Navigating the holiday season often involves the delightful challenge of gift-giving, but it can quickly become overwhelming, especially when managing a budget. This guide, “How to Create a Holiday Gift List to Stay on Budget,” is your roadmap to a stress-free holiday, providing you with practical strategies to plan, shop, and wrap gifts without breaking the bank. We’ll explore everything from setting a realistic budget to finding the perfect presents and wrapping them with a personal touch, all while keeping your finances in check.

This resource breaks down the process into manageable steps, covering essential areas such as creating a budget, identifying gift recipients, brainstorming gift ideas, researching prices, organizing your gift list, shopping efficiently, wrapping presents thoughtfully, and staying on track. Whether you’re a seasoned gift-giver or new to the holiday season, this guide offers valuable insights to help you enjoy the spirit of giving without the financial stress.

Setting a Realistic Budget for Holiday Gifts

Creating a holiday gift list is only the first step. The true magic happens when you align your generosity with your financial reality. Setting a realistic budget is paramount to enjoying the holidays without the post-holiday financial hangover. This involves understanding your financial position and making informed decisions about how much you can comfortably spend.

Determining Your Total Spending Limit

Before you even think about individual gifts, you need to determine your overall spending limit. This is where careful assessment of your finances comes into play. It’s not just about what you

- want* to spend, but what you

- can* afford to spend without jeopardizing your financial well-being.

To determine your total spending limit, consider these strategies:

- Assess Your Income: Begin by calculating your net monthly income, which is your take-home pay after taxes and other deductions. This is the money you have available to spend each month.

- Analyze Your Savings: Determine how much you have in savings. While it’s tempting to dip into savings, remember that these funds are usually earmarked for specific goals or emergencies. Consider how much you’re comfortable using for holiday gifts without hindering your long-term financial goals.

- Evaluate Existing Debt: Factor in your existing debt obligations, such as credit card balances, student loans, or car payments. The more debt you have, the less you’ll likely have available for discretionary spending like gifts. High-interest debt, in particular, should be a major consideration.

- Create a Budget Worksheet: Use a budget worksheet (you can create one in a spreadsheet program like Microsoft Excel or Google Sheets, or use a budgeting app) to Artikel your income, savings, and debt payments. This will provide a clear picture of your financial resources.

- Calculate Available Funds: Subtract your essential expenses (rent/mortgage, utilities, groceries, debt payments) and desired savings contributions from your net income. The remaining amount represents your discretionary income, which includes holiday spending.

- Consider Other Holiday Expenses: Remember that gift-giving isn’t the only holiday expense. Factor in the cost of wrapping paper, postage, holiday cards, decorations, food for holiday gatherings, and potential travel expenses.

- Set a Realistic Percentage: Financial advisors often recommend spending no more than a certain percentage of your discretionary income on holiday gifts. A common guideline is 1-3% of your annual income. For example, if your annual income is $60,000, you might aim to spend between $600 and $1800 on holiday gifts.

- Example: Let’s say your net monthly income is $4,000, your essential expenses are $2,500, and you want to save $500 per month. This leaves you with $1,000 in discretionary income. If you allocate 10% of this to holiday spending, your budget would be $100.

Breaking Down Your Budget and Allocating Funds

Once you have a total spending limit, the next step is to break it down and allocate funds for individual gifts and other holiday expenses. This process requires thoughtful planning to ensure you stay within your budget.Here’s how to break down your total budget:

- Create a Gift List: Start by listing everyone you plan to buy gifts for. Include family members, friends, colleagues, and anyone else on your list.

- Categorize Gift Recipients: Group your recipients by relationship (e.g., immediate family, extended family, friends, etc.). This helps you allocate your budget more effectively.

- Assign Gift Amounts: Decide how much you want to spend on each person. Consider the person’s importance to you, your relationship, and your overall budget. Some people may receive more expensive gifts than others.

- Account for Other Expenses: Allocate a portion of your budget for other holiday expenses like wrapping paper, cards, postage, decorations, and any planned holiday activities.

- Prioritize and Adjust: Be prepared to adjust your gift list or individual gift amounts based on your overall budget. If you find you’ve exceeded your budget, consider giving less expensive gifts, making homemade gifts, or drawing names for a gift exchange.

- Use a Spreadsheet or App: A spreadsheet or budgeting app can be an invaluable tool for tracking your spending and ensuring you stay within your allocated amounts.

- Example: Let’s say your total holiday budget is $800. You have five family members, and you decide to allocate $100 per person for gifts, totaling $500. You allocate $100 for wrapping supplies, $50 for postage and cards, and the remaining $150 for potential unexpected expenses or additional gifts.

