Welcome to a journey designed to empower you against the subtle, yet persuasive, world of marketing tactics. How to Resist Marketing Tricks That Make You Overspend delves into the psychological strategies businesses use to influence your spending habits. From understanding the allure of limited-time offers to recognizing deceptive advertising, this guide provides you with the knowledge and tools to become a savvy consumer.

This comprehensive exploration will equip you with practical strategies. We’ll cover everything from creating a budget and developing a critical mindset to resisting impulse purchases and evaluating product value. By the end, you’ll be able to navigate the consumer landscape with confidence, protect your personal data, and make informed financial decisions that align with your goals.

Understanding Marketing Tactics

Marketing plays a significant role in shaping our purchasing decisions. By understanding the strategies used, we can become more conscious consumers and resist the urge to overspend. This section explores common psychological principles employed in marketing and how they influence our behavior.

Psychological Principles in Marketing

Marketers leverage several psychological principles to influence consumer behavior. These principles tap into our innate tendencies and biases, making us more susceptible to their messages. Understanding these principles is the first step in protecting yourself from manipulative marketing.

- Scarcity: This principle suggests that we value items more when they are perceived as limited in availability.

- Social Proof: We often look to others for cues on how to behave, especially when we are uncertain. Social proof leverages the idea that if many people are doing something, it must be the right thing to do.

- Bandwagon Effect: This is a form of social proof where the desire to be part of a popular trend drives purchasing decisions. It exploits our fear of missing out (FOMO).

- Authority: We tend to trust and obey authority figures. Marketing often uses experts or celebrities to endorse products, leveraging this principle.

Examples of Marketing Tactics

These psychological principles manifest in various marketing techniques. Recognizing these tactics in everyday advertising and product placement can help you become a more discerning consumer.

- Scarcity in Action: Limited-edition products, flash sales, and phrases like “while supplies last” are classic examples of scarcity marketing. For example, a luxury watch brand might release a limited run of a specific model, creating high demand and a sense of exclusivity.

- Social Proof in Action: Advertisements often feature customer testimonials, reviews, and ratings. “Most popular” or “best-selling” labels on products are also forms of social proof. A restaurant might display a sign that says “Over 1,000 satisfied customers served!”

- Bandwagon Effect in Action: Marketing campaigns frequently highlight a product’s popularity or the number of people already using it. Social media trends and influencer marketing are powerful tools for capitalizing on the bandwagon effect. An advertisement might state, “Join the millions who are already enjoying [product name]!”

- Authority in Action: Endorsements from doctors, celebrities, or other experts are common. Product placement in movies and television shows also leverages authority. A toothpaste commercial might feature a dentist recommending the product.

Limited-Time Offers and Urgency

Businesses frequently use limited-time offers and create a sense of urgency to prompt immediate purchases. This tactic plays on our fear of missing out and the desire for immediate gratification.

- Limited-Time Offers: These include flash sales, seasonal promotions, and countdown timers on websites. These create a sense of urgency, encouraging consumers to buy now rather than later.

- Urgency Creation: Phrases like “Offer ends soon,” “Don’t miss out,” and “Only a few left” are used to create a sense of urgency.

- Real-World Examples: Consider a clothing store advertising a “24-hour flash sale” or a website displaying a countdown timer before a discount expires.

Marketing Tactics and Psychological Principles Table

The following table summarizes different marketing tactics and the corresponding psychological principles they utilize.

| Marketing Tactic | Psychological Principle | Description | Example |

|---|---|---|---|

| Limited-Edition Products | Scarcity | Creates a perception of limited availability, increasing desirability. | A limited-edition sneaker release. |

| Customer Testimonials | Social Proof | Demonstrates that others have had a positive experience, influencing purchasing decisions. | A review on an e-commerce website. |

| “Join the Trend” Advertisements | Bandwagon Effect | Appeals to the desire to be part of a popular trend. | An ad showcasing the popularity of a new app. |

| Celebrity Endorsements | Authority | Leverages the credibility and influence of authority figures. | A celebrity promoting a skincare product. |

| Flash Sales | Scarcity & Urgency | Creates a sense of limited time and opportunity. | A website offering a 50% discount for 24 hours. |

Recognizing Deceptive Advertising

Deceptive advertising tricks consumers into making purchases they might not otherwise make. These tactics exploit our cognitive biases and vulnerabilities, leading to financial loss and dissatisfaction. Understanding these techniques is crucial for making informed decisions and protecting yourself from manipulative marketing.

Identifying Techniques Used in Deceptive Advertising

Deceptive advertising employs a range of strategies designed to mislead consumers. Recognizing these tactics is the first step in defending against them.

- Misleading Claims: Advertisements may contain false or unsubstantiated statements about a product’s benefits or performance. For instance, a weight-loss supplement might claim to help users lose a significant amount of weight without any evidence to support the claim.

- Hidden Fees: Businesses sometimes obscure additional costs until the final stages of a purchase. This can include shipping fees, processing charges, or other hidden expenses that inflate the advertised price.

- Fine Print: Important details, limitations, or disclaimers are often buried in small print, making them difficult to notice. This allows advertisers to present an appealing offer while minimizing their responsibility.

- Bait and Switch: This involves advertising a product at a low price (the “bait”) to lure customers, then attempting to sell them a more expensive product (the “switch”) once they’re in the store or on the website. The advertised product may be unavailable or of poor quality.

- False Comparisons: Advertisements may compare a product to a competitor’s product without providing accurate or verifiable information. This can involve selective presentation of data or using misleading metrics.

- Endorsements by Non-Experts: Utilizing endorsements from celebrities or influencers who lack expertise or experience with the product. While endorsements are common, they are deceptive when the endorser is not qualified to assess the product’s claims.

Examples of Advertisements Using Ambiguous Language or Vague Statements

Advertisers frequently use ambiguous language to create an impression of value or benefit without making concrete promises.

- “May Help”: Advertisements for health products often use phrases like “may help support healthy joints” or “may help boost your immune system.” These phrases suggest a possibility but do not guarantee any specific outcome.

- “Up to”: Advertisements using the phrase “up to” often inflate the potential benefits. For example, “lose up to 10 pounds” implies the possibility of losing that much weight, but most users might experience significantly less weight loss, or none at all.

