | Disallowed |

|---|---|---|

| Groceries | Essential food items (produce, staples), household supplies (cleaning products). | Takeout, restaurant meals, snacks and drinks outside of planned grocery trips, specialty foods. |

| Transportation | Public transport, pre-paid gas, car maintenance (if unavoidable). | Ride-sharing services (unless essential), new car purchases, premium fuel. |

| Housing | Rent/mortgage, utilities (electricity, water, gas), pre-existing home maintenance costs. | New furniture, home decor, renovations (unless essential for safety). |

| Personal Care | Essential toiletries (soap, shampoo), haircuts (if pre-scheduled), essential medications. | Cosmetics, spa treatments, new clothes, beauty products. |

| Entertainment | Free activities (hiking, visiting parks, library visits), pre-paid subscriptions (if deemed essential). | Movies, concerts, sporting events, eating out, streaming services (unless already subscribed). |

Handling Temptation and Rule-Breaking

Temptation is inevitable. Having a plan to address it is essential for staying on track.

- Identify your triggers: What situations or emotions lead to spending? (e.g., boredom, stress, social pressure).

- Develop coping mechanisms: Have alternative activities ready. For example, instead of going shopping when bored, read a book, go for a walk, or call a friend.

- Delay purchases: If you feel tempted to buy something, postpone the purchase. Give yourself at least 24 hours to consider whether you truly need it.

- Communicate: If you feel overwhelmed, talk to someone. Seek support from friends, family, or a financial advisor.

- Acknowledge and learn from mistakes: If you break a rule, don’t beat yourself up. Analyze what happened, learn from it, and adjust your plan for the future.

Monitoring Progress and Adjusting Rules

Regularly monitoring your progress and making adjustments to your rules is vital for success.

- Track your spending: Keep a detailed record of all your spending, even if it’s within the allowed categories. This helps you identify areas where you can improve.

- Review your progress weekly: Set aside time each week to review your spending and assess your progress toward your goals.

- Adjust your rules as needed: If a rule proves to be too restrictive or not restrictive enough, modify it. The challenge should be challenging but also sustainable.

- Celebrate your successes: Acknowledge and reward yourself for staying on track. This will help you stay motivated. For example, you could treat yourself to a small, pre-planned reward at the end of the challenge if you meet your goals.

Strategies for Success

Successfully navigating a no-spend challenge requires proactive strategies and a shift in mindset. It’s not about deprivation, but about conscious choices and resourcefulness. By implementing these tactics, you can significantly reduce spending and cultivate healthier financial habits.

Minimizing Spending on Groceries and Food

Reducing food expenses is a key area for success. Careful planning, preparation, and mindful consumption can lead to substantial savings.

- Plan Your Meals: Create a weekly meal plan based on your existing pantry and refrigerator contents. This prevents impulse buys at the grocery store and minimizes food waste.

- Make a Grocery List and Stick to It: Before shopping, compile a detailed grocery list based on your meal plan. Resist the temptation to deviate from the list, especially in areas known for impulse purchases, like the endcaps.

- Cook at Home: Eating out, even fast food, is significantly more expensive than cooking at home. Preparing your meals from scratch allows you to control ingredients and portion sizes.

- Embrace Leftovers: Plan for leftovers when cooking. Repurpose leftovers into new meals to reduce waste and save time and money. For example, roasted chicken can become chicken salad for lunch the next day.

- Shop Smart: Compare prices between different grocery stores and brands. Look for sales, use coupons (digital and paper), and consider store brands, which are often just as good as name brands but less expensive.

- Reduce Food Waste: Properly store food to extend its shelf life. Use up perishable items first. Freeze extra portions of meals and ingredients to prevent spoilage.

- Consider Batch Cooking: Dedicate a few hours each week to prepare multiple meals or components. This saves time during the week and reduces the temptation to order takeout.

- Limit Processed Foods: Processed foods are often more expensive and less nutritious than whole foods. Focus on buying fresh produce, whole grains, and lean proteins.

Finding Free or Low-Cost Entertainment Options

Maintaining a fulfilling social life doesn’t require breaking the bank. Numerous free or low-cost entertainment options are available.

- Explore Free Local Events: Check local community calendars for free concerts, festivals, farmers’ markets, and park events. Libraries often host free workshops, lectures, and movie screenings.

- Utilize Parks and Outdoor Spaces: Enjoy nature by going for hikes, bike rides, picnics, or simply relaxing in a park. These activities are generally free or very low-cost.

- Host Game Nights or Potlucks: Invite friends over for a game night or potluck dinner. Everyone brings a dish or a game, reducing individual costs and fostering social connection.

- Borrow Books, Movies, and Music: Utilize your local library to borrow books, movies, and music for free. This provides access to entertainment without incurring any costs.

- Explore Free Online Resources: Watch free movies and TV shows on streaming services with ads, listen to free podcasts and audiobooks, and participate in online courses or workshops.

- Take Advantage of Free Museum Days: Many museums offer free admission days or evenings. Research free days at local museums and plan your visits accordingly.