- Consider Gift Alternatives: If you’re struggling to stay within your budget, consider alternatives to traditional gifts. Homemade gifts, experiences (like tickets to a show or a cooking class), or simply spending quality time with loved ones can be just as meaningful.

Designing a System for Tracking Spending

Tracking your spending is crucial to staying on budget. Without a system to monitor your expenses, it’s easy to overspend and find yourself in a financial bind after the holidays. The key is to find a method that works for you and to consistently update it.Here’s how to design a system for tracking your spending:

- Choose Your Tracking Method: You can use a spreadsheet (Microsoft Excel, Google Sheets), a budgeting app (Mint, YNAB – You Need A Budget, Personal Capital), or even a notebook and pen. The most important thing is to choose a method you’ll actually use.

- Create a Budget Worksheet: In your spreadsheet or app, create a worksheet specifically for your holiday spending. Include columns for the recipient’s name, the gift description, the budgeted amount, the actual amount spent, and the date of purchase.

- Record Every Purchase: Make a habit of recording every purchase immediately after you make it. Don’t wait until the end of the day or week; the longer you wait, the easier it is to forget or miscalculate.

- Track Online and In-Store Purchases: Be sure to include both online and in-store purchases in your tracking system.

- Categorize Expenses: Categorize your expenses (e.g., gifts, wrapping paper, postage). This helps you see where your money is going and identify areas where you might be overspending.

- Monitor Your Progress: Regularly review your spending against your budget. This allows you to identify potential problems early on and make adjustments as needed.

- Set Spending Alerts: Many budgeting apps allow you to set spending alerts. For example, you can set an alert to notify you when you’ve spent a certain percentage of your budget for a particular category.

- Example: If you’re using a spreadsheet, your tracking system might look like this:

Recipient Gift Description Budgeted Amount Actual Amount Date Category Mom Sweater $75 $70 11/15/2024 Gifts Dad Book $50 $55 11/20/2024 Gifts Wrapping Paper Wrapping Paper & Ribbon $25 $30 11/22/2024 Wrapping Supplies - Make Adjustments as Needed: If you find that you’re overspending in one area, you may need to reduce spending in another area or adjust your gift list.

Identifying Gift Recipients and Their Preferences

Creating a comprehensive holiday gift list involves more than just assigning dollar amounts. It’s crucial to identify who you’re gifting and, more importantly, what they’d appreciate. This stage ensures your budget is allocated effectively and that your gifts are meaningful and well-received.

Creating Your Gift Recipient List

The first step is compiling a master list of everyone you plan to give a gift to. This ensures you don’t overlook anyone and helps you visualize the scope of your gift-giving.To create your list, consider these categories:

- Family: Include immediate and extended family members. Note their relationships (e.g., spouse, sibling, parent, grandparent, cousin).

- Friends: List close friends, acquaintances, and anyone you typically exchange gifts with.

- Colleagues/Work Associates: Consider office gift exchanges, supervisors, or employees.

- Other: Include neighbors, service providers (e.g., babysitter, dog walker), or anyone else you feel inclined to gift.

A well-organized list is key. You can use a spreadsheet, a dedicated notebook, or a digital list-making app. Include columns for the recipient’s name, relationship, and, as you gather it, their gift preferences and budget allocation.

Gathering Gift Preferences

Understanding what your recipients desire is essential for successful gift-giving. Avoid guessing and increase the chances of delighting them by gathering clues about their preferences.Here are some effective methods:

- Direct Communication: The most straightforward approach is to ask. Consider asking for a wish list or suggesting a few gift ideas.

- Wish Lists: Encourage the use of online wish lists (e.g., Amazon, Etsy, or personal websites). This provides specific gift ideas and eliminates guesswork.

- Subtle Hints: Pay attention to what your recipients talk about, what they admire, or what they’ve mentioned needing or wanting. Observe their hobbies, interests, and current trends in their lives.

- Past Gift Successes: Review previous years’ gift-giving. What gifts were well-received? What did they use and enjoy? Replicating past successes can be a reliable strategy.

- Social Media: Check their social media profiles for clues about their interests, recent purchases, or things they’ve been talking about. Be mindful of privacy and avoid being overly intrusive.

- Ask Their Inner Circle: If direct questioning is difficult, discreetly ask family members or close friends for gift suggestions. They often have valuable insights.

Prioritizing Gift Recipients and Budget Allocation

Once you have a list of recipients and some idea of their preferences, you can start prioritizing and allocating your budget effectively.Prioritization helps you manage your resources and ensures that you spend the most on the individuals who are most important to you. Here’s how to approach it:

- Rank Recipients: Assign a priority level to each recipient based on your relationship with them. Consider factors like their importance in your life, the frequency with which you see them, and any cultural or family traditions.