- “New and Improved”: These claims are common but often lack specific details. What exactly has been improved? Without further clarification, these statements offer little substance.

- “Clinically Proven”: The phrase “clinically proven” is used frequently. However, the details of the clinical study, such as the sample size or methodology, are often omitted.

- “Results May Vary”: This disclaimer is often used to protect the advertiser, but it can be a sign that the advertised benefits are not consistently achieved.

Spotting False or Exaggerated Product Testimonials and Reviews

Testimonials and reviews can significantly influence consumer purchasing decisions. It’s important to be able to differentiate between genuine feedback and misleading endorsements.

- Unrealistic Claims: Testimonials that promise miraculous results, such as losing an excessive amount of weight in a short time or curing a serious medical condition, are often suspect.

- Vague Language: Testimonials that lack specific details about the product’s performance or the user’s experience are less credible. Genuine reviews tend to provide concrete examples and insights.

- Anonymous or Unverifiable Sources: Testimonials from anonymous individuals or those with limited information about their identity are more likely to be fake. Look for reviews that include the reviewer’s name, location, or other identifying details.

- Overly Positive Tone: Testimonials that are uniformly positive and lack any criticism or negative feedback can be a red flag. Real-world experiences often include both positive and negative aspects.

- Paid Endorsements: Advertisers often pay individuals to provide positive reviews or testimonials. This practice is deceptive if the relationship is not disclosed.

Legal Implications of Deceptive Advertising Practices and Consumer Protection Laws

Deceptive advertising is illegal and subject to regulation. Consumer protection laws are designed to safeguard consumers from fraudulent and misleading marketing practices.

- Federal Trade Commission (FTC): The FTC is the primary federal agency responsible for protecting consumers from deceptive advertising. The FTC has the power to investigate, issue cease-and-desist orders, and impose fines on companies that engage in deceptive practices.

- Consumer Protection Laws: Many states have their own consumer protection laws that prohibit deceptive advertising and provide consumers with remedies, such as the right to sue for damages or receive refunds.

- False Advertising: False advertising involves making untrue or misleading statements about a product or service. This can include false claims about a product’s effectiveness, safety, or origin.

- Unfair Business Practices: Deceptive advertising is considered an unfair business practice. This means that it violates ethical standards and can harm consumers.

- Consequences for Violations: Companies found guilty of deceptive advertising may face a range of penalties, including fines, lawsuits, and reputational damage.

Budgeting and Financial Planning

Creating a budget and engaging in financial planning are crucial steps in taking control of your finances and resisting the allure of marketing tactics that encourage overspending. By understanding where your money goes, you can make informed decisions, prioritize your spending, and ultimately achieve your financial goals. This section provides practical steps and tools to help you build a solid financial foundation.

Importance of Creating a Budget and Tracking Expenses

A budget serves as a roadmap for your finances, outlining how you intend to spend your money. Tracking your expenses is the process of monitoring where your money actually goes, comparing it against your planned spending. This comparison helps identify areas where you might be overspending and areas where you can cut back.

- Provides Clarity: A budget illuminates your current financial situation, revealing income sources and spending habits. Tracking expenses adds further clarity by detailing where your money is actually going.

- Highlights Overspending: By comparing your planned spending (budget) with your actual spending (tracked expenses), you can easily identify areas where you’re exceeding your limits, which can be particularly helpful in identifying the impact of marketing tactics.

- Facilitates Informed Decisions: Knowing your income and expenses empowers you to make informed choices about your purchases, preventing impulsive buys influenced by marketing.

- Promotes Financial Goals: Budgeting helps you allocate funds towards savings, investments, and debt repayment, contributing to long-term financial security.

Steps for Setting Financial Goals and Prioritizing Spending

Setting financial goals provides direction and motivation for your budgeting efforts. Prioritizing spending ensures that your money is allocated to the most important items first, aligning with your financial objectives.

- Define Your Goals: Clearly define your financial goals. These could include saving for a down payment on a house, paying off debt, or investing for retirement. Make your goals SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. For example, instead of “save money,” aim for “save $5,000 for a down payment on a car within two years.”

- Assess Your Current Financial Situation: Calculate your net worth (assets minus liabilities). Determine your income and expenses. This gives you a baseline to work from.

- Prioritize Your Spending: Categorize your expenses as needs (essential expenses like housing, food, and utilities) and wants (non-essential expenses like entertainment and dining out). Allocate funds to needs first, then prioritize wants based on your goals.

- Allocate Funds to Goals: Once you’ve covered your needs and prioritized wants, allocate a portion of your income to your financial goals, such as savings or investments.

- Regularly Review and Adjust: Review your budget and financial goals regularly (monthly or quarterly) to track progress and make adjustments as needed. Life circumstances and priorities change, so your budget should be flexible.

Distinguishing Between Needs and Wants

Understanding the difference between needs and wants is essential for making sound purchasing decisions and resisting marketing pressures. Marketing often blurs this distinction, making wants appear like needs.

- Needs: These are essential for survival and a basic standard of living. Examples include:

- Housing (rent or mortgage)

- Food

- Utilities (electricity, water)

- Transportation (necessary for work or essential activities)

- Healthcare

- Wants: These are non-essential items or services that enhance your quality of life but are not necessary for survival. Examples include:

- Entertainment (movies, concerts)

- Dining out

- Luxury items (designer clothing, expensive gadgets)

- Hobbies

- Making the Distinction: Ask yourself if you can live without the item or service. If the answer is yes, it’s likely a want. Consider the consequences of not purchasing the item. Would it significantly impact your well-being or ability to function? If not, it’s likely a want.

- Marketing’s Influence: Be aware of marketing tactics that try to convince you that a want is a need. Advertisements often create a sense of urgency or make you believe that you’re missing out if you don’t buy a particular product.

Designing a System for Organizing Personal Finances

A well-organized financial system simplifies budgeting, tracking, and goal achievement. It helps you stay on top of your finances and avoid overspending. Different budgeting methods cater to various needs and preferences.