- Get Creative with DIY Projects: Engage in creative activities like painting, drawing, writing, or crafting. Utilize existing supplies or inexpensive materials.

- Go for Walks or Bike Rides: Explore your neighborhood or nearby trails. This is a great way to get exercise and enjoy the outdoors without spending any money.

Ways to Avoid Impulse Purchases

Impulse purchases can quickly derail a no-spend challenge. Recognizing triggers and developing strategies to resist temptation are crucial.

- Identify Your Triggers: Recognize the situations, emotions, or places that often lead to impulse buys. For example, boredom, stress, or browsing online shopping sites might be triggers.

- Unsubscribe from Promotional Emails: Reduce exposure to tempting offers by unsubscribing from marketing emails.

- Unfollow Retailers on Social Media: Avoid seeing ads and promotions on social media platforms by unfollowing retailers.

- Create a Waiting Period: Before making a non-essential purchase, implement a waiting period, such as 24 or 48 hours. Often, the urge to buy will pass.

- Use the “Needs vs. Wants” Test: Before making a purchase, ask yourself if it’s a genuine need or simply a want. Consider if the item is essential for your well-being or daily functioning.

- Shop with a List: Only buy items on your pre-prepared shopping list. This prevents wandering and impulse buys.

- Leave Your Credit Cards at Home: If possible, leave your credit cards at home when shopping. This limits your spending ability.

- Find Alternative Activities: When you feel the urge to spend, find an alternative activity, such as going for a walk, reading a book, or calling a friend.

Utilizing Existing Resources to Meet Needs

Maximizing existing resources is key to navigating a no-spend challenge successfully. It involves assessing what you already have and leveraging those assets.

- Inventory Your Possessions: Take stock of your belongings. You might discover items you already own that can fulfill your needs, eliminating the need to buy something new.

- Borrow or Trade: Instead of buying, borrow items from friends, family, or your local library. Consider swapping items with others.

- Repair Instead of Replace: Repair items instead of replacing them. This saves money and reduces waste. Learn basic repair skills for common household items.

- Utilize Free Services: Take advantage of free services offered by your community, such as free legal clinics, counseling services, or job search assistance.

- Explore Free Educational Resources: Access free online courses, tutorials, and workshops to learn new skills or expand your knowledge.

- Look for Free Samples and Trials: Many companies offer free samples or trial periods for their products. Take advantage of these opportunities to try out new items without spending money.

- Repurpose and Upcycle: Give new life to old items by repurposing or upcycling them. For example, turn old t-shirts into cleaning rags.

- Ask for Help: Don’t hesitate to ask friends and family for help if you need it. This can be a great way to save money and strengthen relationships.

Money-Saving Tips by Area

Here’s a table summarizing money-saving tips across various categories.

| Category | Tip | Example | Benefit |

|---|---|---|---|

| Food | Plan meals and make a grocery list. | Create a weekly menu and stick to the list when shopping. | Reduces impulse buys and minimizes food waste. |

| Entertainment | Explore free local events. | Attend free concerts, festivals, or park events. | Provides entertainment without cost. |

| Transportation | Walk, bike, or use public transport. | Choose walking or biking for short trips, and use public transit instead of driving. | Reduces fuel and vehicle maintenance costs. |

| Household | Borrow or trade items. | Borrow a tool from a neighbor instead of buying it. | Avoids unnecessary purchases and reduces clutter. |

Dealing with Challenges and Temptations

Embarking on a no-spend challenge can be a rewarding experience, but it’s not without its hurdles. Understanding these common challenges and equipping yourself with effective strategies is crucial for success. This section will delve into the obstacles you might encounter, providing practical techniques to navigate temptations, manage social pressures, and stay motivated throughout your journey.

Common Challenges Faced During a No-Spend Challenge

The path of a no-spend challenge is rarely smooth. Various challenges can arise, potentially derailing your progress. Recognizing these potential pitfalls allows you to proactively prepare and mitigate their impact.

- Impulse Purchases: This is perhaps the most frequent challenge. Seeing a tempting item, especially online or in stores, can trigger an immediate desire to buy, even if it wasn’t planned.

- Social Pressure: Friends, family, or colleagues may not understand or support your challenge. Social events often revolve around spending, creating pressure to participate.

- Boredom: Without spending, you might find yourself with extra time and potentially, boredom. This can lead to seeking entertainment through spending as a default.

- Emotional Spending: Stress, sadness, or other negative emotions can trigger the urge to spend as a form of self-soothing.

- Lack of Planning: Failing to anticipate needs or having a clear plan for your challenge can make it difficult to stay on track.

- Unexpected Expenses: Life throws curveballs. Unexpected bills, car repairs, or other unforeseen costs can disrupt your no-spend plan.

Techniques for Overcoming Temptation and Staying Motivated

Staying the course requires a proactive approach to managing temptation and maintaining motivation. Employing specific techniques can significantly enhance your chances of success.

- Identify Your Triggers: What situations, places, or emotions most often lead to spending? Recognizing these triggers is the first step in avoiding them. For example, if online shopping is a trigger, unsubscribe from promotional emails and avoid browsing shopping websites.

