In today’s digital world, subscriptions are everywhere. From streaming services to software, they offer convenience but can quickly become a financial burden if not managed carefully. This guide, “How to Manage Subscriptions to Avoid Unwanted Charges,” provides a comprehensive roadmap to take control of your recurring expenses and prevent unexpected charges.

We’ll delve into identifying your active subscriptions, understanding their billing cycles, and mastering cancellation procedures. You’ll learn how to navigate free trials, secure your payment information, and resolve disputes. By the end, you’ll be equipped with the knowledge and tools to confidently manage your subscriptions and safeguard your finances.

Identifying Subscription Services and Tracking Them

Managing your subscriptions effectively is crucial to avoid unwanted charges and stay in control of your finances. This involves knowing exactly what you’re paying for and when, which requires a proactive approach to identification and tracking. Understanding where your money goes is the first step toward smart financial management.

Identifying Subscription Services

Identifying all your active subscriptions across various platforms is the initial step in taking control of your spending. This process may seem daunting at first, but with a systematic approach, it becomes manageable.

- Reviewing Bank and Credit Card Statements: This is perhaps the most crucial step. Scrutinize your bank and credit card statements for recurring charges. Look for any unfamiliar or unexpected transactions, as these could be hidden subscriptions you’ve forgotten about or even fraudulent charges. Pay close attention to the billing descriptors; they can sometimes be cryptic.

- Checking Email Accounts: Search your email inboxes and spam folders for subscription confirmations, welcome emails, and monthly statements. These emails often contain valuable information about the services you’re subscribed to, including the billing cycle, renewal dates, and contact information for cancellation.

- Examining Online Accounts: Log in to your online accounts across different platforms, such as streaming services (Netflix, Spotify, Hulu), software providers (Adobe Creative Cloud, Microsoft 365), and online membership sites (Amazon Prime, online courses). Many platforms have a dedicated “Subscriptions” or “Billing” section where you can view your active subscriptions and manage your payment methods.

- Using Password Managers: Password managers often have features that can help identify subscriptions. They might suggest services based on the websites you visit or the accounts you log into. Some password managers can even alert you to upcoming renewal dates.

- Checking Mobile Devices: Review your app store subscriptions on your smartphone or tablet. Both the Apple App Store and Google Play Store have sections where you can manage your subscriptions for apps downloaded on your devices.

Creating a Centralized Tracking System

Once you’ve identified your subscriptions, the next step is to create a centralized system for tracking them. This will help you stay organized and avoid missing important deadlines.

A well-structured tracking system should include key information about each subscription. Consider using a spreadsheet, a dedicated app, or even a simple notebook to keep track of your subscriptions. Here’s how to set up an effective tracking system:

| Subscription Name | Due Date | Amount | Payment Method |

|---|---|---|---|

| Netflix | 1st of each month | $19.99 | Credit Card ending in 1234 |

| Spotify Premium | 15th of each month | $10.99 | PayPal |

| Adobe Creative Cloud | 20th of each month | $52.99 | Credit Card ending in 5678 |

| Amazon Prime | Annually, November 1st | $139.00 | Credit Card ending in 9012 |

Subscription Name: Clearly state the name of the subscription service (e.g., Netflix, Spotify, Adobe Creative Cloud).

Due Date: Note the date when the subscription renews or when the payment is due. This could be monthly, annually, or on another recurring schedule.

Amount: Specify the cost of the subscription. This will help you track your overall spending and identify areas where you can save money.

Payment Method: Indicate how you’re paying for the subscription (e.g., credit card, debit card, PayPal). This is useful if you need to update your payment information or dispute a charge.

Importance of Regularly Reviewing Subscription Lists

Regularly reviewing your subscription list is essential for maintaining control and avoiding unwanted charges. Failing to do so can lead to several negative consequences.

- Avoiding Unwanted Charges: Subscriptions often renew automatically, and if you forget about a service you no longer use, you’ll continue to be charged.

- Identifying Fraudulent Charges: Regularly reviewing your subscriptions can help you identify unauthorized charges or fraudulent activity.

- Optimizing Spending: By reviewing your subscriptions, you can identify areas where you can cut back on spending, such as by canceling services you don’t use or switching to cheaper alternatives.

- Preventing “Subscription Creep”: It is easy to accumulate numerous subscriptions over time. Regular review prevents this phenomenon, helping to keep your budget under control.

Online Tools and Applications for Tracking Subscriptions

Several online tools and applications can help you track your subscriptions efficiently. These tools offer various features to simplify the process.

- Personal Finance Apps: Apps like Mint, YNAB (You Need a Budget), and Personal Capital allow you to link your bank accounts and credit cards to automatically track your subscriptions. These apps categorize your transactions and provide insights into your spending habits.

- Subscription Management Apps: Dedicated subscription management apps, such as Truebill (now Rocket Money), Bobby, and Trim, are designed specifically for tracking subscriptions. These apps can identify your subscriptions, track renewal dates, and even help you negotiate better rates or cancel unwanted services.