- Choose a Budgeting Method: Select a budgeting method that suits your lifestyle and financial situation. Popular options include:

- The 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Zero-Based Budgeting: Allocate every dollar of your income to a specific category, ensuring your income minus expenses equals zero.

- Envelope Budgeting: Physically allocate cash into envelopes for different spending categories.

- Track Your Income and Expenses: Use a method to track your income and expenses. This could be:

- Spreadsheet: Create a spreadsheet (e.g., using Google Sheets or Microsoft Excel) to track your income and expenses.

- Budgeting App: Utilize budgeting apps (e.g., Mint, YNAB, Personal Capital) to automate tracking and provide insights.

- Notebook/Planner: For a more hands-on approach, use a notebook or planner to record your income and expenses.

- Categorize Your Expenses: Group your expenses into categories (e.g., housing, food, transportation, entertainment, savings) to gain a clear understanding of your spending habits.

- Set Up a Savings Plan: Automate savings by setting up automatic transfers from your checking account to your savings or investment accounts.

- Review and Adjust Regularly: Review your budget and track your expenses regularly (e.g., monthly) to identify areas for improvement and make adjustments as needed. Life changes, and your budget should reflect those changes.

Developing a Critical Mindset

Building a critical mindset is crucial for navigating the complex world of marketing. It equips you with the tools to analyze information objectively, resist manipulative tactics, and make informed purchasing decisions. This section focuses on developing these critical thinking skills, empowering you to become a more savvy and responsible consumer.

Strategies for Evaluating Marketing Messages Objectively

Objectively evaluating marketing messages involves a systematic approach to deconstructing the information presented. This process helps identify biases, hidden agendas, and manipulative techniques. It is important to be aware of your own biases and how they might influence your perception of a marketing message.

- Identify the Target Audience: Understanding who the marketing message is aimed at reveals potential biases. Consider if the message is tailored to a specific demographic and how that might influence its content.

- Analyze the Tone and Language: Pay attention to the emotional appeals used, such as fear, excitement, or belonging. Are the claims supported by evidence, or are they based on vague promises?

- Scrutinize Visual Elements: Examine the use of colors, images, and layout. Do they create a specific mood or association? Are the visuals realistic or manipulated? Consider how these elements influence your perception.

- Look for Omissions and Exaggerations: Marketing messages often omit negative aspects of a product or service. Are there any key details missing? Do the claims seem exaggerated or too good to be true?

- Verify Claims: Cross-reference the information with independent sources. Check for scientific evidence, customer reviews, and expert opinions to validate the claims made in the marketing message.

Comparing Prices and Reading Reviews

Comparing prices and reading reviews are vital steps in making informed purchasing decisions. These practices help you assess the value of a product or service, identify potential issues, and avoid overspending.

- Price Comparison: Compare prices across different retailers and platforms. Utilize price comparison websites and apps to streamline the process.

- Reading Customer Reviews: Reviews offer insights from real users. Focus on detailed reviews that mention specific aspects of the product or service.

- Evaluating Review Authenticity: Be wary of fake or biased reviews. Look for reviews that seem genuine and offer a balanced perspective. Consider the reviewer’s profile and review history.

- Assessing Overall Value: Weigh the price against the features, benefits, and customer feedback. Determine if the product or service offers a good value for the money.

Questions to Ask Before Buying

Before making a purchase, asking yourself a series of questions can help you assess your needs and the product’s suitability. This critical self-assessment process prevents impulse buys and ensures you are making a well-considered decision.

- Do I truly need this product or service? Differentiate between needs and wants. Consider whether the purchase will genuinely improve your life or is driven by external factors.

- What problem am I trying to solve? Clearly define the need that the product or service addresses. Does this product/service effectively solve that problem?

- What are the alternatives? Explore different options and compare their features, benefits, and prices. Research competitors and assess if other options are more suitable.

- What are the costs beyond the initial price? Consider any additional expenses, such as maintenance, accessories, or subscription fees. Factor in the total cost of ownership.

- What are the potential downsides? Research any known issues or drawbacks associated with the product or service. Are there any risks involved?

- Can I afford this purchase without impacting my financial goals? Ensure the purchase aligns with your budget and financial plans. Avoid overspending and maintain financial stability.

Researching Company Reputation and History

Investigating a company’s reputation and history provides valuable context for evaluating its products or services. This research helps you assess the company’s reliability, ethical practices, and long-term viability.

- Check the company’s website: Review the “About Us” section, mission statement, and values. Does the company have a clear vision and commitment to its customers?

- Search for reviews and ratings: Explore online platforms such as the Better Business Bureau (BBB), Trustpilot, and consumer forums. What do other customers say about their experiences?

- Investigate any past controversies: Look for any reports of product recalls, lawsuits, or ethical breaches. These issues can indicate potential problems with the company’s practices.

- Examine the company’s financial health: Research the company’s financial performance. This can indicate its long-term stability and ability to support its products or services.

- Consider the company’s sustainability practices: Assess the company’s environmental and social responsibility. Does the company prioritize ethical sourcing, fair labor practices, and environmental sustainability?

Resisting Impulse Purchases

Impulse purchases can quickly derail your budget and lead to financial stress. Recognizing the triggers that lead to these spontaneous buys, and developing strategies to resist them, is a crucial skill in managing your finances effectively. This section focuses on understanding the psychology behind impulse buying and providing practical techniques to curb this behavior.

Identifying Triggers for Impulse Buying

Understanding the root causes of impulse purchases is the first step toward controlling them. These triggers often stem from emotional states, environmental factors, or marketing tactics.

- Stress: When stressed, people often seek immediate gratification to alleviate negative feelings. This can manifest as retail therapy, where buying something provides a temporary sense of comfort. For example, a study by the American Psychological Association found that chronic stress can lead to increased impulsive buying behavior.

- Boredom: Boredom can make individuals more susceptible to impulsive purchases as they seek stimulation and excitement. This is especially true when individuals are exposed to advertisements or browsing online.

- Emotional Cues: Advertising often uses emotional cues, such as fear, excitement, or belonging, to trigger impulsive buying. Limited-time offers, scarcity tactics (e.g., “only a few left!”), and social proof (e.g., “most popular product”) can exploit these emotional vulnerabilities.