- Create a “No-Spend Zone”: Designate specific areas or times of day where you actively avoid spending. This could be your home, certain stores, or even your commute.

- Delay Purchases: If you’re tempted to buy something, wait 24-48 hours. Often, the urge will pass. Use this time to consider if you truly need the item.

- Use the “Needs vs. Wants” Checklist: Before buying anything, ask yourself: Is this a need or a want? If it’s a want, can I live without it?

- Visualize Your Goals: Regularly remind yourself why you’re doing the challenge. Picture the financial freedom or other benefits you’re working towards.

- Track Your Progress: Keep a record of your savings and any areas where you’ve successfully resisted temptation. This provides a sense of accomplishment and reinforces positive behavior.

- Find an Accountability Partner: Share your goals with a friend or family member who can provide support and encouragement.

- Reward Yourself (Non-Monetarily): Celebrate milestones with non-spending rewards, such as a relaxing bath, a walk in nature, or reading a good book.

Strategies for Dealing with Social Pressures

Social situations can be particularly challenging during a no-spend challenge. However, it’s possible to navigate these situations gracefully while staying true to your goals.

- Communicate Your Goals: Politely and clearly explain your no-spend challenge to friends and family. Most people will be understanding and supportive.

- Suggest Alternative Activities: Propose free or low-cost activities for social gatherings, such as potlucks, game nights, hikes, or movie nights at home.

- Plan Ahead: If you know you’ll be in a social situation that might involve spending, prepare beforehand. Bring your own food or drinks, or suggest an activity that aligns with your budget.

- Be Prepared to Say “No”: It’s okay to decline invitations that involve spending. You can always suggest an alternative or reschedule for a later date.

- Focus on the Social Aspect: Remember that the most important part of social events is spending time with loved ones, not necessarily the spending itself.

- Find Supportive Friends: Seek out friends who understand and respect your financial goals.

Alternative Activities to Replace Spending-Related Habits

Replacing spending-related habits with alternative activities is essential for maintaining a fulfilling lifestyle during your no-spend challenge. This approach helps prevent boredom and redirects your energy towards more enriching experiences.

- Explore Free Entertainment: Visit local parks, museums (many offer free admission days), libraries, or attend free community events.

- Pursue Hobbies: Rediscover or explore new hobbies that don’t involve spending, such as reading, writing, painting, gardening, or learning a new skill online (e.g., coding, a new language).

- Get Active: Exercise is a great way to relieve stress and improve your mood. Go for walks, runs, bike rides, or try free workout videos online.

- Connect with Loved Ones: Spend quality time with family and friends. Organize game nights, potlucks, or simply have meaningful conversations.

- Volunteer: Giving back to your community can be a rewarding experience. Volunteer your time at a local charity or organization.

- Declutter and Organize: Tackle those home projects you’ve been putting off. Decluttering and organizing can be therapeutic and create a sense of accomplishment.

- Learn Something New: Take advantage of free online courses, tutorials, or workshops to expand your knowledge and skills.

- Cook at Home: Prepare meals at home instead of eating out. This is a great way to save money and eat healthier.

Coping with Feelings of Deprivation or Boredom

Feelings of deprivation or boredom are common during a no-spend challenge. Addressing these feelings proactively is crucial for preventing setbacks and maintaining your commitment.

- Acknowledge Your Feelings: It’s okay to feel deprived or bored. Acknowledge these feelings without judgment.

- Reframe Your Perspective: Instead of focusing on what you can’t have, focus on the benefits of your no-spend challenge.

- Practice Gratitude: Take time to appreciate what you already have. Keep a gratitude journal to focus on the positive aspects of your life.

- Create a Schedule: Structure your day with activities to combat boredom. Plan your meals, exercise, and free activities in advance.

- Focus on Your “Why”: Remind yourself of your financial goals and the reasons behind your no-spend challenge. This can help you stay motivated.

- Allow for Small Treats: If your rules allow, incorporate small, affordable treats to avoid feeling completely deprived.

- Seek Support: Talk to friends, family, or an accountability partner about your feelings. Sharing your experiences can help you feel less alone.

Monitoring Progress and Making Adjustments

Tracking your progress is crucial for the success of your no-spend challenge. It allows you to identify what’s working, what’s not, and make necessary adjustments along the way. Consistent monitoring ensures you stay on track and achieve your financial goals. This section will guide you through the process, providing practical tools and strategies.

Tracking Spending Throughout the Challenge

To effectively monitor your progress, meticulous tracking of all spending is essential. This involves recording every transaction, no matter how small, to gain a clear understanding of your spending habits.

- Choose a Tracking Method: Select a method that suits your lifestyle and preferences. Consider these options:

- Spreadsheet: Create a spreadsheet using software like Google Sheets or Microsoft Excel. This allows for customization and detailed analysis.

- Budgeting Apps: Utilize budgeting apps like Mint, YNAB (You Need a Budget), or Personal Capital. These apps often automatically track transactions when linked to your bank accounts.