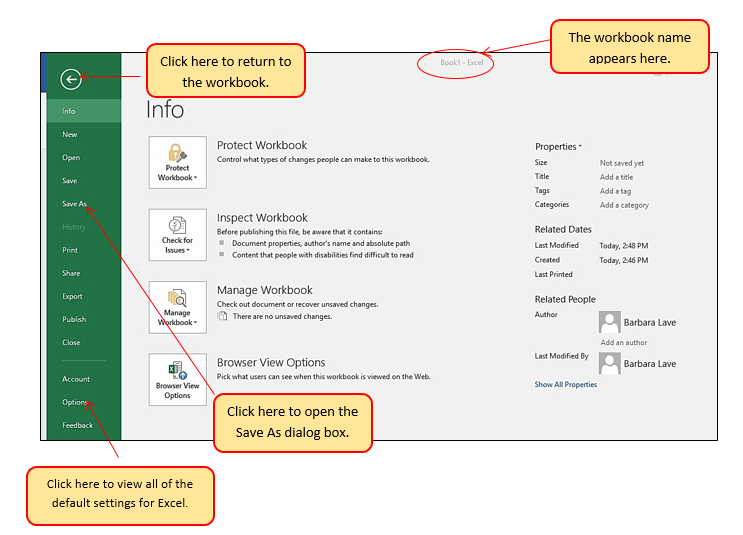

- Spreadsheet Software: Tools like Google Sheets and Microsoft Excel are versatile and free options for creating your own subscription tracking system. You can customize the spreadsheet to include the information that’s most important to you.

- Password Managers: Some password managers, like 1Password and LastPass, can help you track subscriptions by identifying the services you’re subscribed to and alerting you to upcoming renewal dates.

Understanding Subscription Models and Billing Cycles

Understanding the different subscription models and billing cycles is crucial for effectively managing your subscriptions and avoiding unwanted charges. This knowledge empowers you to make informed decisions, track your spending, and cancel services before you’re billed. Let’s delve into the various models and cycles commonly used.

Subscription Models

Subscription models determine how you pay for a service. They vary in their structure and impact on your spending.There are several common subscription models:* Recurring Subscriptions: These are the most common type. You pay a regular fee (monthly, annually, etc.) for ongoing access to a service or product. Examples include streaming services like Netflix, software subscriptions like Adobe Creative Cloud, and meal kit deliveries.

The subscription automatically renews until you cancel it.* Free Trials: Many services offer free trials to entice new customers. These trials allow you to use the service for a limited time without paying. At the end of the trial, you’re automatically charged unless you cancel beforehand. Always be mindful of the trial’s end date to avoid unwanted charges.* Tiered Pricing: Some services offer different subscription tiers with varying features and price points.

For example, a cloud storage service might offer Basic, Standard, and Premium tiers, each with different storage capacity and features. The price increases with each tier, reflecting the added value.* Usage-Based Subscriptions: In this model, you’re charged based on your consumption of the service. For instance, a cloud computing service charges you based on the amount of storage you use or the amount of data you transfer.

Another example is a mobile phone plan, where you might be charged based on the number of calls made or data used.* Freemium: This model combines “free” and “premium.” A basic version of the service is offered for free, with limited features. Users can upgrade to a paid premium version for access to more features or resources.

Examples include Spotify (free with ads, premium without) and Dropbox (free storage, paid storage plans).

Billing Cycles

Billing cycles determine how often you are charged for a subscription. Different frequencies have different implications for your cash flow and financial planning.Common billing cycles include:* Monthly: The most common cycle, where you’re charged every month.

Annual

You’re charged once a year. Often, annual subscriptions offer a discounted price compared to monthly plans.

Quarterly

You’re charged every three months.

Weekly

Less common, but some services may bill weekly.

Advantages and Disadvantages of Different Billing Frequencies

Different billing frequencies have pros and cons, which are important to consider when selecting a subscription.* Monthly Billing:

Advantages

Easier to budget, provides flexibility to cancel or change plans frequently, allows you to monitor spending closely.

Disadvantages

Typically the most expensive option in the long run, can be time-consuming to manage multiple monthly payments.

Annual Billing

Advantages

Often the cheapest option overall, simplifies budgeting (one large payment instead of multiple small ones), less frequent need to manage the subscription.

Disadvantages

Requires a larger upfront payment, harder to cancel mid-term (you may not get a refund), requires careful planning to avoid overspending.

Quarterly Billing

Advantages

A middle ground between monthly and annual billing, providing some cost savings compared to monthly.

Disadvantages

Less flexibility than monthly billing, requires more planning than monthly.

Weekly Billing

Advantages

Not commonly used, but may provide a very granular view of spending.

Disadvantages

Can be more difficult to track, and can result in higher overall costs compared to annual options.

Identifying Billing Cycles and Charges

Identifying the billing cycle and associated charges is a key aspect of managing subscriptions. It helps you avoid surprises and ensures you’re only paying for services you want.To identify billing cycles and charges:* Review Subscription Confirmation Emails: These emails typically contain the billing cycle, the amount charged, and the date of the next payment.

Check Your Account Settings

Log in to your account on the service’s website or app. Navigate to the “Billing,” “Subscription,” or “Account” section. You should find details about your billing cycle, the price, and upcoming charges.

Examine Your Bank and Credit Card Statements

Your statements list all recurring charges. Look for the service name and the amount to identify the billing cycle.

Use a Subscription Management Tool

As mentioned previously, these tools can aggregate your subscriptions and display their billing details in one place, making it easier to track.By understanding subscription models, billing cycles, and how to identify charges, you can take control of your spending and make informed decisions about the services you use.

Avoiding Unwanted Charges

Dealing with unwanted subscription charges can be frustrating, but taking proactive steps can significantly reduce your risk. This section focuses on the practical aspects of preventing unexpected costs by providing clear guidance on canceling subscriptions and securing refunds when necessary.Understanding cancellation and refund procedures is crucial for effective subscription management. Knowing how to cancel subscriptions on different platforms and how to request refunds can save you money and prevent unnecessary stress.

Cancellation Procedures Before Renewal

To avoid unwanted charges, it is crucial to cancel subscriptions before their renewal date. This requires establishing a proactive system to monitor and manage your subscriptions.To create a procedure for canceling subscriptions before the renewal date:

- Centralized Tracking: Maintain a central list or spreadsheet that includes all your subscriptions, their renewal dates, and associated costs. This is your primary tool for managing subscriptions.