- Budget Allocation: Decide how much you’re willing to spend overall, then allocate a portion of that budget to each recipient based on their priority level.

- Flexible Budgeting: Create a flexible budget that allows for some variance. Some gifts might be more expensive than anticipated, while others might be less.

- Example Scenario: Consider a hypothetical scenario where your overall gift budget is $1,000. You may decide to allocate $200 for your spouse, $100 each for your parents, $50 for each sibling, $30 for each close friend, and $20 for colleagues and acquaintances. This example can be adjusted according to your specific situation and relationships.

Prioritization is not about valuing people; it’s about managing resources to show your appreciation to the people in your life in a sustainable way.

Brainstorming Gift Ideas within Budget Constraints

Now that you’ve set your budget and identified your gift recipients, it’s time for the fun part: brainstorming gift ideas! This is where your creativity shines. The key is to think outside the box and find presents that are thoughtful and meaningful, regardless of the price tag. Remember, the best gifts come from the heart and show you care.

Diverse Gift Ideas Across Budget Ranges

Finding the perfect gift doesn’t always require a hefty price tag. By exploring a range of options, you can discover thoughtful presents that suit any budget.

- Stocking Stuffers (Under $10): These are perfect for small gifts or additions to larger presents. Consider:

- Gourmet chocolates or candies.

- Fun socks with unique patterns.

- Small, travel-sized toiletries like hand creams or lip balms.

- A funny or inspirational magnet.

- A pack of their favorite pens or pencils.

- Small Gifts ($10-$25): These offer a wider range of options, allowing for slightly more elaborate presents.

- A scented candle or diffuser.

- A cozy mug and a packet of gourmet coffee or tea.

- A book by their favorite author.

- A stylish phone case or pop socket.

- A small piece of jewelry like a bracelet or necklace.

- Mid-Range Gifts ($25-$50): These gifts provide opportunities for more substantial presents.

- A high-quality scarf or gloves.

- A gift basket filled with their favorite snacks and treats.

- A portable Bluetooth speaker.

- A subscription box tailored to their interests (e.g., coffee, beauty products, or books).

- A nice bottle of wine or spirits.

- Larger Gifts (Over $50): For those you want to splurge on, these gifts offer the chance to provide more significant presents.

- A high-end kitchen gadget, such as a stand mixer.

- A piece of electronics, like a smart watch.

- Tickets to a concert or show.

- A weekend getaway.

- A designer handbag or shoes.

Creative Gift Options

Beyond the traditional store-bought gifts, there are many creative ways to give meaningful presents while staying within your budget.

- Homemade Gifts: These gifts are often the most personal and can be very cost-effective.

- Bake cookies, brownies, or a loaf of bread.

- Create a scrapbook filled with memories.

- Knit or crochet a scarf or hat.

- Make a personalized photo album.

- Create a custom piece of art, such as a painting or drawing.

- Experience-Based Gifts: These gifts create lasting memories.

- Tickets to a local museum or art gallery.

- A cooking class.

- A spa day or massage.

- A hot air balloon ride.

- A weekend camping trip.

- Gifts That Support Local Businesses: This is a great way to give back to your community while finding unique presents.

- Purchase gift certificates from local restaurants.

- Buy handcrafted items from local artisans.

- Support a local bookstore by buying a book.

- Purchase a membership to a local gym or fitness studio.

- Buy locally sourced food items like honey, jam, or coffee.

Adapting Gift Ideas to Individual Interests and Personalities

Personalizing gifts shows you care and makes them even more special. Consider the recipient’s interests, hobbies, and personality when choosing a gift.

- For the Foodie: Consider a gourmet food basket, a cooking class, or a high-quality kitchen gadget. Think about their favorite cuisines or ingredients. For example, if they love Italian food, create a gift basket with pasta, olive oil, and a cookbook featuring Italian recipes.

- For the Bookworm: A new release by their favorite author, a subscription to a book-of-the-month club, or a cozy reading nook setup with a comfortable blanket and a reading light. Consider their favorite genres and authors when selecting books.

- For the Techie: A new gadget, a subscription to a streaming service, or a high-tech accessory. Consider their current tech setup and what might complement it.

- For the Fashionista: A stylish accessory, a gift certificate to their favorite clothing store, or a personalized piece of jewelry. Consider their style and preferences when choosing items.

- For the Traveler: A travel-sized toiletries kit, a portable charger, or a subscription to a travel magazine. Consider their travel style and destinations.

Example: Let’s say you’re buying a gift for your sister who loves gardening and is on a budget. Instead of a pre-made gift basket, you could create your own. Purchase a decorative gardening pot from a local shop, fill it with gardening gloves, seed packets for her favorite flowers, and a small trowel. This personalized gift is both thoughtful and cost-effective.