- Notebook and Pen: For a more hands-on approach, use a notebook to manually record each expense.

- Categorize Expenses: Group your spending into categories (e.g., groceries, transportation, entertainment, personal care). This helps you identify where your money is going.

- Record Every Transaction: Immediately record each expense, including the date, amount, category, and a brief description.

- Reconcile Regularly: At least weekly, compare your records with your bank statements to ensure accuracy.

Reviewing Progress at Regular Intervals

Regular reviews provide opportunities to assess your progress and make necessary adjustments to your approach. These check-ins help maintain momentum and prevent derailment.

- Establish a Schedule: Schedule regular review sessions, such as weekly or bi-weekly. Consistency is key.

- Analyze Spending Data: Review your tracked expenses to identify spending patterns and areas where you’re succeeding or struggling.

- Compare to Goals: Compare your actual spending against your no-spend challenge goals and budget.

- Reflect on Challenges: Consider any challenges or temptations you faced during the review period and how you overcame (or didn’t overcome) them.

- Document Insights: Keep a record of your observations, insights, and any planned adjustments.

Identifying Areas of Success and Struggle

Understanding your successes and struggles is vital for refining your approach and achieving your goals. This involves a deep dive into your spending data and behavior.

- Areas of Success:

- Identify Categories Where You’ve Successfully Reduced Spending: For example, if you’ve significantly decreased your spending on dining out, celebrate that achievement.

- Recognize Positive Behavioral Changes: Note any positive changes in your spending habits, such as planning meals or avoiding impulse purchases.

- Acknowledge Effective Strategies: Identify which strategies from the “Strategies for Success” section are working well for you.

- Areas of Struggle:

- Pinpoint Categories Where Spending Exceeded Expectations: If your grocery bill is higher than anticipated, investigate the reasons.

- Identify Triggers for Overspending: Recognize situations or emotions that led to overspending (e.g., stress, boredom, social pressure).

- Analyze Recurring Challenges: Look for patterns in your struggles to develop targeted solutions.

Weekly Progress Report Template

A well-structured progress report provides a concise overview of your progress, facilitating effective monitoring and adjustment.

Here’s a sample template for a weekly progress report:

| Date Range: | [Start Date]

|

|

|---|---|---|

| Category | Budgeted Amount | Actual Spending |

| Groceries | $50 | $60 |

| Transportation | $20 | $15 |

| Entertainment | $0 | $10 |

| Personal Care | $10 | $5 |

| Total | $80 | $90 |

| Summary: Briefly describe the overall performance for the week. | ||

| Successes: List any positive outcomes or areas where you did well. | ||

| Challenges: Detail any difficulties encountered and the reasons behind them. | ||

| Adjustments for Next Week: Artikel any changes or modifications to your approach. | ||

Example: In the provided example, the individual exceeded their grocery budget by $10 and entertainment budget by $10. They stayed within budget for transportation and personal care. The summary might note that the individual needs to improve grocery shopping habits and find alternative forms of entertainment.

The adjustment for next week might involve planning meals and finding free activities.

Adjusting the Challenge’s Rules

Flexibility is essential for a successful no-spend challenge. Be prepared to modify the rules as needed to address unforeseen circumstances or improve your overall experience.

- Review and Reflect: After each review period, reflect on whether the rules are realistic and effective.

- Identify Areas for Adjustment: Determine which rules need modification based on your progress and challenges.

- Consider the Impact of Changes: Before making changes, assess how they might affect your overall goals and motivation.

- Examples of Adjustments:

- Modify the Scope: If a particular category proves too restrictive, consider relaxing the rules slightly. For example, allowing a small amount for takeout coffee if it helps you avoid more expensive impulse purchases.

- Change the Duration: If the initial timeframe is too challenging, consider shortening the challenge or breaking it into smaller segments.

- Add or Remove Categories: If a category is causing excessive stress, remove it from the challenge. Conversely, add categories to expand your control over spending.

- Document Changes: Keep a record of all rule adjustments and the rationale behind them.

- Maintain Consistency: While being flexible, ensure that changes align with your overall financial goals.

Post-Challenge Reflection and Habit Formation

Congratulations on completing your no-spend challenge! Now comes the crucial phase: reflecting on your experience and transforming the lessons learned into lasting financial habits. This process is essential for making the challenge worthwhile and ensuring you don’t revert to old spending patterns. Let’s delve into how to evaluate your journey and solidify positive changes.

Evaluating the Overall Experience

After the challenge, it’s time to assess your success and identify areas for improvement. This evaluation helps you understand what worked, what didn’t, and why.

Here are several methods for evaluating the overall experience:

- Review Your Journal or Tracker: Revisit the notes you made throughout the challenge. What were the biggest struggles? What were the moments of triumph? Identify patterns in your emotions and behaviors. For example, did cravings for certain items always coincide with specific times of day or emotional states?