- Calendar Reminders: Set calendar reminders well in advance of each renewal date. A good practice is to set reminders 1-2 weeks before the renewal date to allow ample time for cancellation and to account for potential delays.

- Regular Review: Regularly review your subscription list. Monthly or quarterly reviews can help identify subscriptions you no longer use or need.

- Cancellation Timing: Always cancel subscriptions before the renewal date to avoid being charged for another billing cycle. Check the specific terms of service for each subscription to understand their cancellation policies.

- Confirmation and Documentation: After canceling a subscription, always confirm the cancellation through email or your account dashboard. Save confirmation emails or screenshots as proof of cancellation.

Specific Steps for Canceling Subscriptions on Various Platforms

Cancellation processes vary by platform. Here are specific steps for canceling subscriptions on popular services:

- Netflix:

- Sign in to your Netflix account.

- Go to “Account”.

- Click “Cancel Membership”.

- Follow the on-screen instructions to confirm your cancellation. Netflix usually allows you to continue watching until the end of your current billing cycle.

- Amazon Prime:

- Go to “Amazon Prime” in your Amazon account.

- Click “Manage membership”.

- Select “End membership” or “Cancel”.

- Follow the on-screen prompts to confirm. You may be offered options like pausing your membership.

- Spotify:

- Log in to your Spotify account on the Spotify website.

- Go to “Account” and then “Manage your plan”.

- Click “Change or cancel”.

- Choose “Cancel Premium”.

- Follow the instructions to confirm your cancellation. You will typically revert to the free version at the end of your billing period.

- Apple Subscriptions (iOS):

- Open the “Settings” app on your iPhone or iPad.

- Tap your name, then “Subscriptions”.

- Select the subscription you want to cancel.

- Tap “Cancel Subscription”. The cancellation will take effect at the end of the current billing cycle.

- Google Play Subscriptions (Android):

- Open the Google Play Store app.

- Tap your profile icon, then “Payments & subscriptions”, then “Subscriptions”.

- Select the subscription you want to cancel.

- Tap “Cancel subscription”.

- Follow the instructions. The cancellation will be effective at the end of the current billing cycle.

Common Issues and Resolutions When Canceling Subscriptions

Encountering issues during cancellation is common. Here’s how to resolve them:

- Difficulty Finding Cancellation Options: Some services make it difficult to find the cancellation button.

Resolution: Search the platform’s help section for “cancel subscription” or “manage account”. If you still can’t find it, contact customer support for assistance.

- Unexpected Charges After Cancellation: You may be charged even after canceling.

Resolution: Review your cancellation confirmation. If you have proof of cancellation, contact customer support immediately and provide evidence. You may be eligible for a refund.

- Cancellation Not Confirmed: You might not receive a confirmation email.

Resolution: Check your account dashboard for the cancellation status. If there is no confirmation, contact customer support to verify the cancellation.

- Recurring Charges Despite Cancellation: Sometimes, charges continue after cancellation.

Resolution: Contact your bank or credit card company to dispute the charges. Provide any proof of cancellation you have. Simultaneously, contact the service provider’s customer support.

Requesting Refunds for Unwanted Charges

Requesting refunds for unwanted charges requires a systematic approach. This table Artikels the process:

| Step | Description | Example | Tips |

|---|---|---|---|

| Identify the Charge | Locate the unwanted charge on your bank or credit card statement. Note the date, amount, and service provider. | A $14.99 charge from “StreamingServiceX” on June 15th. | Keep a record of all your subscription expenses for easy reference. |

| Review the Terms of Service | Check the service provider’s terms of service for their refund policy. Understand the conditions under which refunds are offered. | “StreamingServiceX” states refunds are available for technical issues or if you cancel within 24 hours of renewal. | Look for sections on billing, cancellations, and refunds. |

| Contact Customer Support | Reach out to the service provider’s customer support. Explain the situation, providing details about the unwanted charge and your cancellation attempts. | “I was charged $14.99 on June 15th despite canceling on June 10th. I have proof of cancellation.” | Be polite but firm. Provide any supporting documentation, such as screenshots or confirmation emails. |

| Escalate if Necessary | If the service provider doesn’t offer a refund, escalate the issue. Contact your bank or credit card company to dispute the charge. Provide them with all relevant documentation. | If “StreamingServiceX” refuses a refund, contact your bank to dispute the charge. | Keep a record of all communications and follow-up actions. Banks often have dispute forms that must be completed. |

Managing Free Trials and Promotional Offers

Free trials and promotional offers can be tempting ways to test out a service or product. However, they often come with the risk of unexpected charges if not managed carefully. Understanding how these offers work and taking proactive steps to avoid automatic renewals is crucial for preventing unwanted subscription fees.

Free Trials Leading to Charges

Free trials are designed to entice users to subscribe to a service. They typically provide a limited period of access to a product or service without immediate payment. The catch is often the automatic conversion to a paid subscription at the end of the trial period. If a user doesn’t cancel before the trial ends, they are automatically charged the full subscription price.

This can lead to unwanted charges if the user forgets about the trial, doesn’t enjoy the service, or simply doesn’t realize the trial is ending.

Strategies for Managing Free Trials

Effectively managing free trials requires a proactive approach. Here’s how to avoid unwanted charges:

- Set a Reminder: Immediately after signing up for a free trial, set a reminder in your calendar or phone for a few days before the trial’s expiration date. This will give you ample time to evaluate the service and cancel if necessary.