Researching Prices and Finding Deals

Finding the best prices and securing deals is crucial for staying within your holiday gift budget. This section will guide you through the process of researching prices, identifying discounts, and planning your shopping strategy to maximize savings. Careful planning and a little effort can make a significant difference in your overall spending.

Comparing Costs: Online and In-Store

Thorough price comparison is essential for making informed purchasing decisions. It helps you identify the best value for each gift and avoid overspending.To effectively compare prices:

- Online Research: Utilize online search engines and price comparison websites. Many websites, like Google Shopping, PriceGrabber, and CamelCamelCamel (for Amazon), allow you to compare prices from various retailers quickly. Check the websites of major retailers (e.g., Amazon, Target, Walmart) and smaller specialty stores. Look for free shipping offers and factor shipping costs into the total price.

- In-Store Research: Visit brick-and-mortar stores to compare prices directly. Take advantage of price matching policies offered by many retailers. Price matching allows you to purchase an item at a lower price if you find it advertised at a lower price by a competitor.

- Compare Product Details: Ensure you are comparing the same product. Check the model number, size, color, and any included accessories. Differences in these details can significantly impact the price.

- Read Reviews: Before making a purchase, read customer reviews to assess the product’s quality and reliability. This can prevent you from buying a gift that might disappoint the recipient.

- Use Browser Extensions: Install browser extensions like Honey or Rakuten to automatically search for coupons and cashback offers while you browse online.

Strategies for Finding Discounts and Deals

Maximizing savings requires a proactive approach to finding and utilizing discounts. Understanding various deal types can significantly reduce your overall gift expenses.Here are some effective strategies:

- Coupons: Utilize both physical and digital coupons. Search online for coupon codes before making a purchase. Many websites and apps offer coupons for various retailers. Check your local newspaper and flyers for physical coupons.

- Sales and Promotions: Take advantage of sales events, such as Black Friday, Cyber Monday, and pre-holiday sales. Many retailers offer significant discounts during these periods. Pay attention to flash sales, which offer limited-time deals on specific items.

- Loyalty Programs: Join loyalty programs offered by retailers. These programs often provide exclusive discounts, early access to sales, and reward points that can be redeemed for future purchases.

- Cashback Rewards: Use credit cards or apps that offer cashback rewards on purchases. These rewards can help you earn back a percentage of your spending.

- Bundle Deals: Look for bundle deals, where you can purchase multiple items together at a discounted price. These deals are often available for related products.

- Clearance Sections: Browse clearance sections in stores and online. You can often find significant discounts on items that are being discontinued or are out of season.

Planning Shopping Times for the Best Prices

Strategic timing can be a key factor in securing the best deals. Planning your shopping throughout the year, rather than waiting until the last minute, can help you spread out your spending and take advantage of seasonal sales.Here’s a plan for shopping at different times of the year:

- Early Bird Specials: Start shopping early, even before the holiday season officially begins. Retailers often offer early bird specials to attract customers and clear out inventory.

- Summer Sales: Take advantage of summer sales, which often offer discounts on various items, including gifts.

- Back-to-School Sales: Back-to-school sales can sometimes offer discounts on items that can be given as gifts.

- Black Friday and Cyber Monday: These events offer some of the most significant discounts of the year. Plan your purchases carefully and be prepared to act quickly, as deals can sell out fast.

- Pre-Holiday Sales: Many retailers offer sales leading up to the holiday season. These sales can be a good opportunity to find deals on items that are likely to be popular gifts.

- Post-Holiday Sales: After the holidays, retailers often have clearance sales to clear out remaining inventory. These sales can be a great time to purchase gifts for next year or to stock up on items at a significant discount.

Example: Consider a scenario where you are looking to purchase a popular gaming console as a gift. During the pre-holiday season, you find it at $300. However, by monitoring prices and waiting for Black Friday, you might find it on sale for $250. This represents a significant saving, allowing you to allocate the saved $50 to another gift or save it for future purchases.

Organizing Your Gift List and Tracking Progress

Creating and managing your holiday gift list effectively is crucial for staying organized and within your budget. This step helps you visualize your spending, track your progress, and avoid overspending or last-minute gift-buying stress. Let’s dive into how to build a robust gift list and utilize it effectively.Organizing your gift list is the cornerstone of a successful holiday gifting strategy.

A well-structured list allows you to monitor your spending, track your progress, and avoid the last-minute rush.