- Environmental Factors: The environment you’re in can also influence impulse buying. The layout of a store, the placement of products, and even the music playing can all affect your purchasing decisions. For example, supermarkets often place tempting items near the checkout to encourage last-minute purchases.

- Social Influence: Peer pressure and social media can significantly impact impulse buying. Seeing others purchase items, or feeling the need to keep up with trends, can lead to impulsive decisions.

Techniques for Delaying Purchases and Avoiding Immediate Gratification

Delaying a purchase allows time for rational thought and reduces the likelihood of regret. Here are some techniques to implement:

- The “24-Hour Rule”: Before making a non-essential purchase, wait at least 24 hours. This gives you time to consider whether you truly need the item and if it aligns with your budget.

- List and Review: Before shopping, make a detailed list of what you need. Stick to this list and avoid browsing or straying from your planned purchases.

- Avoid Temptation: Steer clear of situations or places that trigger impulse buying. This might mean avoiding online shopping late at night or skipping the mall altogether.

- Unsubscribe from Marketing Emails: Reduce exposure to tempting offers by unsubscribing from marketing emails and notifications. This removes constant reminders of products you might want.

- Consider Alternatives: Before buying something, explore alternative options. Could you borrow it, rent it, or find a cheaper alternative?

Creating a “Waiting Period” Before Making a Purchase

A waiting period is a specific time frame you set before making a purchase, allowing you to evaluate your need and the value of the item.

- Define the Waiting Period: Determine how long you’ll wait before making a purchase. This could be a day, a week, or even a month, depending on the item’s cost and importance.

- Research and Compare: During the waiting period, research the item, compare prices, and read reviews. This can help you make a more informed decision.

- Evaluate Your Budget: Ensure the purchase fits within your budget and doesn’t compromise your financial goals.

- Ask Yourself Key Questions: Before buying, ask yourself: “Do I really need this?”, “Can I afford it without sacrificing something else?”, and “Will this bring lasting value?”.

- Track Your Progress: Keep a record of your delayed purchases. This helps you understand your buying patterns and identify areas for improvement.

Strategies for Unsubscribing from Marketing Emails and Reducing Exposure to Advertisements

Reducing exposure to advertisements is a proactive way to minimize impulse buying triggers.

- Unsubscribe from Email Lists: Take time to unsubscribe from marketing emails. Many email providers offer an easy “unsubscribe” button.

- Use Ad Blockers: Install ad blockers on your web browser and mobile devices to reduce exposure to online advertisements.

- Limit Social Media Use: Reduce your time on social media, where targeted advertising is prevalent.

- Review Subscriptions: Regularly review your subscriptions (streaming services, magazines, etc.) and cancel any that you no longer use or need.

- Be Mindful of Retail Environments: When shopping in physical stores, be aware of product placement and marketing displays. Avoid areas that are designed to tempt you into impulse purchases.

Evaluating Product Value

Understanding the true worth of a product or service is crucial for making informed spending decisions. Marketing often focuses on superficial aspects, making it challenging to discern real value. This section provides practical strategies for evaluating products and services, ensuring your money is well-spent.

Assessing True Value Beyond Marketing Claims

Evaluating product value requires moving beyond marketing hype. It involves a thorough assessment of the product’s features, quality, and long-term utility.

- Identify Core Needs: Determine if the product or service truly addresses your needs. Does it solve a problem or enhance your life in a meaningful way? Avoid purchases based solely on impulse or trends.

- Research Features and Specifications: Examine the product’s specifications, such as materials, performance metrics, and warranties. Compare these features across different brands to assess which offers the best value for your needs.

- Read Reviews and Testimonials: Seek out independent reviews from consumers and experts. Consider both positive and negative feedback to gain a balanced understanding of the product’s strengths and weaknesses.

- Consider the Brand Reputation: Research the brand’s history, customer service, and commitment to quality. A reputable brand is often a good indicator of a reliable product.

- Evaluate Durability and Lifespan: Consider how long the product is likely to last. A higher-priced product that lasts longer may offer better value than a cheaper, less durable alternative.

Comparing Brands and Products

Comparing different brands and products is essential for making informed choices. A systematic comparison allows you to identify the best option based on your priorities.

- Establish Comparison Criteria: Define the key factors you want to compare, such as price, features, quality, durability, and user reviews.

- Gather Data: Collect information about each product or brand you’re considering. Use product websites, reviews, and comparison tools.

- Create a Comparison Table: Organize the data in a table format for easy comparison. This helps you visually assess the strengths and weaknesses of each option.

- Prioritize Your Needs: Determine which criteria are most important to you. For example, if durability is a priority, give more weight to products with longer lifespans and better warranties.

- Calculate the Total Cost of Ownership: Consider not just the initial purchase price but also any ongoing costs, such as maintenance, repairs, or replacement parts.

Calculating Cost Per Use

Determining the cost per use of a product is a powerful way to assess its long-term value. This calculation helps you understand how much each use of the product costs over its lifespan.

Cost Per Use = Total Cost / Number of Uses

- Determine the Total Cost: This includes the initial purchase price, plus any additional costs such as taxes, shipping, and maintenance.

- Estimate the Number of Uses: Estimate how many times you will use the product over its expected lifespan. For example, a pair of shoes might be used hundreds of times, while a specialty tool might be used only a few times.

- Calculate the Cost Per Use: Divide the total cost by the estimated number of uses. This will give you the cost per use.

- Compare the Cost Per Use: Compare the cost per use of different products to determine which offers the best value. A product with a lower cost per use is generally a better value.

- Example: Consider two coffee makers: one costs $50 and lasts for 2 years (730 days), and the other costs $100 and lasts for 5 years (1825 days). Assuming you make coffee daily, the first has a cost per use of $0.07, while the second has a cost per use of $0.05. Despite the higher initial cost, the second coffee maker offers better long-term value.