- Cancel Immediately (if desired): If you’re unsure about the service or know you won’t use it, consider canceling the subscription immediately after signing up. You’ll often still have access to the trial benefits for the remaining period.

- Review Trial Details: Carefully review the terms and conditions of the free trial, paying close attention to the cancellation policy, the date the trial ends, and the subscription price after the trial.

- Use a Dedicated Email Address: Consider using a separate email address for free trials and promotional offers. This can help keep your primary inbox clean and make it easier to track these subscriptions.

- Track Your Trials: Maintain a list or spreadsheet of all your free trials, including the service name, start date, end date, and any relevant cancellation instructions.

Reading Terms and Conditions of Promotional Offers

Promotional offers, like free trials, are governed by specific terms and conditions. These terms Artikel the details of the offer, including the duration, any limitations, and the subscription price after the promotional period ends. Failing to read and understand these terms can lead to unexpected charges or limitations on the offer’s benefits. The fine print often contains critical information about automatic renewals, cancellation policies, and any restrictions on the offer.

Checklist for Evaluating Promotional Subscriptions

Before signing up for a promotional subscription, use this checklist to assess its value and potential risks:

- Offer Details: Clearly understand the terms of the offer, including the duration, any limitations (e.g., features, content), and the price after the promotional period.

- Value Assessment: Determine if the service aligns with your needs and if the benefits outweigh the cost. Consider how frequently you’ll use the service and the value you’ll receive.

- Cancellation Policy: Review the cancellation policy to understand how to cancel the subscription and any associated deadlines or fees. Ensure the cancellation process is straightforward.

- Automatic Renewal: Confirm whether the subscription automatically renews at the end of the promotional period and the price you’ll be charged.

- Payment Information: Understand what payment information you are providing and how it will be used. Ensure that you are comfortable with the security measures in place.

- Trial Reminders: Decide how you will remember the trial and its renewal date to avoid paying for something you do not want.

Security and Payment Management for Subscriptions

Managing subscriptions effectively involves not only tracking and canceling them but also prioritizing the security of your payment information. This is crucial to prevent unauthorized charges and protect your financial well-being. Understanding the risks associated with storing payment details and implementing secure practices can save you from potential headaches and financial losses.

Securing Payment Information

Protecting your payment details is paramount when dealing with subscriptions. This involves several key practices to minimize the risk of fraud and unauthorized access.

- Use Strong, Unique Passwords: Create strong, unique passwords for all accounts associated with subscriptions. Avoid reusing passwords across multiple platforms. Consider using a password manager to generate and store complex passwords securely.

- Enable Two-Factor Authentication (2FA): Whenever possible, enable 2FA on your subscription accounts. This adds an extra layer of security by requiring a verification code from your phone or email in addition to your password.

- Monitor Your Accounts Regularly: Frequently review your bank statements and credit card transactions for any unauthorized charges. Promptly report any suspicious activity to your bank or credit card provider.

- Be Wary of Phishing Attempts: Be cautious of emails, messages, or calls requesting your payment information. Always verify the sender’s authenticity before clicking on any links or providing sensitive data. Look for signs of phishing, such as generic greetings, poor grammar, and urgent requests.

- Secure Your Devices: Ensure your devices (computers, smartphones, tablets) are protected with up-to-date antivirus software and firewalls. Regularly update your operating system and apps to patch security vulnerabilities.

Benefits of Virtual Credit Cards and Single-Use Payment Options

Utilizing virtual credit cards or single-use payment options offers an enhanced layer of security when subscribing to services. These tools limit your exposure to potential fraud.

- Virtual Credit Cards: Many banks and financial institutions offer virtual credit cards. These are essentially temporary card numbers linked to your primary account. You can set spending limits and expiration dates for each virtual card. If a subscription service is compromised, the damage is limited to the virtual card’s balance or pre-set limit.

- Single-Use Payment Options: Services like PayPal or specific payment gateways often provide single-use payment options. These generate a unique payment token for each transaction, reducing the risk of your actual card details being stolen and reused.

- Reduced Risk of Recurring Charges: By using these methods, you can prevent unwanted recurring charges even if you forget to cancel a subscription. If the virtual card expires or the single-use token is invalidated, the subscription payment will fail.

- Example: Imagine subscribing to a streaming service. Instead of using your primary credit card, you create a virtual card with a spending limit equal to the monthly subscription fee. If the streaming service’s security is breached, the fraudsters can only access the funds available on the virtual card, protecting the rest of your account.

Potential Risks of Storing Payment Information

Storing payment information on various platforms presents certain risks that users should be aware of. Understanding these risks allows you to make informed decisions about where and how you store your financial data.

- Data Breaches: Platforms that store your payment information can be targeted by hackers. A successful data breach can expose your credit card numbers, expiration dates, and other sensitive details to malicious actors.

- Unauthorized Access: Even if a platform has strong security measures, there’s always a risk of unauthorized access by employees or insiders.

- Account Compromise: If your account is compromised, a hacker could potentially access your stored payment information and use it to make unauthorized purchases or sign up for unwanted subscriptions.

- Lack of Control: Once your payment information is stored, you may have limited control over how it’s used. Some platforms might share your data with third-party vendors or use it for targeted advertising.

- Outdated Security: Platforms may not always keep their security measures up-to-date, leaving your data vulnerable to evolving cyber threats.

- Example: In 2018, a major hotel chain experienced a data breach that exposed the payment information of millions of customers. This illustrates the potential for large-scale breaches and the significant risks associated with storing payment data on platforms that handle sensitive financial information.

Reviewing and Managing Payment Methods

Regularly reviewing and managing your payment methods is a proactive step in securing your subscriptions and preventing unauthorized charges. This involves several key actions to maintain control over your financial information.