- Analyze Your Savings: Calculate the total amount of money you saved during the challenge. This provides a tangible measure of your success. If you tracked where you

-would* have spent money, compare those potential expenses with your actual spending. - Assess Your Feelings: How did you feel during the challenge? Did you experience feelings of deprivation, freedom, or empowerment? Understanding your emotional responses is crucial for long-term habit formation. For instance, if you felt deprived, explore alternative strategies to satisfy those needs that don’t involve spending.

- Gather Feedback (If Applicable): If you involved a partner, family member, or friend, discuss their observations and perspectives. Their insights can offer a valuable external viewpoint.

- Document Your Learnings: Write a summary of your key takeaways. What surprised you? What did you learn about yourself and your spending habits? Keep this document as a reference for future challenges and financial planning.

Analyzing Spending Habits

Understanding your spending habits is the cornerstone of financial improvement. This involves identifying triggers, patterns, and areas where you can make sustainable changes.

Here’s how to analyze what you learned about your spending habits:

- Identify Spending Triggers: What situations, emotions, or environments prompted you to spend money? Was it boredom, stress, social pressure, or advertising? Recognizing these triggers is the first step toward managing them. For example, if you often spent money when you were stressed, consider alternative stress-relief techniques like exercise or meditation.

- Pinpoint Spending Patterns: Look for recurring themes in your spending. Do you tend to overspend on certain categories, like eating out or entertainment? Are there specific days of the week or times of the month when your spending spikes?

- Categorize Your Spending: Review your tracked expenses and categorize them (e.g., needs vs. wants, essential vs. non-essential). This provides a clear picture of where your money goes.

- Assess Impulse Purchases: How often did you feel the urge to make an impulse purchase? What prompted those urges? Did you resist them successfully? Impulse purchases are often a major contributor to overspending.

- Recognize Areas for Improvement: Based on your analysis, identify specific areas where you can improve your spending habits. This might involve setting stricter budgets, creating a waiting period before making non-essential purchases, or finding free alternatives to paid activities.

Translating Lessons into Long-Term Financial Habits

The goal is to transform the insights gained during the no-spend challenge into lasting financial behaviors. This requires a proactive approach and a commitment to change.

Here are ways to translate the lessons learned into long-term financial habits:

- Set Realistic Financial Goals: Based on your experience, establish specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. These could include saving a certain amount each month, paying off debt, or investing for the future.

- Create a Budget: Develop a budget that reflects your spending priorities and aligns with your financial goals. Use the insights from your challenge to allocate funds wisely and identify areas where you can cut back.

- Automate Savings and Bill Payments: Automate these processes to ensure consistent savings and avoid late fees. This removes the temptation to spend money that should be allocated elsewhere.

- Implement a Waiting Period for Non-Essential Purchases: Before making a significant purchase, wait a set period (e.g., 24 hours, a week, or a month). This allows you to evaluate whether you truly need the item and helps curb impulse spending.

- Track Your Spending Regularly: Continue tracking your expenses to monitor your progress and identify any potential issues. This will keep you accountable and help you stay on track with your budget.

- Review and Adjust Your Plan: Regularly review your budget and financial goals, and make adjustments as needed. Life changes, and your financial plan should adapt accordingly.

Maintaining Positive Changes

Maintaining positive changes requires consistent effort and a proactive approach. This involves creating a supportive environment and staying committed to your goals.

Here is a plan for maintaining positive changes after the challenge ends:

- Create a Support System: Surround yourself with people who support your financial goals. This could include friends, family, or a financial advisor.

- Reward Yourself (Non-Monetarily): Celebrate your successes with non-monetary rewards, such as a relaxing bath, a walk in nature, or spending time with loved ones. This reinforces positive behaviors.

- Practice Mindful Spending: Before making a purchase, ask yourself if it aligns with your values and financial goals. Consider whether you truly need the item or if it’s an impulse purchase.

- Stay Informed: Continue to educate yourself about personal finance. Read books, articles, or listen to podcasts to stay motivated and informed.

- Embrace Setbacks as Learning Opportunities: Everyone makes mistakes. If you slip up, don’t get discouraged. Learn from the experience and get back on track.

- Regularly Schedule Financial Check-ins: Set aside time each month or quarter to review your finances, track your progress, and make adjustments as needed.

Forming New Habits

Building new habits takes time and effort. Using the insights from your no-spend challenge will provide a solid foundation for long-term success.

Here are bullet points for forming new habits based on the challenge experience:

- Start Small: Begin by focusing on one or two key habits, rather than trying to change everything at once.

- Make It Obvious: Make it easy to do the desired behavior. For example, if you want to save money, set up automatic transfers from your checking account to your savings account.

- Make It Attractive: Associate your new habits with positive experiences. For instance, if you are saving for a vacation, visualize yourself enjoying that vacation.

- Make It Easy: Reduce friction. If you want to eat healthier, prepare healthy meals in advance.

- Make It Satisfying: Reward yourself for sticking to your new habits. This could be a small treat, a compliment, or a feeling of accomplishment.

- Track Your Progress: Use a journal, app, or spreadsheet to monitor your progress and stay motivated. Seeing your progress can be incredibly rewarding.