Product Comparison Table

The following table provides an example of how to compare different products based on specific criteria. This table is designed to be responsive, adapting to different screen sizes for optimal viewing.

| Product | Durability | Cost | User Reviews |

|---|---|---|---|

| Product A: Smartphone | 5 years, average | $800 | 4.5/5 (Reliable performance, good camera) |

| Product B: Smartphone | 3 years, average | $600 | 3.8/5 (Good features, some software issues) |

| Product C: Laptop | 6 years, average | $1200 | 4.7/5 (Excellent performance, durable build) |

| Product D: Laptop | 4 years, average | $900 | 4.2/5 (Good value, some hardware limitations) |

The table presents a comparison of four products, outlining their durability, cost, and user review scores. The ‘Durability’ column provides an estimated lifespan, while the ‘Cost’ column displays the purchase price. The ‘User Reviews’ column summarizes customer feedback, helping you assess the product’s overall satisfaction level. This comparative data allows you to make a more informed decision based on your specific needs and priorities.

For instance, Product C might be the best choice if durability and long-term performance are key, even though it has a higher initial cost.

Protecting Personal Data and Privacy

In today’s digital landscape, our personal data is a valuable commodity. Understanding how to safeguard this information is crucial for avoiding financial loss, identity theft, and unwanted marketing. This section provides actionable strategies to protect your privacy and make informed decisions about your data.

Importance of Protecting Personal Information Online

The internet is a vast repository of information, and unfortunately, not everyone has good intentions. Cybercriminals and unscrupulous marketers constantly seek to collect personal data for various purposes, including financial gain, identity theft, and targeted advertising. Protecting your personal information is essential to mitigate these risks. Failure to do so can lead to serious consequences.

Identifying and Avoiding Phishing Scams and Data Breaches

Phishing scams and data breaches are common threats to online security. Being able to recognize these threats is the first step in protecting yourself.

Phishing scams typically involve fraudulent emails, messages, or websites designed to trick you into revealing sensitive information, such as passwords, credit card numbers, or social security numbers. Data breaches occur when hackers gain unauthorized access to a company’s or organization’s systems and steal personal data.

- Examine the Sender’s Email Address: Phishing emails often use suspicious or misspelled email addresses. Always verify the sender’s address before clicking on any links or downloading attachments.

- Check for Grammatical Errors and Poor Formatting: Legitimate businesses typically have professional-looking communications. Phishing emails often contain grammatical errors and poor formatting.

- Be Wary of Urgent Requests: Phishing scams often create a sense of urgency to pressure you into acting quickly. Be cautious of emails that threaten account suspension or financial penalties.

- Verify Links Before Clicking: Hover your mouse over any links in an email to see the actual URL. If the URL looks suspicious, do not click on it.

- Use Strong Passwords and Enable Two-Factor Authentication (2FA): Strong, unique passwords and 2FA add an extra layer of security to your accounts. 2FA requires a second verification method, such as a code sent to your phone, in addition to your password.

- Keep Software Updated: Regularly update your operating system, web browser, and other software to patch security vulnerabilities.

- Be Cautious on Public Wi-Fi: Avoid entering sensitive information on public Wi-Fi networks, as they are often unsecured. Use a virtual private network (VPN) for added security.

- Report Suspicious Activity: Report any suspected phishing attempts or data breaches to the appropriate authorities, such as the Federal Trade Commission (FTC) or your bank.

Methods for Controlling Online Tracking and Limiting Data Collection

Many websites and online services track your activity to personalize your experience and serve targeted advertising. However, you can take steps to control this tracking and limit the amount of data collected about you.

- Use Privacy-Focused Web Browsers: Some web browsers, such as Brave and Firefox, are designed with privacy in mind and offer built-in features to block trackers and protect your data.

- Install Privacy-Enhancing Browser Extensions: Several browser extensions can help block trackers, such as ad blockers and privacy-focused extensions like Privacy Badger.

- Adjust Privacy Settings on Social Media: Review and adjust the privacy settings on your social media accounts to control who can see your posts, photos, and other information.

- Use a VPN: A VPN encrypts your internet traffic and masks your IP address, making it more difficult for websites and advertisers to track your activity.

- Clear Cookies and Cache Regularly: Cookies and cache store information about your browsing activity. Clearing them regularly can help limit tracking.

- Opt Out of Targeted Advertising: Many advertising networks allow you to opt out of targeted advertising. You can typically find opt-out options on their websites or through privacy dashboards.

- Use Private Search Engines: Consider using search engines like DuckDuckGo, which do not track your search history.

- Limit the Information You Share Online: Be mindful of the personal information you share online, and avoid providing unnecessary details.

Reading Privacy Policies and Understanding Data Usage Practices

Privacy policies are legal documents that Artikel how a company collects, uses, and shares your personal data. Reading and understanding these policies is crucial for making informed decisions about your privacy.

Privacy policies can be lengthy and complex, but it’s important to take the time to read them carefully. Look for information about what data is collected, how it’s used, who it’s shared with, and your rights regarding your data.

- Locate the Privacy Policy: Privacy policies are usually linked in the footer of a website or within the settings of an app or service.

- Understand Data Collection Practices: Pay attention to what data is collected, such as your name, email address, location, browsing history, and device information.

- Review Data Usage Purposes: Determine how the company uses your data. Is it used for personalization, advertising, research, or other purposes?

- Identify Data Sharing Practices: Find out if the company shares your data with third parties, such as advertisers, data brokers, or other businesses.

- Learn About Your Rights: Understand your rights regarding your data, such as the right to access, correct, and delete your personal information.

- Look for Data Security Measures: Note how the company protects your data from unauthorized access or breaches.

- Pay Attention to Updates: Privacy policies can change, so review them periodically to stay informed about updates to data practices.

- Use Privacy Tools: Consider using tools like PrivacyScore to help you understand and compare privacy policies. This tool analyzes privacy policies and provides a summary of key information in an easy-to-understand format.

Building Consumer Awareness

Staying informed and empowered is crucial to navigating the complex world of marketing. This section equips you with the knowledge to protect yourself from deceptive practices and become a savvy consumer. We’ll explore your rights, how to report wrongdoing, and where to find reliable resources.

Consumer Rights and Protections

Understanding your rights is the first step in defending yourself against unfair marketing. Consumer protection laws vary by region, but fundamental rights are often consistent.

- Right to Safety: Products should not pose unreasonable risks of harm. This includes proper labeling and warnings.