- Regularly Review Your Payment Methods: Log into your subscription accounts and review the payment methods associated with each. Verify that the information is accurate and up-to-date.

- Update Expired or Incorrect Payment Details: If your credit card has expired or your bank details have changed, update the payment information promptly to avoid service interruptions or late payment fees.

- Remove Unused Payment Methods: Delete payment methods that are no longer in use or that you no longer trust. This reduces the risk of unauthorized charges.

- Set Up Payment Alerts: Enable payment alerts from your bank or credit card provider to receive notifications for every transaction. This allows you to quickly identify and address any unauthorized charges.

- Use a Centralized Management System (if available): Some platforms offer a centralized system to manage your subscriptions and payment methods. This can simplify the process of reviewing and updating your information.

- Example: Many banks provide tools for managing your credit cards, including setting spending limits, receiving transaction alerts, and freezing your card if it’s lost or stolen. Similarly, you can manage payment methods within your subscription accounts to ensure that the correct card is charged and to remove old or unwanted cards.

Dispute Resolution and Contacting Customer Service

Sometimes, despite your best efforts, unwanted subscription charges can still appear on your statements. Knowing how to effectively dispute these charges and contact customer service is crucial for protecting your finances and ensuring a fair resolution. This section will guide you through the steps involved in resolving billing disputes and provide you with the tools and strategies you need to navigate these situations successfully.Understanding the process of dispute resolution is important for protecting your financial well-being and securing a fair outcome.

This includes knowing how to contact both the service provider and your bank, understanding the necessary documentation, and recognizing when to escalate a dispute.

Disputing Unauthorized Subscription Charges

If you find unauthorized subscription charges on your account, taking swift action is essential. This involves notifying both the service provider and your bank or credit card company.

Here’s a step-by-step guide:

- Gather Information: Collect all relevant details about the unauthorized charge. This includes the date, amount, service provider’s name, and any transaction IDs.

- Contact the Service Provider: Reach out to the subscription service directly. Most providers have customer service contact information on their website or within their app. Explain the situation and request a refund. Be prepared to provide evidence, such as screenshots or email confirmations.

- Contact Your Bank/Credit Card Company: If the service provider is unresponsive or refuses to issue a refund, contact your bank or credit card company immediately. Inform them about the unauthorized charge and dispute it. They will guide you through their dispute process.

- Submit a Dispute Form: Your bank or credit card company will likely require you to complete a dispute form. Provide all the necessary information, including the details of the unauthorized charge and any communication you’ve had with the service provider.

- Provide Supporting Documentation: Gather and submit any supporting documentation that strengthens your case. This might include screenshots of your account activity, emails with the service provider, or any terms and conditions that were violated.

- Follow Up: Keep track of the dispute’s progress. Your bank or credit card company will investigate the claim and notify you of the outcome. This process can take several weeks.

Contacting Customer Service to Resolve Billing Issues

Directly contacting customer service is often the first step in resolving any billing issues. Effective communication is key to a successful resolution.

Here’s how to approach it:

- Locate Contact Information: Find the customer service contact information for the subscription service. This is usually available on their website, within the app, or in the terms and conditions. Look for a phone number, email address, or live chat option.

- Prepare Your Information: Before contacting customer service, gather all necessary information. This includes your account details, the specific billing issue you’re experiencing (e.g., incorrect charges, duplicate charges), and any relevant transaction IDs or dates.

- Be Clear and Concise: When you contact customer service, clearly and concisely explain the issue. State the facts without getting overly emotional. Provide all the necessary details and avoid unnecessary jargon.

- Document Everything: Keep a record of all communication with customer service. This includes the date and time of the contact, the name of the representative you spoke with, and a summary of the conversation. Save any emails or chat transcripts.

- Follow Up: If the issue isn’t resolved during the initial contact, follow up with customer service. If you were promised a resolution, make sure to inquire about the status.

Effective Communication Strategies for Resolving Subscription Disputes

Communicating effectively can significantly increase your chances of a successful resolution.

Here are some communication strategies:

- Be Polite and Professional: Even if you’re frustrated, remain polite and professional in your communication. This can help build rapport with the customer service representative and make them more willing to assist you.

- State Your Issue Clearly: Clearly and concisely explain the issue you’re experiencing. Avoid ambiguity and provide specific details, such as the date and amount of the charge, the name of the subscription service, and the nature of the issue.

- Provide Evidence: Support your claims with evidence. This could include screenshots of your account activity, email confirmations, or any other documentation that supports your case.

- Set Realistic Expectations: Understand that resolving a dispute can take time. Be patient and follow up with customer service as needed.

- Keep a Record of All Communication: Document all communication with the service provider, including the date and time of each contact, the name of the representative you spoke with, and a summary of the conversation.

- Use a Formal Tone: When communicating in writing, use a formal and respectful tone. Avoid slang or informal language.

Example Communication:

“Dear [Subscription Service Name] Customer Service, I am writing to dispute an unauthorized charge of $XX.XX on my account on [Date]. I did not authorize this charge and would like to request a full refund. My account details are: [Account Information]. I have attached a screenshot of my account activity showing the unauthorized charge. Thank you for your time and assistance. Sincerely, [Your Name]”

Escalating a Dispute if Initial Attempts Fail

Sometimes, initial attempts to resolve a dispute are unsuccessful. Knowing how to escalate the issue is essential.