- Be Patient: It takes time to form new habits. Don’t get discouraged if you slip up. Just keep practicing and eventually, these behaviors will become second nature.

Customizing the Challenge to Fit Your Needs

The beauty of a no-spend challenge lies in its adaptability. It’s not a one-size-fits-all solution; instead, it’s a framework that you can mold to perfectly fit your financial situation, spending habits, and personal goals. This section will guide you through the process of personalizing your challenge, ensuring it’s effective and sustainable for you.

Adapting the Challenge to Different Financial Situations

The flexibility of a no-spend challenge allows for adjustments based on your financial realities. Whether you’re on a tight budget or have more disposable income, the challenge can be tailored to be both effective and achievable.* Low Income: Focus on essential spending categories. This might mean excluding non-essential items like entertainment, dining out, and subscription services. The goal is to prioritize needs over wants and identify areas where spending can be significantly reduced.

Consider looking into local resources for free entertainment options or free food pantries if needed.

Moderate Income

You can broaden the scope to include categories like clothing, eating out, and entertainment. This provides more opportunities for savings and habit modification. Focus on identifying areas where you can cut back without feeling overly restricted.

High Income

A no-spend challenge can focus on luxury spending, such as expensive hobbies, designer items, or frequent travel. The aim here is to re-evaluate spending habits, promote mindful consumption, and redirect funds toward savings or investments.

Modifying the Challenge for Varying Income Levels

Income levels directly influence the parameters of a no-spend challenge. The duration and the restrictions imposed should align with your financial capacity.* Short-Term, Focused Challenges: Individuals with lower incomes may benefit from shorter challenges (e.g., one week or a single pay period) to build momentum and avoid feeling overwhelmed. The focus is on small, manageable changes.

Longer-Term, Gradual Challenges

Those with moderate to high incomes might consider longer challenges (e.g., a month or a quarter) to tackle more significant spending areas and develop sustainable habits.

Percentage-Based Rules

Instead of fixed amounts, set rules based on a percentage of your income. For example, “No spending on non-essentials exceeding 5% of your monthly income.” This approach ensures the challenge remains relevant regardless of income fluctuations.

Tailoring the Challenge to Specific Spending Goals

A no-spend challenge is an excellent tool for achieving specific financial objectives. Defining clear goals makes the challenge more purposeful and increases the likelihood of success.* Saving for a Down Payment: Focus on cutting expenses related to entertainment, dining out, and non-essential purchases to free up funds for your down payment. Track your progress weekly to stay motivated.

Paying Off Debt

Prioritize reducing spending on items that are not necessities. Allocate the saved money towards debt repayment. This strategy creates a snowball effect, as reducing debt will free up more money in the long run.

Building an Emergency Fund

Minimize spending on non-essential items to quickly accumulate emergency savings. Aim to have at least three to six months of living expenses saved.

Investing

Reduce discretionary spending to redirect funds towards investments. This could involve reducing dining out or entertainment expenses to invest in the stock market or other assets.

Examples of No-Spend Challenges Based on Different Lifestyle Categories

Here are some examples to illustrate how to adapt a no-spend challenge to specific lifestyle categories.* The Foodie Challenge: No eating out, no takeout, and no coffee shop purchases for one month. The focus is on cooking at home and finding free or low-cost entertainment options.

The Entertainment Challenge

No spending on movies, concerts, or other entertainment. Utilize free resources like libraries, parks, and community events. This can be a great way to discover new hobbies.

The Shopping Challenge

No purchasing of non-essential items like clothing, accessories, or home decor. This challenge is designed to curb impulse buys and promote mindful consumption.

The Transportation Challenge

No spending on taxis, ride-sharing services, or new transportation-related purchases. Utilize public transport, cycling, or walking to save money.

Guidelines for Personalizing the Challenge Based on Individual Circumstances

Creating a personalized challenge involves a thoughtful assessment of your circumstances and goals. These guidelines will assist you in designing an effective and sustainable no-spend challenge.

1. Assess Your Financial Situation

Review your income, expenses, and debts. Understand your current financial health to determine the scope of your challenge.

2. Identify Your Spending Triggers

Determine what situations or emotions lead to overspending. This could be stress, boredom, or social pressure. Set Clear, Realistic Goals: Define what you want to achieve through the challenge. Be specific about your financial goals.

4. Choose a Duration

Select a timeframe that aligns with your goals and financial capacity. Start with a shorter duration and gradually increase it.

5. Define Your Rules and Boundaries

Specify what you can and cannot spend money on. Be clear and concise.

6. Plan for Alternatives

Identify free or low-cost alternatives for the activities you usually spend money on.

7. Track Your Progress

Monitor your spending and savings. This will help you stay motivated and make adjustments.

8. Be Flexible

Adjust your rules as needed. Life happens, and flexibility is key to long-term success.

-

9. Celebrate Your Successes

Acknowledge and reward yourself for achieving your goals. This will reinforce positive behaviors.

- 1

0. Review and Refine

After the challenge, reflect on what worked and what didn’t. Use this information to improve your future challenges.