Creating a Detailed Gift List Template

To effectively track your gift-giving, you need a comprehensive gift list template. This template should include key information to monitor your budget and purchasing progress. Consider the following columns:

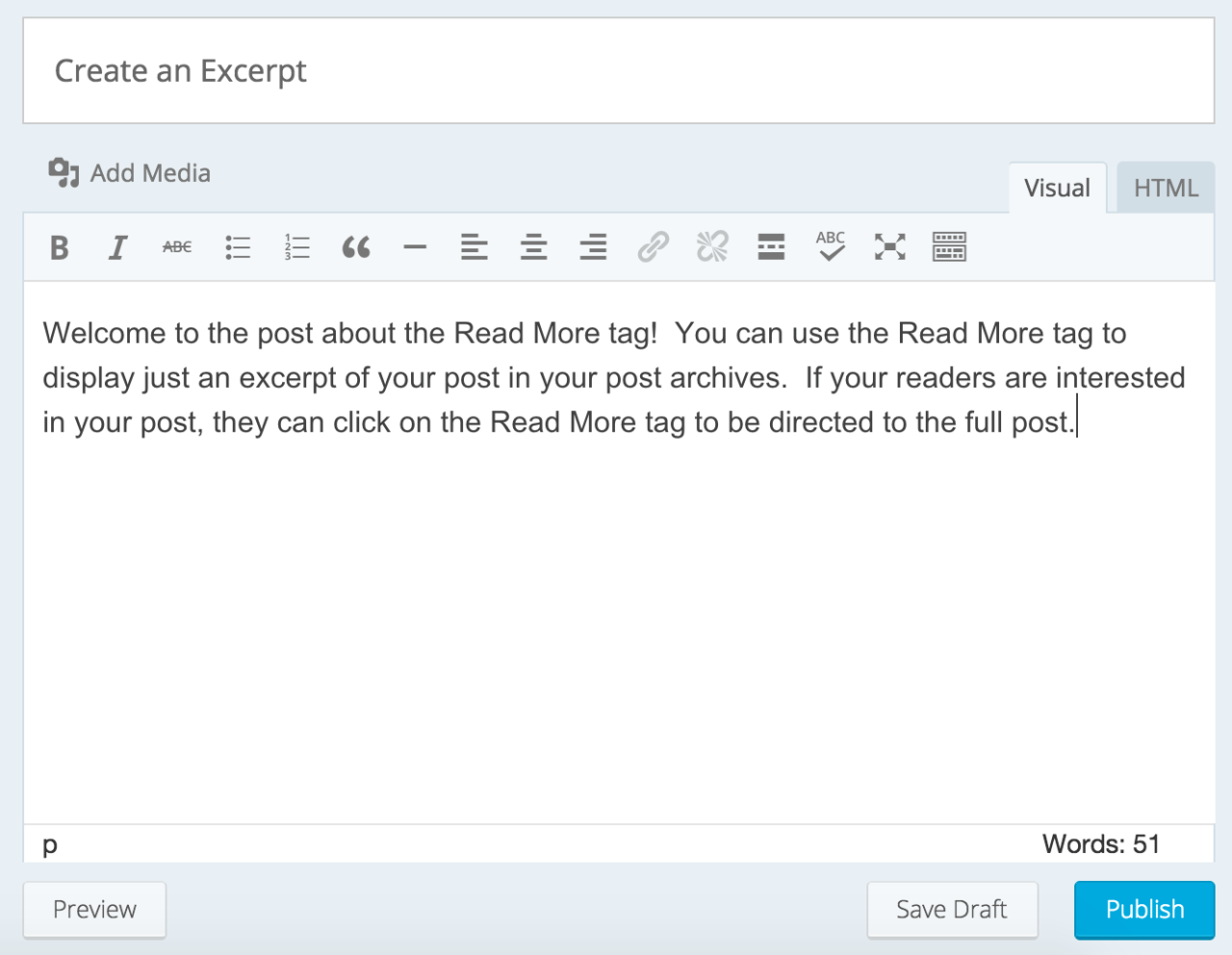

Here’s a suggested template you can adapt to your needs, displayed in an HTML table format:

| Recipient | Gift Idea | Estimated Cost | Actual Cost | Purchase Status |

|---|---|---|---|---|

| Mom | Cozy Blanket | $50 | Not Purchased | |

| Dad | Coffee Maker | $75 | Not Purchased | |

| Sister | Gift Card | $25 | Not Purchased | |

| Friend – Sarah | Book | $20 | Not Purchased |

Explanation of each column:

- Recipient: The name of the person you’re buying a gift for.

- Gift Idea: A brief description of the gift you plan to purchase.

- Estimated Cost: Your anticipated cost for the gift. This is important for budgeting.

- Actual Cost: The final price you paid for the gift.

- Purchase Status: Indicates whether the gift has been purchased (e.g., “Purchased,” “Not Purchased,” “Wrapped,” “Shipped”).