Here’s a table detailing the escalation process:

| Step | Action | Details | Expected Outcome |

|---|---|---|---|

| 1. Initial Contact | Contact Customer Service | Contact the subscription service’s customer service department via phone, email, or chat. Explain the issue and request a resolution. | A resolution to the billing issue. |

| 2. Follow-Up and Documentation | Follow up with Customer Service | If no resolution is reached, follow up with customer service, referencing previous communications. Keep detailed records of all interactions, including names, dates, and times. | Acknowledge and investigate the issue further. |

| 3. Request a Supervisor or Manager | Escalate to a Supervisor | If the initial attempts fail, request to speak with a supervisor or manager. Explain the issue and the steps you’ve taken to resolve it. | A different perspective and potentially a resolution that customer service could not offer. |

| 4. File a Complaint with Higher Authority | File a Complaint | If a resolution is still not reached, consider filing a complaint with a higher authority. This could include the Better Business Bureau (BBB), the Federal Trade Commission (FTC), or your state’s Attorney General’s office. | Investigation by a third party and potential resolution, including a refund or account termination. |

Setting Up Alerts and Reminders

Staying on top of your subscriptions is much easier when you have a reliable system to remind you of upcoming due dates. Setting up alerts and reminders is a proactive way to avoid unwanted charges, ensure you’re getting the most out of your subscriptions, and maintain control of your finances. This section provides a guide to setting up and managing these crucial reminders.

Designing a System for Tracking Due Dates

Creating a system for tracking subscription due dates involves choosing a method that works best for your needs and lifestyle. This can be as simple as using a calendar or a more sophisticated approach using dedicated apps or spreadsheets.

- Centralized Calendar: Choose a primary calendar (Google Calendar, Outlook Calendar, Apple Calendar, etc.) to record all subscription due dates. This provides a single point of reference.

- Categorization: Categorize your subscriptions within your calendar. For example, use different colors or categories (e.g., “Entertainment,” “Software,” “Utilities”) to easily identify subscription types at a glance.

- Detailed Entries: For each subscription, include the subscription name, the billing amount, the billing cycle (monthly, annually, etc.), and the date the payment is due.

- Regular Review: Make it a habit to review your calendar regularly, ideally weekly or monthly, to ensure all information is up-to-date and to anticipate upcoming charges.

- Notification Settings: Configure notifications to alert you before each payment is due. Setting alerts a few days or even a week in advance gives you time to cancel or modify a subscription if needed.

Tools and Applications for Alert Management

Several tools and applications can streamline the process of managing alerts for your subscriptions. These tools range from simple calendar apps to dedicated subscription management platforms.

- Calendar Applications:

- Google Calendar: A widely used and versatile option. It allows for creating recurring events, setting custom notifications, and integrating with other services.

- Apple Calendar: Integrated with Apple devices, it offers similar functionality to Google Calendar, with easy syncing across your devices.

- Outlook Calendar: Part of the Microsoft Office suite, it’s suitable for users who already use other Microsoft products.

- Subscription Management Apps:

- Truebill (now Rocket Money): A popular app that tracks subscriptions, identifies wasteful spending, and allows users to cancel subscriptions directly through the app. It provides reminders and alerts.

- Trim: Similar to Truebill, Trim helps users manage their subscriptions and negotiate bills. It also offers alert features.

- Bobby: A subscription tracking app that allows users to manually add and track subscriptions, with reminders and budgeting features.

- Spreadsheets: A simple and customizable method. Create a spreadsheet with columns for subscription name, cost, due date, billing cycle, and notes. Set reminders in your calendar based on the due dates in the spreadsheet.

Benefits of Calendar Integrations

Integrating your subscription tracking with a calendar offers several advantages, enhancing your ability to stay organized and informed about upcoming payments.

- Centralized View: Consolidates all your subscription due dates alongside other important events and appointments, providing a comprehensive overview of your schedule.

- Automated Reminders: Calendar apps send automatic notifications, reducing the risk of missing due dates and incurring unwanted charges.

- Sync Across Devices: Most calendar apps sync across multiple devices (phones, tablets, computers), ensuring you can access your subscription information from anywhere.

- Easy Editing and Updates: Calendar entries can be easily modified to reflect changes in subscription costs, billing cycles, or cancellation dates.

- Visualization: Calendars provide a visual representation of your subscription payments, helping you to understand your spending patterns over time.

Customizing Alert Settings

Customizing alert settings is crucial to ensure that reminders align with your individual preferences and needs, maximizing their effectiveness in managing your subscriptions.

- Notification Timing: Set reminders to alert you at different intervals before the due date. This might range from a few days to a week or more, depending on your risk tolerance and the subscription’s importance. For example, for a streaming service, you might set a reminder a few days in advance. For an annual software subscription, you may want a reminder a month in advance.

- Notification Type: Choose the type of notification that suits you best. Options typically include email, push notifications (on mobile devices), or both.

- Multiple Notifications: Consider setting up multiple notifications for the same subscription. For instance, a preliminary notification a week before the due date, followed by a reminder a day or two before.

- Customization of Message: Some apps allow you to customize the message content of your notifications. This can be useful for including specific information about the subscription, such as the renewal date, the cost, or any special terms.

- Snooze Options: Ensure that the alert system allows you to snooze notifications if you need more time to review the subscription.

Analyzing Subscription Costs and Budgeting

Understanding your subscription expenses is crucial for maintaining control over your finances. By analyzing these costs, you can make informed decisions about which services to keep, which to adjust, and how to allocate your budget effectively. This process empowers you to avoid unnecessary spending and achieve your financial goals.

Calculating Total Subscription Costs

Accurately calculating the total cost of your subscriptions is the first step toward managing them effectively. This involves gathering all your active subscriptions and determining their respective costs and billing frequencies.To calculate the total cost, you can use the following method:

1. Compile a list

Create a comprehensive list of all your active subscriptions. This should include streaming services (Netflix, Spotify, etc.), software subscriptions (Adobe Creative Cloud, Microsoft 365, etc.), online memberships (Amazon Prime, etc.), and any other recurring payments.