Utilizing Resources and Support

Successfully navigating a no-spend challenge often requires more than just willpower. Accessing the right resources and building a strong support system can significantly increase your chances of success. This section explores the tools, communities, and insights that can empower you to stay on track and achieve your financial goals.

Identifying Helpful Resources

Numerous resources are available to support you throughout your no-spend challenge and beyond. These tools can help you track your spending, understand your financial habits, and stay motivated.

- Budgeting Apps: Apps like Mint, YNAB (You Need a Budget), and Personal Capital offer features like expense tracking, budget creation, and goal setting. They often connect to your bank accounts to automatically categorize transactions, providing a clear picture of where your money goes. For example, Mint allows you to set up alerts when you exceed your spending limits in certain categories, providing immediate feedback on your progress.

- Financial Blogs and Websites: Websites such as NerdWallet, The Balance, and Investopedia provide articles, calculators, and financial advice. They cover topics ranging from budgeting and saving to investing and debt management. These resources can provide valuable insights and practical tips for managing your finances effectively.

- Spreadsheets: Using tools like Google Sheets or Microsoft Excel, you can create customized budget trackers to suit your specific needs. This allows you to meticulously monitor your spending and tailor your approach to the no-spend challenge.

- Online Calculators: Financial calculators, readily available on many financial websites, can help you estimate savings goals, project investment returns, and calculate debt repayment schedules. These tools can provide a clearer understanding of the long-term impact of your financial decisions.

Finding Support Networks

Having a support system can make a significant difference during a no-spend challenge. Sharing your goals and experiences with others can provide encouragement, accountability, and practical advice.

- Friends and Family: Informing your friends and family about your challenge allows them to understand your choices and offer support. They can help you find free activities, avoid tempting situations, and celebrate your successes. For instance, you could invite a friend to join you for a free park walk instead of suggesting a costly dinner out.

- Online Communities: Online forums and social media groups dedicated to personal finance and no-spend challenges offer a space to connect with like-minded individuals. You can share your progress, ask for advice, and receive encouragement from others who are on a similar journey. Reddit’s r/personalfinance is a popular example.

- Financial Coaches or Counselors: If you’re struggling, consider consulting a financial coach or counselor. They can provide personalized guidance, help you identify areas for improvement, and create a sustainable financial plan.

Using Online Tools for Motivation

Online tools can play a crucial role in keeping you motivated and tracking your progress during a no-spend challenge.

- Tracking Apps: Use budgeting apps to visualize your spending and see how close you are to your goals. The visual representation of your progress can be highly motivating.

- Progress Charts: Create a simple chart or graph to track your savings or the amount you’ve avoided spending. Seeing the numbers increase can reinforce your commitment to the challenge.

- Goal Setting Platforms: Some budgeting apps and websites allow you to set financial goals and track your progress toward achieving them. These tools can provide a sense of accomplishment and keep you focused on your objectives.

- Social Media Accountability: Consider sharing your progress on social media, such as a private Instagram or Facebook group. This can create a sense of accountability and allow you to receive encouragement from your network.

Recommended Books and Websites

Expanding your knowledge of financial literacy and habit formation can enhance your success in the long term. Here are some recommended resources:

- Books:

- The Total Money Makeover by Dave Ramsey: This book provides a step-by-step plan for getting out of debt and building wealth.

- Your Money or Your Life by Vicki Robin and Joe Dominguez: This book explores the relationship between money and happiness and offers strategies for achieving financial independence.

- Atomic Habits by James Clear: While not solely focused on finance, this book offers a practical guide to building good habits and breaking bad ones, which is highly relevant to a no-spend challenge.

- Websites:

- NerdWallet: Offers comprehensive financial advice, tools, and calculators.

- The Balance: Provides articles and resources on various personal finance topics.

- Investopedia: A reliable source for financial education and terminology.

Helpful Quotes About Financial Discipline

These quotes offer inspiration and wisdom to help you stay focused during your no-spend challenge.

“Do not save what is left after spending, but spend what is left after saving.”

Warren Buffett

“The habit of saving is itself an education; it fosters every virtue, teaches self-denial, cultivates the sense of order, trains to forethought, and so prepares a man for all the duties and possibilities of life.”T.T. Munger

“It is not the man who has too little, but the man who craves more, that is poor.”Seneca

“A budget tells us what we can’t afford, but it doesn’t keep us from buying it.”

William Feather

“Money, like emotions, is something you must control to keep your life on the right track.”

Natasha Munson

Long-Term Impact and Sustainability

The no-spend challenge is more than just a temporary austerity measure; it’s a catalyst for lasting financial well-being. By consciously changing spending habits and building financial awareness, you can create a foundation for a more secure and fulfilling financial future. This section focuses on how to translate the initial gains of the challenge into enduring positive changes.

Overall Financial Well-being Impact

A no-spend challenge has a profound impact on overall financial well-being, extending far beyond the period of the challenge itself. It equips individuals with crucial skills and insights that can reshape their relationship with money.