- Right to Information: Consumers have the right to accurate information about products and services, including ingredients, features, and pricing. This means marketers cannot mislead you.

- Right to Choose: Consumers should have access to a variety of products and services at competitive prices.

- Right to be Heard: Consumers have the right to voice complaints and have them addressed by businesses and regulatory bodies.

- Right to Redress: Consumers are entitled to compensation for damages or losses resulting from defective products or deceptive practices.

Consumer protection agencies, such as the Federal Trade Commission (FTC) in the United States, and similar organizations in other countries, are dedicated to enforcing these rights. They investigate complaints, issue warnings, and take legal action against companies that violate consumer protection laws. For example, the FTC has taken action against companies making false claims about health products, online scams, and deceptive advertising practices.

Reporting Deceptive Marketing Practices

Knowing how to report deceptive marketing is essential for holding companies accountable and protecting other consumers. Reporting is a vital step in ensuring fairness and preventing future harm.

The process typically involves the following steps:

- Gather Evidence: Collect all relevant documentation, including advertisements, receipts, contracts, and any communication with the company. This documentation provides essential support for your claim.

- Identify the Responsible Party: Determine the company or individual responsible for the deceptive practice. This may involve researching the company’s contact information.

- Contact the Company: Attempt to resolve the issue directly with the company. This may involve sending a written complaint, detailing the problem and the desired resolution.

- File a Complaint with the Appropriate Authority: If the issue is not resolved, file a complaint with the relevant consumer protection agency or regulatory body. This could be the FTC, your state’s attorney general, or a similar agency in your region.

- Provide Details: Clearly explain the deceptive practice, providing specific examples and supporting evidence. Be concise and factual.

- Follow Up: Keep records of all communication with the company and the regulatory body. Follow up on the status of your complaint.

For example, if you receive a misleading advertisement about a product’s effectiveness, you would gather the advertisement, any purchase receipts, and any communication you had with the company. Then, you would contact the company, and if unsatisfied with their response, you would file a complaint with the FTC, providing the advertisement and details about the misleading claims.

Resources for Consumer Advocacy and Education

Access to reliable information is critical for making informed decisions. Numerous resources are available to help consumers stay informed and protect themselves.

- Government Agencies: Organizations like the FTC (United States), the Competition and Markets Authority (United Kingdom), and similar agencies worldwide offer information, complaint filing services, and educational materials. They often provide detailed guides on consumer rights and protection laws.

- Consumer Advocacy Groups: Non-profit organizations dedicated to consumer protection provide valuable information, advocacy, and resources. Examples include Consumer Reports and the National Consumer League. These groups often conduct research, publish reports, and advocate for consumer-friendly policies.

- Legal Aid Societies: Legal aid societies offer free or low-cost legal assistance to low-income individuals, including help with consumer-related issues.

- Online Resources: Websites and online platforms provide consumer reviews, product comparisons, and educational articles. Examples include websites like Yelp, Trustpilot, and dedicated consumer education sites. Always verify the credibility of the information.

These resources provide invaluable support in navigating the complexities of the marketplace. They empower consumers to make informed decisions, report deceptive practices, and seek redress when necessary. For example, a consumer researching a new appliance can consult Consumer Reports for product reviews and ratings, and then file a complaint with the FTC if they encounter misleading advertising.

Spotting Misleading Marketing Techniques

Recognizing common marketing tricks is a key defense against overspending. Understanding these techniques allows you to make more informed decisions.

Here are some common misleading marketing techniques and how to spot them:

- False or Misleading Claims: Advertisements may contain false or unsubstantiated claims about a product’s benefits.

- Example: A weight-loss product claiming to cause rapid weight loss without diet or exercise.

- How to Spot It: Look for vague language, lack of scientific evidence, and testimonials that seem too good to be true. Always research the claims and look for independent verification.

- Bait and Switch: Advertising a product at a low price to lure customers, then attempting to sell them a more expensive product.

- Example: A store advertises a cheap laptop but then claims it’s out of stock and tries to sell you a more expensive model.

- How to Spot It: Be wary of deals that seem too good to be true. Ask about the advertised product’s availability and compare prices with other retailers.

- Hidden Fees and Charges: Adding unexpected fees or charges to the final price.

- Example: An airline advertises a low fare, but then adds baggage fees, seat selection fees, and other hidden charges.

- How to Spot It: Carefully review the total price before making a purchase. Look for any hidden fees and charges, and read the fine print.

- Emotional Appeals: Using emotional appeals, such as fear, guilt, or excitement, to influence purchasing decisions.

- Example: An advertisement using fear tactics to sell home security systems.

- How to Spot It: Recognize when an advertisement is trying to manipulate your emotions. Focus on the product’s features and benefits rather than the emotional appeal.

- False Endorsements: Using endorsements from celebrities or experts who are not qualified to endorse the product.

- Example: A celebrity endorsing a medical product without having any medical expertise.

- How to Spot It: Evaluate the endorser’s credibility and expertise. Look for evidence that the endorser has actually used and tested the product.

- “Limited Time Offer” and “Limited Quantity” Scams: Creating a sense of urgency to pressure consumers into making a purchase.

- Example: An advertisement claiming a sale is ending soon, even though it is a recurring promotion.

- How to Spot It: Don’t be pressured by time limits. Take your time to research the product and compare prices before making a purchase.

- Vague or Ambiguous Language: Using unclear or misleading language to avoid making specific promises.

- Example: A product that claims to “improve” your health without specifying how.

- How to Spot It: Look for specific details about the product’s features and benefits. Avoid products that make vague or unsubstantiated claims.

By being aware of these techniques, consumers can make more informed decisions and avoid falling prey to deceptive marketing practices. Remember that critical thinking is your best defense.

The Power of Delayed Gratification

Resisting marketing’s allure often hinges on our ability to delay gratification. This means choosing long-term rewards over immediate pleasures. It’s a powerful tool for financial well-being and a cornerstone of smart consumer behavior. Understanding and practicing delayed gratification can significantly reduce overspending and help you achieve your financial goals.

Psychological Benefits of Delaying Gratification

Delaying gratification offers numerous psychological advantages. It strengthens self-control, reduces impulsive behaviors, and fosters a greater sense of overall well-being. The ability to postpone immediate rewards for future gains is linked to improved mental health and greater success in various aspects of life.