Using the Gift List to Monitor Spending and Track Progress

The gift list is a dynamic tool that needs to be updated regularly to ensure you’re on track.

Here’s how to use your gift list effectively:

- Track Estimated vs. Actual Costs: As you purchase gifts, fill in the “Actual Cost” column. Compare the actual cost to the estimated cost to see if you’re staying within budget.

- Calculate Remaining Budget: Regularly calculate your remaining budget. Subtract the total actual costs from your overall gift budget.

- Monitor Purchase Status: Update the “Purchase Status” column to reflect the progress of your gift-buying. This helps you visualize what gifts you still need to buy.

- Identify Potential Overspending: If the “Actual Cost” significantly exceeds the “Estimated Cost” for a gift, you might need to adjust your budget or find a more affordable alternative.

Organizing the Gift List by Category

Categorizing your gift list streamlines your shopping process and helps avoid last-minute rushes.

Consider these categories:

- Family: Group gifts for immediate and extended family members together.

- Friends: Separate your friends’ gifts for focused shopping.

- Work/Colleagues: Include gifts for coworkers or your boss.

- Other: Include categories like neighbors, service providers, or anyone else on your list.

By organizing your list this way, you can:

- Prioritize Shopping: Focus on buying gifts for one category at a time.

- Avoid Overspending in One Area: Easily track your spending within each category.

- Prevent Last-Minute Scrambling: Ensure you don’t forget anyone by systematically working through each category.

Shopping and Purchasing Gifts Efficiently

Now that you’ve meticulously planned your gift list and budget, it’s time to tackle the actual shopping! This stage can be the most exciting, but also the most challenging if not approached strategically. Efficient shopping minimizes stress, saves time, and helps you stick to your financial goals. Let’s dive into practical tips and strategies to make your holiday gift purchasing a smooth and successful experience.

Planning Shopping Trips and Avoiding Impulse Buys

Effective planning is key to efficient shopping. Without a solid plan, you risk aimless wandering, overspending, and frustration.

- Create a Detailed Shopping Plan: Before you even leave your home, map out your shopping route. Prioritize stores based on your gift list, starting with those that carry the most items you need. This minimizes travel time and reduces the temptation to browse aimlessly. For example, if you need items from a department store and a specialty shop, plan to visit the department store first, followed by the specialty shop, grouping similar gift needs together.

- Set Time Limits for Each Store: Allocate a specific amount of time for each shopping location. This prevents you from lingering too long, which can lead to impulse purchases and fatigue. Set a timer on your phone or watch to stay on track. Consider using an app that helps manage time.

- Make a List and Stick to It: Bring your gift list with you and check off items as you purchase them. Resist the urge to deviate from your planned purchases. Impulse buys are a major contributor to overspending. Focus on your intended purchases.

- Shop Alone or with a Focused Companion: Avoid shopping with friends or family who may encourage impulse buys. If you must shop with someone, choose a companion who understands your budget and can help you stay on track.

- Avoid Shopping When Tired or Hungry: These conditions can make you more susceptible to impulse purchases. Shop when you are well-rested and have eaten a meal or snack.

- Use Cash or a Dedicated Gift Card: If possible, use cash or a gift card loaded with your budget amount. This physically limits your spending and helps you avoid the temptation to overcharge a credit card.

Comparing Online and In-Store Shopping

Choosing between online and in-store shopping involves weighing several factors. Each method offers distinct advantages and disadvantages that can influence your overall shopping experience.

- Online Shopping Advantages:

- Convenience: Shop from the comfort of your home, anytime. This is especially beneficial for busy individuals or those with mobility limitations.

- Wider Selection: Online retailers often have a larger inventory than physical stores.

- Price Comparison: Easily compare prices from different retailers. Price comparison tools and browser extensions can automate this process.

- Time Savings: Avoid travel time and crowds.

- Detailed Product Information: Access product reviews and specifications readily.

- Online Shopping Disadvantages:

- Shipping Costs and Times: Shipping fees can add to the cost, and delivery times may not be immediate.

- Inability to See or Touch Products: You can’t physically examine the product before buying. This can lead to disappointment if the item doesn’t meet your expectations.

- Return Complications: Returning items can be more cumbersome than in-store returns.

- Risk of Scams: Be wary of fraudulent websites and sellers. Always shop from reputable sources.

- In-Store Shopping Advantages:

- Immediate Gratification: Take the gift home immediately.

- Ability to Inspect Products: See and touch the items before purchasing.

- Easy Returns: Returns are often simpler and faster.

- Personal Assistance: Get help from sales associates.

- In-Store Shopping Disadvantages:

- Time-Consuming: Requires travel time and dealing with crowds.

- Limited Selection: Physical stores may have a smaller inventory than online retailers.