2. Record the cost

Note the monthly or annual cost for each subscription. Be sure to account for any introductory rates or promotional pricing that might be expiring soon.

3. Determine the billing cycle

Identify whether each subscription is billed monthly, annually, or at another frequency.

4. Calculate the annual cost

For monthly subscriptions, multiply the monthly cost by 12. For subscriptions billed at other frequencies, adjust the calculation accordingly to find the equivalent annual cost.

5. Sum the costs

Add up the annual cost of all your subscriptions to arrive at your total annual subscription expenditure.For example, if you have:* Netflix: \$15 per month (\$180 per year)

Spotify

\$10 per month (\$120 per year)

Adobe Creative Cloud

\$53 per month (\$636 per year)Your total annual subscription cost would be \$180 + \$120 + \$636 = \$936. This is the amount you are spending annually on these three services.

Strategies for Reducing Subscription Costs

Once you know your total subscription costs, you can explore strategies to reduce them and optimize your spending. These strategies involve evaluating your current subscriptions, seeking discounts, and considering alternatives.Here are some effective ways to lower your subscription expenses:* Audit your subscriptions: Review each subscription to determine its value. Do you still use the service regularly? Is it essential for your needs?

If not, consider canceling it.

Negotiate with providers

Contact subscription providers to inquire about potential discounts or lower rates, especially if you’re a long-term customer. Some providers may offer special deals to retain your business.

Look for bundled services

Explore bundled subscription options that offer multiple services for a lower combined price. For example, some mobile carriers offer streaming services as part of their plans.

Share subscriptions

If possible, share subscriptions with family or friends to split the cost. Ensure you understand the terms of service to avoid violating any rules.

Take advantage of free trials and promotions

Utilize free trials and promotional offers strategically. Set reminders to cancel before the trial period ends to avoid being charged.

Choose the right billing cycle

Consider paying annually instead of monthly for subscriptions that offer a discount. This can lead to significant savings over time.

Switch to free alternatives

Evaluate if there are free alternatives that meet your needs. For example, instead of a premium music streaming service, you could use a free, ad-supported option.By implementing these strategies, you can significantly reduce your subscription costs and free up funds for other financial goals.

Designing a Budget Template for Subscription Expenses

Creating a budget template that specifically includes subscription expenses will help you track and manage these costs effectively. This template allows you to monitor your spending, identify areas for potential savings, and stay within your budget.Here’s a sample budget template, presented in an HTML table format, with four responsive columns to help you organize your subscription expenses:“`html

| Subscription Name | Monthly Cost | Annual Cost | Notes/Actions |

|---|---|---|---|

| Netflix | $15 | $180 | Review usage, consider Basic plan |

| Spotify | $10 | $120 | Consider family plan |

| Adobe Creative Cloud | $53 | $636 | Evaluate necessity |

| Amazon Prime | $15 | $180 | Utilize benefits |

| Gym Membership | $60 | $720 | Check attendance |

| Totals | $153 | $1836 |

“`* Subscription Name: Lists the name of each subscription service.

Monthly Cost

Shows the monthly cost of the subscription.

Annual Cost

Calculates the annual cost by multiplying the monthly cost by 12.

Notes/Actions

Provides space for notes, such as usage frequency, potential cost-saving actions (e.g., downgrading to a lower tier, cancelling), or important dates (e.g., renewal dates).This template provides a clear overview of your subscription spending and allows you to make informed decisions about your subscriptions and budget. You can adapt this template to include additional columns or categories as needed, such as the billing date or the payment method.

Regularly reviewing and updating this template is key to effective subscription management.

Legal Aspects of Subscriptions

Understanding the legal landscape surrounding subscriptions is crucial for protecting your rights and avoiding potential pitfalls. Consumer protection laws vary by jurisdiction, but certain core principles generally apply. Knowing your rights empowers you to make informed decisions and navigate subscription services with confidence.

Consumer Rights Related to Subscriptions

Consumers possess fundamental rights concerning subscriptions that aim to ensure fair practices and protect against deceptive or unfair business conduct. These rights are often enshrined in consumer protection laws.

- Right to Information: Subscribers have the right to clear, concise, and accurate information about the subscription, including its terms, conditions, pricing, billing cycles, and cancellation policies. This information should be readily available before subscribing.

- Right to Cancel: Consumers generally have the right to cancel a subscription at any time, subject to the terms and conditions. The cancellation process should be straightforward and accessible.

- Right to Fair Practices: Subscription providers must adhere to fair business practices, which include not engaging in deceptive advertising, hidden fees, or unfair contract terms.

- Right to Dispute: Subscribers have the right to dispute charges or billing errors. Subscription providers should have a clear process for handling disputes and providing refunds when appropriate.

- Right to Privacy: Providers must protect subscribers’ personal information and comply with data privacy regulations, such as GDPR or CCPA, depending on the location.

Regulations Regarding Automatic Renewals

Automatic renewal clauses are common in subscription agreements, but they are often subject to specific regulations designed to protect consumers from unwanted charges. These regulations vary depending on the region, but generally aim to ensure transparency and consent.

- Disclosure Requirements: Laws often require providers to clearly disclose the terms of automatic renewal before the consumer subscribes. This disclosure should include the renewal period, the cost, and the cancellation process.

- Consent Requirements: Many jurisdictions require affirmative consent from the consumer before an automatic renewal can take effect. This means that the consumer must actively agree to the renewal, rather than simply failing to opt-out.