- Increased Savings: The most immediate benefit is increased savings. By curbing unnecessary spending, more money becomes available for savings, debt repayment, or investments. Consider a person who, before the challenge, spent $200 a month on impulse purchases. During the challenge, they redirected that $200 to a high-yield savings account. Over a year, this accumulates to $2,400, representing a significant boost to their financial reserves.

- Reduced Debt: The discipline gained during the challenge can be channeled into aggressive debt repayment strategies. The money saved from the challenge can be directly applied to paying down high-interest debts, such as credit card balances. Reducing debt reduces financial stress and frees up cash flow.

- Improved Budgeting Skills: Participants become more adept at budgeting and tracking expenses. The challenge necessitates a heightened awareness of where money goes, leading to more informed spending decisions. They learn to differentiate between needs and wants, a fundamental skill in financial planning.

- Enhanced Financial Awareness: The challenge fosters a greater understanding of personal finances, including income, expenses, and net worth. This increased awareness empowers individuals to make better financial choices. This heightened awareness helps prevent future financial pitfalls.

- Development of Delayed Gratification: The challenge promotes delayed gratification, a crucial life skill. Resisting impulse purchases builds self-control and helps individuals make more rational spending decisions.

Building Upon Positive Changes

To ensure the positive changes from the no-spend challenge endure, it’s essential to build upon them. This involves integrating new habits into daily life and establishing a framework for ongoing financial management.

- Review and Reflect: Regularly review the lessons learned during the challenge. Identify the spending triggers, the areas where you struggled, and the strategies that worked best.

- Adjust Your Budget: Update your budget to reflect the new spending patterns established during the challenge. Allocate funds based on your priorities, including savings, debt repayment, and essential expenses.

- Set Realistic Goals: Don’t immediately revert to old habits. Gradually reintroduce discretionary spending, but do so consciously and within the boundaries of your budget.

- Automate Savings: Set up automatic transfers from your checking account to your savings and investment accounts. This “pay yourself first” approach ensures that saving becomes a priority.

- Continue Tracking Expenses: Continue to track your spending, even after the challenge is over. This helps you stay aware of your spending habits and identify areas for improvement. Consider using budgeting apps or spreadsheets to streamline this process.

Setting Long-Term Financial Goals

Setting long-term financial goals provides direction and motivation. They offer a roadmap for achieving financial security and provide a sense of purpose to your financial efforts.

- Define Your Goals: Identify what you want to achieve financially. This could include buying a home, saving for retirement, paying off debt, or starting a business. Be specific and set measurable goals. For example, instead of “save for retirement,” specify “save $1 million for retirement by age 65.”

- Prioritize Your Goals: Rank your goals based on importance and timeframe. Determine which goals are most critical and when you want to achieve them.

- Calculate the Costs: Estimate the financial resources needed to achieve each goal. Use online calculators or consult with a financial advisor to determine the amount you need to save or invest.

- Create a Plan: Develop a detailed plan to achieve each goal. This plan should include a savings or investment strategy, a timeline, and a budget.

- Review and Adjust: Regularly review your goals and plans. Life circumstances change, so it’s essential to adjust your plans as needed.

Incorporating Regular Financial Check-ins

Regular financial check-ins are essential for monitoring progress, making adjustments, and staying on track with your financial goals.

- Schedule Check-ins: Set a specific time each month or quarter to review your finances. Treat this as an important appointment, like a doctor’s visit.

- Review Your Budget: Compare your actual spending to your budget. Identify any overspending or underspending and make adjustments as needed.

- Monitor Your Progress: Track your progress toward your financial goals. Are you on track to meet your savings, debt repayment, or investment targets?

- Review Investments: Evaluate the performance of your investments. Make adjustments to your portfolio as needed, based on your risk tolerance and long-term goals.

- Seek Professional Advice: Consider consulting with a financial advisor at least once a year to get professional advice and ensure your financial plan is aligned with your goals.

Illustration of Growth Over Time

Imagine a strong, healthy tree. Its roots, firmly planted in the ground, represent the no-spend challenge. These roots provide the foundation for the tree’s growth. The challenge provides the initial stability and the necessary nutrients for future financial health. The trunk of the tree symbolizes the sustained positive changes, such as improved budgeting, debt reduction, and increased savings, that emerge from the challenge.

The branches of the tree represent the new, healthy financial habits cultivated during the challenge. These branches grow and flourish over time, symbolizing the continuous development of financial well-being. The leaves on the branches are the financial goals achieved, such as buying a home or paying off debt. The more branches and leaves the tree has, the healthier and more financially secure the individual becomes.

The sun shining on the tree represents the financial awareness and understanding gained through the challenge. This illustration emphasizes the long-term nature of the process and how the initial efforts can lead to sustained financial success.

Closing Summary

Embarking on a ‘No-Spend Challenge’ is more than just a temporary financial fix; it’s a catalyst for profound change. You’ll not only reshape your spending habits but also gain invaluable insights into your relationship with money. By reflecting on your journey, forming new habits, and building a sustainable plan, you can transform your financial well-being. So, take the leap, embrace the challenge, and watch as it blossoms into a more financially secure and fulfilling life.