- Higher Prices: Prices may be higher than online, although this is not always the case.

Handling Unexpected Expenses and Overspending

Even with careful planning, unexpected expenses can arise. Having a strategy in place can help you mitigate the impact and stay within your overall budget.

- Review Your Gift List: The first step is to revisit your gift list. Can you eliminate any gifts? Can you substitute a less expensive item for a more costly one? Consider whether you can adjust the quantity of gifts or make homemade gifts.

- Adjust Gift Giving: Think about whether you can reduce the number of gifts per recipient or opt for group gifts. For example, instead of individual gifts for each family member, consider a single, larger gift that everyone can enjoy.

- Prioritize Essential Purchases: Focus on the gifts that are most important. If necessary, delay or eliminate less critical purchases.

- Negotiate Prices: Don’t be afraid to ask for discounts or sales.

- Utilize Coupons and Sales: Always look for coupons and take advantage of sales. Many retailers offer special promotions during the holiday season.

- Consider Alternatives: Explore alternative gift ideas, such as gift certificates, experiences (like tickets to a show), or homemade gifts. These options can be more affordable and personalized.

- Monitor Your Spending Regularly: Keep track of your spending as you shop. Use a budgeting app or spreadsheet to monitor your progress.

- Don’t Use Credit Cards if You Can’t Pay Them Off: Using credit cards can lead to debt if you can’t pay them off. If you are struggling to stay within your budget, consider paying with cash or a debit card.

- Borrow or Ask for Help: If the overspending is significant and you cannot adjust your gift list, consider asking for help. This could mean borrowing money from a family member or friend or delaying some purchases until after the holidays.

Wrapping and Presenting Gifts Thoughtfully

Thoughtful gift wrapping and presentation elevate the giving experience, transforming a simple present into a cherished memory. It’s an opportunity to show care and consideration, regardless of the gift’s price. This section provides ideas for creating beautifully wrapped gifts that are both budget-friendly and personal.

Creative and Budget-Friendly Gift Wrapping Techniques

Using creative wrapping techniques allows you to create visually appealing gifts without spending a fortune on expensive wrapping paper. Consider these cost-effective and stylish options:

- Brown Paper Packages Tied Up with String: Embrace the classic simplicity of brown paper. It’s inexpensive and versatile. Decorate it with twine, ribbon, and embellishments like dried flowers, leaves, or small ornaments. Consider stamping designs with potatoes cut into shapes or using stencils for personalized patterns.

- Fabric Scraps and Scarves: Repurpose fabric scraps, old scarves, or bandanas as gift wrap. This is a sustainable and beautiful option. Wrap the gift like a furoshiki (Japanese wrapping cloth) for an elegant presentation. You can also use fabric remnants from previous sewing projects.

- Newspaper or Magazine Pages: Give newspapers or magazine pages a second life. Choose pages with interesting text, images, or colors. These can be used as wrapping paper, adding a unique and vintage touch. Tie with twine or ribbon for a rustic look.

- Reusable Gift Bags and Boxes: Invest in a collection of reusable gift bags and boxes. These can be used year after year, saving money and reducing waste. Decorate them with ribbons, tags, or small ornaments to personalize them for each recipient.

- DIY Paper: Create your own wrapping paper using plain paper or even butcher paper. Decorate it with paint, markers, crayons, or stamps. This allows for complete customization and can be a fun activity to do with family. Consider creating a themed design based on the recipient’s interests.

Adding Personal Touches to Gifts

Personalizing gifts makes them more meaningful and memorable. These small details show the recipient that you put extra thought and effort into their gift.

- Handwritten Notes: A handwritten note is one of the most personal touches you can add. Write a heartfelt message expressing your feelings or sharing a special memory. Even a short, sincere message can make a big difference.

- Customized Packaging: Instead of generic gift tags, create your own using cardstock, paper, or even fabric scraps. Include the recipient’s name and a short, personalized message. Consider using a calligraphy pen or adding decorative elements.

- Adding Embellishments: Incorporate small, inexpensive embellishments that reflect the recipient’s interests. For example, if they love coffee, include a coffee bean charm or a small bag of gourmet coffee. If they enjoy reading, add a bookmark.

- Creating Themed Gift Baskets: Assemble a gift basket based on the recipient’s interests. For instance, a “movie night” basket could include popcorn, candy, and a gift card to a streaming service. A “spa day” basket could contain bath bombs, candles, and a face mask.

- Using Photos: Include a printed photo of you and the recipient, or a photo of something that reminds you of them. This is a great way to add a personal touch and create a lasting memory. You can include the photo in the gift wrapping or attach it to the gift with a ribbon.