- Notification Requirements: Some laws mandate that providers send reminders to subscribers before the renewal date, informing them of the upcoming renewal and providing instructions on how to cancel.

- Cancellation Procedures: Regulations typically require that providers make it easy for consumers to cancel automatic renewals, often through online portals, email, or phone.

- Examples of Legislation: The California Automatic Renewal Law (Cal. Bus. & Prof. Code § 17600 et seq.) is a prime example, requiring clear and conspicuous disclosure of renewal terms, affirmative consent, and an easy cancellation process. The Restore Online Shoppers’ Confidence Act (ROSCA) in the United States also addresses automatic renewals, focusing on pre-notification and easy cancellation.

Legal Implications of Canceling Subscriptions

Canceling a subscription has legal implications that both the subscriber and the provider must understand. These implications are usually defined in the terms and conditions of the subscription agreement and are also subject to consumer protection laws.

- Terms and Conditions: The subscription agreement’s terms and conditions govern the cancellation process. These terms Artikel how and when a subscriber can cancel, any associated fees, and the effective date of cancellation.

- Cancellation Fees: Some subscriptions may impose cancellation fees, particularly if the subscriber cancels before the end of a committed term. The legality and enforceability of these fees often depend on their reasonableness and whether they were disclosed to the subscriber.

- Refunds: The subscriber’s right to a refund after canceling depends on the terms and conditions and applicable laws. Generally, subscribers are entitled to a refund for unused portions of the service if they cancel within a specific timeframe or if the provider fails to deliver the promised service.

- Contractual Obligations: Canceling a subscription typically releases the subscriber from future obligations under the agreement. However, the subscriber may still be responsible for any outstanding charges incurred before the cancellation takes effect.

- Breach of Contract: If a provider fails to honor the cancellation terms or breaches the subscription agreement, the subscriber may have legal recourse, such as the right to sue for damages.

Rights Consumers Have When a Subscription is Canceled

When a subscription is canceled, consumers have certain rights to ensure a fair and transparent conclusion to the service agreement. These rights are meant to protect the consumer’s interests and prevent any potential issues.

- Right to Service Termination: The subscriber has the right to have the service terminated promptly after cancellation, as per the terms of the agreement.

- Right to Access to Information: The subscriber has the right to retain access to any data or content associated with the subscription, subject to the terms and conditions.

- Right to a Refund (if applicable): If the subscription agreement or applicable law entitles the subscriber to a refund, the subscriber has the right to receive it promptly and accurately.

- Right to Confirmation: The subscriber has the right to receive confirmation of the cancellation, including the effective date and any outstanding charges.

- Right to Dispute: If the subscriber believes the cancellation process was not handled correctly or if there are any disputed charges, the subscriber has the right to dispute these issues with the provider.

Case Studies: Common Subscription Scenarios

Understanding how subscription issues unfold in real life is crucial for effective management. Examining actual cases provides practical insights and highlights the importance of proactive measures. Let’s delve into some common scenarios, analyze the steps taken to resolve them, and extract valuable lessons.

Unwanted Subscription Charges Case Study

Here’s a detailed case study illustrating a common subscription pitfall and the process of resolution:

Scenario: Sarah, a university student, noticed an unexpected $15 charge on her credit card statement from a music streaming service she believed she had cancelled months ago. She hadn’t used the service since.

To resolve this issue, Sarah took the following steps:

- Step 1: Reviewing Account History: Sarah logged into her account on the music streaming service’s website. She carefully reviewed her billing history and confirmed the recurring charge.

- Step 2: Checking Cancellation Confirmation: Sarah searched her email inbox for a cancellation confirmation email. She remembered cancelling, but couldn’t find the email, indicating a potential issue with the cancellation process.

- Step 3: Contacting Customer Support: Sarah contacted the streaming service’s customer support through their website’s live chat feature. She explained the situation, provided her account details, and requested a refund for the unwanted charge.

- Step 4: Providing Documentation: During the chat, Sarah provided screenshots of her billing history showing the charge and explained that she hadn’t used the service since the supposed cancellation date.

- Step 5: Following Up: After the initial chat, Sarah didn’t receive an immediate resolution. She followed up with customer support a few days later, reiterating her request and referencing her previous communication.

- Step 6: Escalation (If Necessary): Had Sarah not received a satisfactory response, she was prepared to escalate the issue by contacting her credit card company to dispute the charge.

The outcome of Sarah’s case was:

- Refund Granted: After providing her account details and explaining the situation to the customer service representative, Sarah was granted a full refund for the $15 charge. The customer service representative confirmed that the initial cancellation hadn’t been processed correctly.

- Cancellation Confirmed: The customer service representative also confirmed that the subscription was now properly cancelled to prevent future charges.

Lessons learned from Sarah’s experience:

- Always Verify Cancellations: Always request and save confirmation emails after cancelling subscriptions. This serves as proof of cancellation.

- Regularly Monitor Statements: Regularly check bank and credit card statements for unauthorized charges. Early detection is key.

- Document Everything: Keep records of all communication with customer support, including chat transcripts and email exchanges.

- Understand Refund Policies: Be aware of the service’s refund policies. Knowing the policy can strengthen your position when requesting a refund.

- Be Persistent: If the initial attempt to resolve the issue fails, don’t hesitate to follow up and escalate the matter if necessary.

Wrap-Up

Mastering subscription management is key to financial well-being. By implementing the strategies Artikeld in this guide, from tracking services to understanding your rights, you can avoid unwanted charges and optimize your spending. Remember to stay vigilant, review your subscriptions regularly, and don’t hesitate to take action if you encounter issues. Taking control of your subscriptions empowers you to make informed decisions and maintain financial peace of mind.