- Increased Self-Control: Regularly practicing delayed gratification builds self-discipline. This ability extends beyond financial decisions, influencing choices in areas like diet, exercise, and relationships.

- Reduced Impulsivity: By consciously choosing to wait, you become less susceptible to impulsive purchases. This helps you avoid the regret often associated with buying things you later realize you didn’t need.

- Enhanced Goal Achievement: Delayed gratification is crucial for achieving long-term goals. Whether it’s saving for a down payment on a house or investing for retirement, the ability to postpone immediate desires fuels progress.

- Improved Mental Well-being: Studies have shown a correlation between the ability to delay gratification and reduced stress, anxiety, and depression. The feeling of control and accomplishment contributes to a more positive outlook.

Strategies for Practicing Patience and Self-Control

Marketing often exploits our desire for instant satisfaction. To combat this, we need strategies to cultivate patience and self-control. These techniques can help you resist tempting offers and make more thoughtful purchasing decisions.

- The “Wait and See” Rule: Before making a purchase, especially a non-essential one, commit to waiting a specific period, such as 24 hours, a week, or even a month. This allows you to evaluate whether you still truly want the item. Often, the initial impulse fades.

- Create a “No-Buy” Zone: Designate areas in your home or online where you avoid spending money. This could be a specific store, a category of online shopping, or a section of your home where you avoid impulse purchases.

- Identify Triggers: Recognize the situations or emotions that lead to impulsive spending. Are you more likely to overspend when you’re stressed, bored, or feeling down? Once you identify these triggers, you can develop strategies to manage them.

- Use the “Mental Math” Technique: Before buying something, calculate how many hours you need to work to earn the money. This can put the purchase in perspective and make you reconsider its value.

- Unsubscribe from Marketing Emails: Reduce exposure to tempting offers by unsubscribing from marketing emails and promotional newsletters. This limits the constant stream of advertisements that can trigger impulse buys.

Setting Long-Term Financial Goals

Establishing clear, long-term financial goals is a powerful motivator for responsible spending. When you have something significant to work towards, the immediate allure of a purchase often diminishes in comparison.

- Define Your Goals: Start by identifying your financial aspirations. This might include saving for a down payment on a house, paying off debt, funding your children’s education, or planning for retirement.

- Set Realistic Timelines: Break down your goals into manageable steps with specific timelines. For example, instead of just “save for retirement,” aim to save a certain amount each month or year.

- Create a Budget: A budget is essential for tracking your income and expenses and allocating funds towards your goals. It helps you see where your money is going and identify areas where you can cut back to save more.

- Automate Savings: Set up automatic transfers from your checking account to your savings or investment accounts. This makes saving effortless and ensures you’re consistently making progress toward your goals.

- Regularly Review Your Progress: Periodically assess your progress towards your goals. This helps you stay motivated and make adjustments to your budget or savings plan as needed.

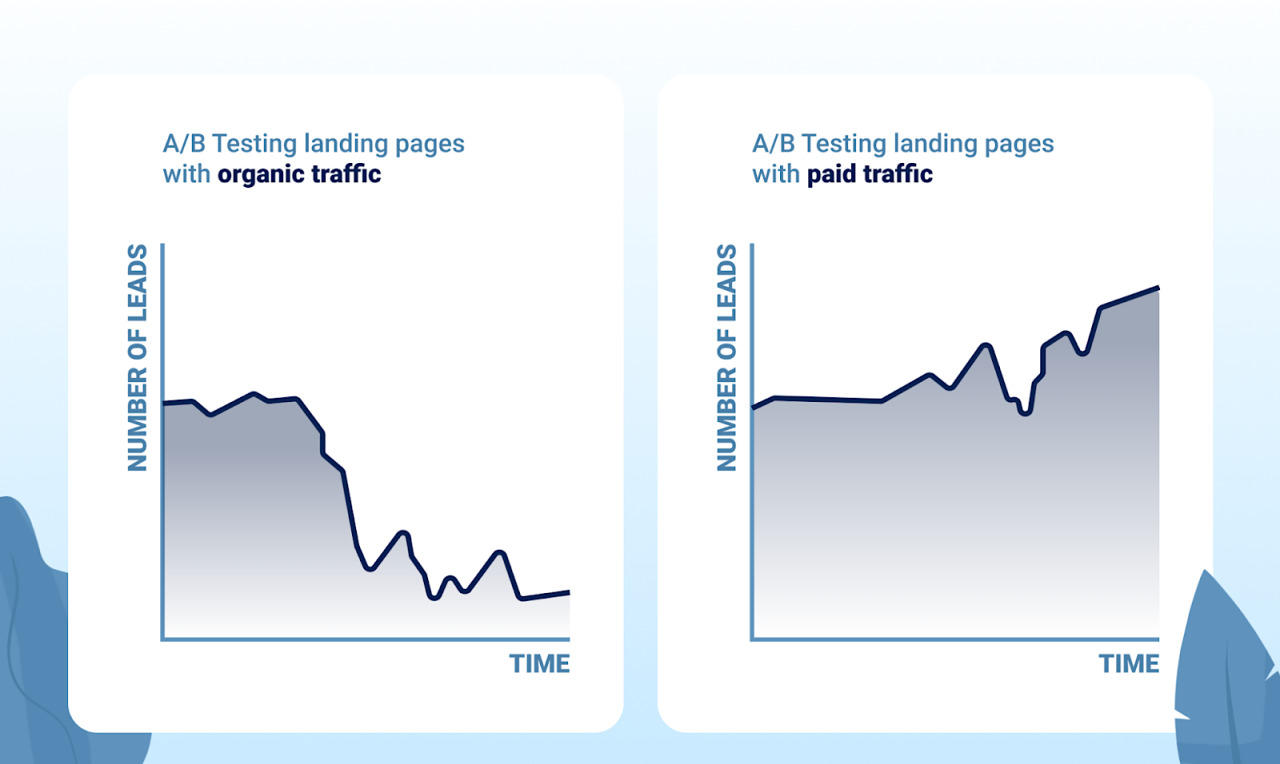

Visual Representation of Delayed Gratification and the Brain’s Reward System

Understanding how our brains process rewards is crucial for mastering delayed gratification. The following illustrates the concept and the underlying neurological processes.