Presenting Gifts Meaningfully and Memorably

The way you present a gift can enhance the overall experience. Even a simple gift can feel special with thoughtful presentation.

- Consider the Presentation Space: Set up a designated area for gift-giving, such as a decorated table or a cozy corner. Ensure the space is clean and organized.

- Use Color Themes: Choose a color scheme that complements the gift and the recipient’s preferences. This can create a cohesive and visually appealing presentation.

- Add a Finishing Touch: Tie a beautiful ribbon around the gift, or add a sprig of greenery or a small ornament. These finishing touches elevate the presentation and add a touch of elegance.

- Timing and Delivery: Consider when and how you will deliver the gift. Present it in person, or wrap it nicely if you’re shipping it. A well-timed delivery can make the gift even more special.

- Focus on the Experience: The most important thing is the experience of giving and receiving. Take your time, show genuine appreciation, and let the recipient know how much you care. Remember, the thought behind the gift is what truly matters.

Managing Expectations and Staying on Track

Staying within your holiday gift budget requires more than just a plan; it demands consistent effort and the ability to navigate potential challenges. This section focuses on anticipating common pitfalls, communicating budget limitations effectively, and implementing strategies to keep your gift-giving on track throughout the holiday season.

Identifying Common Budget Pitfalls

Several factors can easily lead to overspending during the holidays. Recognizing these potential traps allows you to proactively avoid them and maintain control of your finances.

- Impulse Purchases: The holiday season is filled with tempting deals and limited-time offers. These can lead to impulsive buys that weren’t planned for and quickly drain your budget.

- Peer Pressure: Seeing what others are buying or feeling obligated to match their spending can create pressure to exceed your budget. Remember that everyone’s financial situation is different.

- Unexpected Expenses: Holiday gatherings, travel, and other related costs can quickly add up, leaving less money for gifts.

- Emotional Spending: The holiday season can evoke strong emotions. Using shopping as a way to cope with stress or sadness can lead to overspending on gifts.

- Lack of Tracking: Failing to monitor your spending can make it difficult to identify when you are going over budget until it’s too late.

Communicating Budget Limitations

Open and honest communication is key to managing expectations and ensuring everyone understands your financial constraints. This helps avoid disappointment and fosters a more realistic approach to gift-giving.

- Be upfront: When discussing gift expectations with family and friends, be clear about your budget limitations. For example, “I’m setting a budget of $X for gifts this year.”

- Suggest alternative gift ideas: Instead of expensive gifts, suggest options like homemade gifts, experiences (e.g., a dinner at home, a movie night), or a gift exchange with a price limit.

- Focus on the sentiment: Emphasize the importance of the thought behind the gift, not the monetary value.

- Lead by example: Show others that you’re prioritizing thoughtful, budget-conscious gifts. This can encourage them to do the same.

- Use gentle language: Avoid being accusatory or defensive. Frame your message in a positive and understanding way. For example, “I’m trying to be more mindful of my spending this year, so I’m planning on giving more personal gifts.”

Strategies for Staying on Track

Maintaining your budget requires consistent effort and the ability to adjust your plan as needed. Implement these strategies to help you stay on course.

- Regular Budget Reviews: Check your spending regularly, at least weekly, to see how you’re tracking against your budget.

- Be Flexible: Be prepared to adjust your gift list or the amount you spend on each person if necessary. If a particular gift is too expensive, consider a less expensive alternative or homemade option.

- Utilize Price Tracking Tools: Use browser extensions or websites to track price fluctuations and find the best deals.

- Avoid Shopping When Stressed: If you’re feeling stressed or overwhelmed, avoid shopping. Take a break and revisit your list when you are in a calmer state.

- Stick to Your List: Resist the urge to make unplanned purchases. Only buy items on your gift list.

- Delay Purchases: If possible, delay buying gifts until closer to the holiday to take advantage of sales and discounts.

- Consider a “No-Spend” Week: Take a break from shopping for a week or two to give yourself a financial breather and reassess your spending habits.

- Track Purchases and Review Receipts: Keep track of all purchases and review receipts to ensure you are not overspending.

- Set Realistic Expectations: Understand that you may not be able to buy everything on your list or give extravagant gifts. Focus on giving thoughtful gifts that align with your budget.

- Celebrate Your Successes: Acknowledge and reward yourself for staying within your budget. This can help you stay motivated.

Conclusive Thoughts

In conclusion, creating a holiday gift list to stay on budget is achievable with a little planning and the right strategies. By following these steps, you can transform the often-dreaded task of holiday shopping into an organized and enjoyable experience. Remember to prioritize, stay flexible, and focus on the true meaning of the season: connecting with loved ones. With these tools in hand, you’re well-equipped to spread joy this holiday season while keeping your finances intact.

Happy gifting!