Illustration Description: The visual representation shows a simplified illustration of the human brain and the concept of delayed gratification.

The brain is divided into two main sections: a smaller section labeled ‘Impulse’ and a larger section labeled ‘Long-Term Goals’.

- Impulse Section: This part of the brain represents immediate desires and the reward center. It’s shown with a light-colored area and a visual representation of a fast-food meal. This signifies the instant gratification associated with impulsive purchases.

- Long-Term Goals Section: This larger section represents the prefrontal cortex, responsible for planning, decision-making, and delayed gratification. It’s depicted with a darker, more developed area and an image of a house. This signifies the long-term rewards that come from responsible spending.

- The Reward System: A simplified diagram shows how the brain’s reward system works. When faced with a marketing temptation (e.g., a sale), the ‘Impulse’ section is activated, creating a feeling of excitement and desire. However, if the ‘Long-Term Goals’ section is stronger (due to self-control and goal-setting), it can override the impulse, leading to a more rational decision.

- Connections: Arrows and connecting lines are used to illustrate the interplay between these two brain regions. A thick arrow going from ‘Long-Term Goals’ to ‘Impulse’ shows how setting long-term goals can influence decisions and make impulse buys less attractive. A dotted arrow going from ‘Impulse’ to ‘Long-Term Goals’ indicates that impulsive spending can sometimes hinder progress towards long-term objectives.

The illustration conveys that the brain can be trained to favor long-term rewards over immediate gratification by strengthening the “Long-Term Goals” section. This helps you to resist marketing tricks and make better financial decisions.

Using Technology to Your Advantage

Technology offers a powerful arsenal of tools to combat marketing tricks and manage your finances effectively. By leveraging these resources, you can gain greater control over your spending habits, make informed purchasing decisions, and protect your personal data. This section will explore various technological solutions to help you navigate the consumer landscape with confidence.

Budgeting and Expense Tracking Applications

Budgeting and expense tracking apps provide a streamlined way to monitor your finances. These apps typically link to your bank accounts and credit cards, automatically categorizing your transactions.

- Mint: Mint is a popular, free budgeting app that allows users to track spending, create budgets, and monitor financial goals. It provides a visual representation of your finances and alerts you to potential overspending. For example, if your entertainment budget is $100 per month, Mint will notify you when you’ve spent 75% or more of that amount.

- YNAB (You Need A Budget): YNAB is a paid budgeting software that emphasizes the “envelope” budgeting method, where you assign every dollar a specific purpose. It encourages proactive budgeting and helps users to become more aware of where their money is going. YNAB’s methodology helps users to proactively allocate funds to various categories, like groceries, rent, and entertainment, preventing overspending in any single area.

- Personal Capital: Personal Capital is a free financial dashboard that allows users to track their investments, manage their budget, and monitor their net worth. It also provides financial planning tools and offers investment advice. Personal Capital can help users track their investment portfolio performance, visualize their net worth over time, and plan for retirement.

- PocketGuard: PocketGuard is a budgeting app that automatically calculates how much “safe-to-spend” money you have left after accounting for bills, goals, and savings. It connects to your financial accounts to track income and expenses, helping users to stay within their budget.

Price Comparison Websites and Browser Extensions

Price comparison websites and browser extensions are valuable tools for finding the best deals and avoiding overpaying. These tools help you to compare prices across different retailers and ensure you’re getting the best value for your money.

- Price Comparison Websites: Websites such as Google Shopping, PriceGrabber, and Shopzilla allow you to compare prices for a specific product across multiple retailers. You can simply search for a product and instantly see which stores offer the best price, including shipping costs. For instance, if you’re looking to purchase a new laptop, you can compare prices from Best Buy, Amazon, and other retailers simultaneously.

- Browser Extensions: Browser extensions, such as Honey and Rakuten, automatically find and apply coupons and cashback rewards when you’re shopping online. Honey, for example, scours the internet for coupon codes and automatically applies them during checkout. Rakuten offers cashback on purchases from various retailers, providing a percentage of your purchase price back to you.

- CamelCamelCamel: CamelCamelCamel specifically tracks prices on Amazon. This tool provides price history charts, allowing you to see how the price of a product has changed over time. This helps you determine if the current price is a good deal or if you should wait for a price drop. For example, you can see if the price of a product is at its lowest point in the last six months.

Blocking Advertisements and Tracking Online Activity

Protecting your privacy and minimizing exposure to manipulative advertising is essential. Blocking advertisements and tracking your online activity helps to reduce distractions, avoid impulse purchases, and limit the amount of data collected about you.

- Ad Blockers: Ad blockers, such as AdBlock and uBlock Origin, prevent advertisements from appearing on websites. This reduces distractions and minimizes exposure to marketing messages. By blocking ads, you’re less likely to be tempted by impulse purchases.

- Privacy-Focused Search Engines: Using search engines like DuckDuckGo, which do not track your search history, helps to maintain your privacy. Unlike Google, DuckDuckGo does not collect personal data to personalize search results or target you with ads.

- Browser Privacy Extensions: Browser extensions such as Privacy Badger and Ghostery help to block trackers and protect your online activity. Privacy Badger automatically learns to block trackers based on your browsing behavior. Ghostery blocks trackers and provides information about the trackers present on a website.

- Virtual Private Networks (VPNs): A VPN encrypts your internet traffic and masks your IP address, making it more difficult for advertisers to track your online activity. VPNs are particularly useful when using public Wi-Fi networks, as they protect your data from potential threats.

Ultimate Conclusion

In conclusion, this guide on How to Resist Marketing Tricks That Make You Overspend serves as your personal compass in the complex world of consumerism. By understanding the techniques used to influence you, and by adopting practical strategies like budgeting, critical thinking, and delayed gratification, you can reclaim control of your finances. Armed with this knowledge, you’re well-equipped to make mindful purchasing decisions, protect your privacy, and build a more secure financial future.

Remember, being a smart consumer is a journey, and every step you take empowers you.